Overview

Today we begin our look at “imperfect competition,” where firms have market power, meaning they can charge p>MCp>MC and search for the profit-maximizing quantity and price. Today is merely about how do change the model to understand how a firm with market power behaves. To assist us, we begin with an extreme case of a single seller, i.e. a monopoly. For now we only assume that there is a single firm, and see how it behaves differently than if it were in a competitive market. Next class we will begin to explore what could cause a market to have only a single seller, and what are some of the social consequences of market power.

Practice

Today we will be working on practice problems. Answers will be posted later on that page.

Slides

Below, you can find the slides in two formats. Clicking the image will bring you to the html version of the slides in a new tab. Note while in going through the slides, you can type h to see a special list of viewing options, and type o for an outline view of all the slides.

The lower button will allow you to download a PDF version of the slides. I suggest printing the slides beforehand and using them to take additional notes in class (not everything is in the slides)!

Assignments

Problem Set 5 Due Wednesday April 27

Problem set 5 (on classes 3.1-3.5) is due by Wednesday, April 27 by PDF upload to Blackboard Assignments. This will be your final graded homework!

Appendix

Monopolists Only Produce Where Demand is Elastic: Proof

Let’s first show the relationship between MR(q)MR(q) and price elasticity of demand, ϵDϵD.

MR(q)=p+(ΔpΔq)qDefinition of MR(q)MR(q)p=pp+(ΔpΔq)qpDividing both sides by pMR(q)p=1+(ΔpΔq×qp)⏟1ϵSimplifyingMR(q)p=1+1ϵDRecognize price elasticity ϵD=ΔqΔp×pqMR(q)=p(1+1ϵD)Multiplying both sides by p

Remember, we’ve simplified ϵD=1slope×pq, where 1slope=ΔqΔp because on a demand curve, slope=ΔpΔq.

Now that we have this alternate expression for MR(q), lets assume MC(q)≥0 and set them equal to one another to maximize profits:

MR(q)=MC(q)p(1+1ϵD)=MC(q)p(1−1|ϵD|)=MC(q)

I rearrange the last line only to remind us that ϵD is always negative!

Now note the following:

- If |ϵD|<1, then MR(q) is negative. Since MC(q) is assumed to be positive, it cannot equal a negative MR(q), hence this is not profit-maximizing.

- If |ϵD|=1, then MR(q) is 0. Only if MC(q) is also 0 is this profit-maximizing.

- If |ϵD|>1, then MR(q) is positive. It can equal a positive MC(q) to be profit-maximizing.

Hence, a monopolist will never produce in the inelastic region of the demand curve (where MR(q)<0), and will only produce at the unit elastic part of the demand curve (where MR(q)=0) if MC(q)=0. Thus, it generally produces in the elastic region where MR(q)>0.

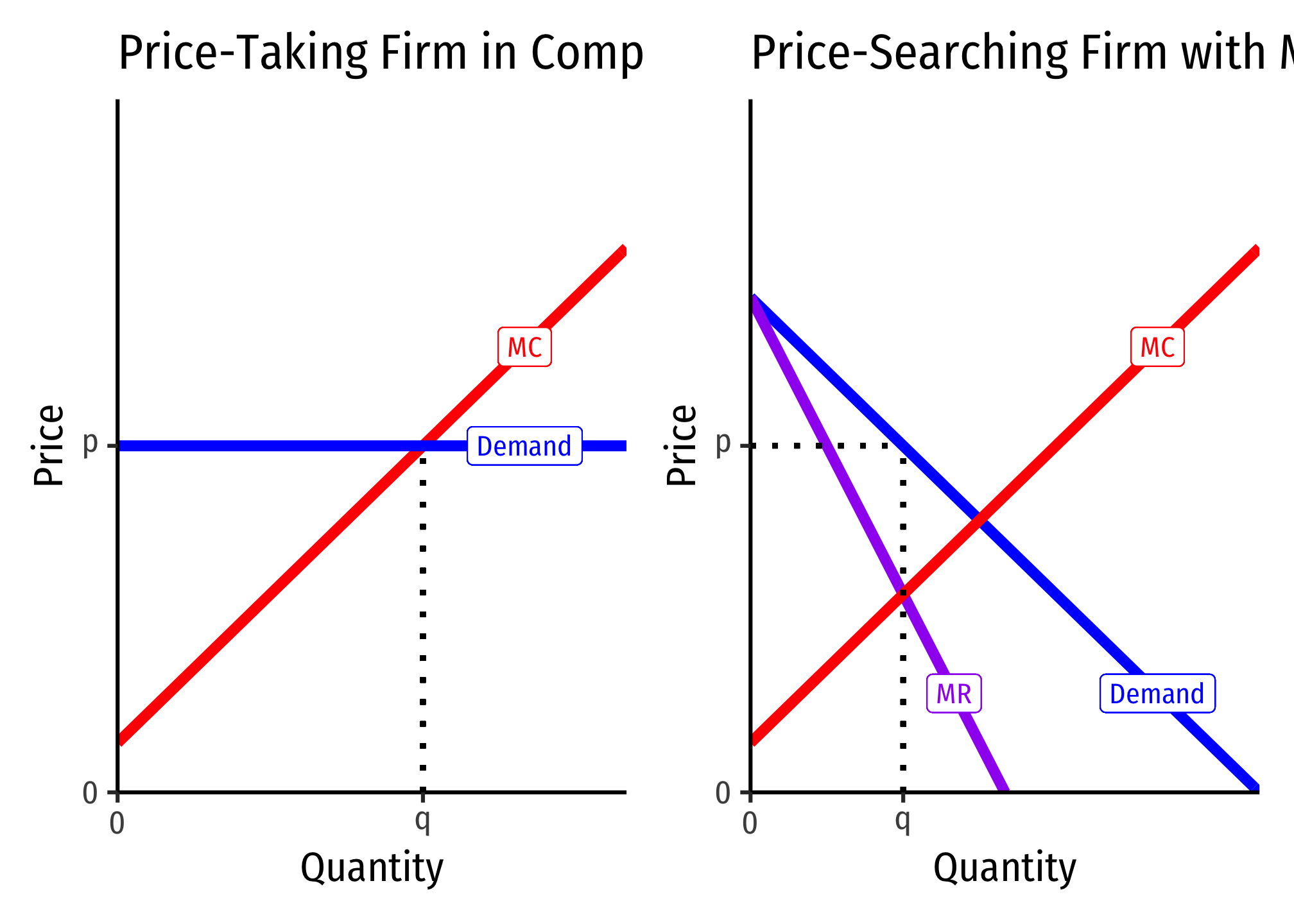

See the graphs on slide 32.

Derivation of the Lerner Index

Marginal revenue is strongly related to the price elasticity of demand, which is ED=ΔqΔp×pq1

We derived marginal revenue (in the slides) as: MR(q)=p+ΔpΔqq

Firms will always maximize profits where:

MR(q)=MC(q)Profit-max outputp+(ΔpΔq)q=MC(q)Definition of MR(q)p+(ΔpΔq)q×pp=MC(q)Multiplying the left by pp (i.e. 1)p+(ΔpΔq×qp)⏟1ϵ×p=MC(q)Rearranging the leftp+1ϵ×p=MC(q)Recognize price elasticity ϵ=ΔqΔp×pqp=MC(q)−1ϵpSubtract 1ϵp from both sidesp−MC(q)=−1ϵpSubtract MC(q) from both sidesp−MC(q)p=−1ϵDivide both sides by p

The left side gives us the fraction of price that is markup (p−MC(q)p), and the right side shows this is inversely related to price elasticity of demand.

Firms With Market Power vs. Competitive Firms’ Responses to Market Changes

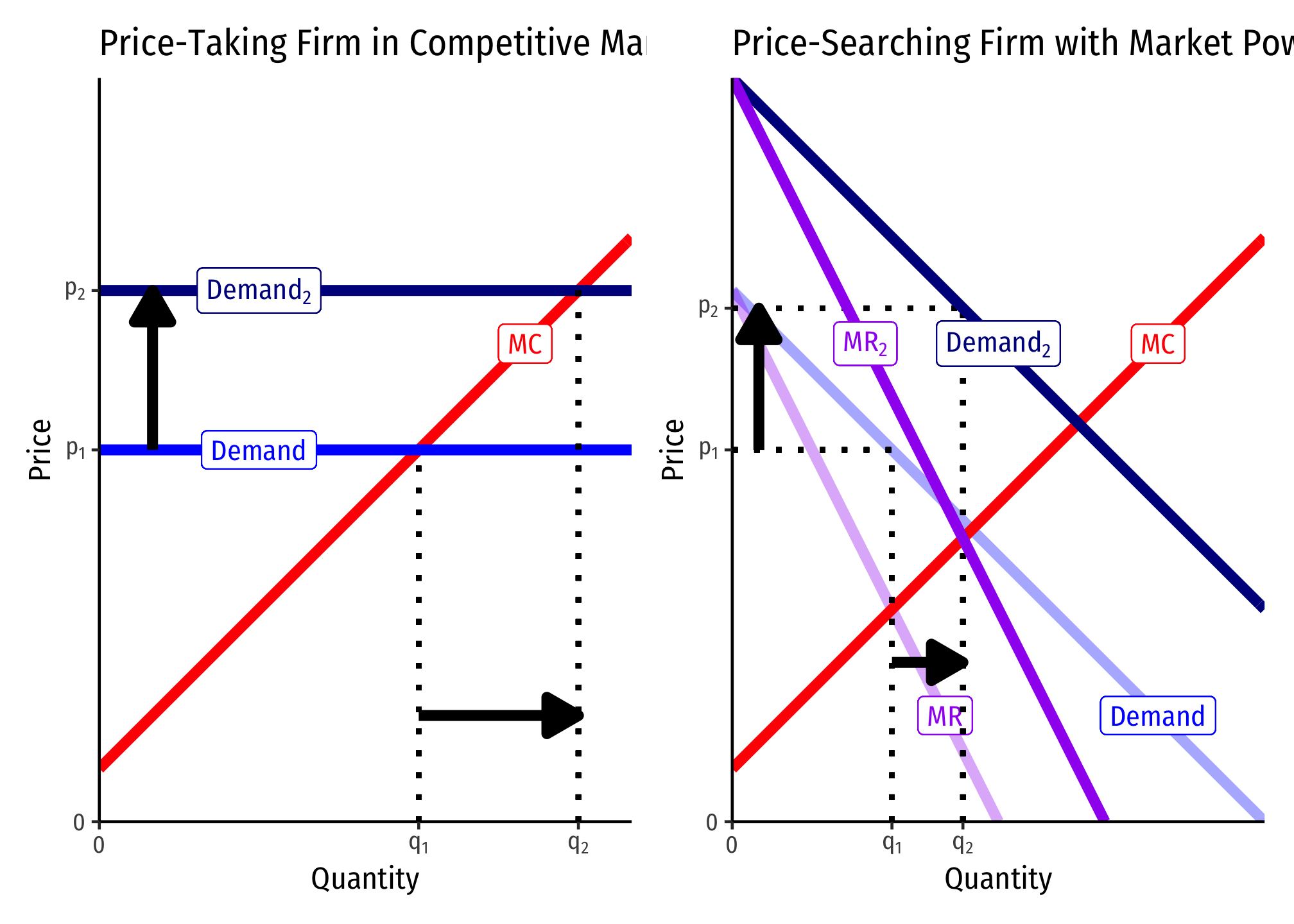

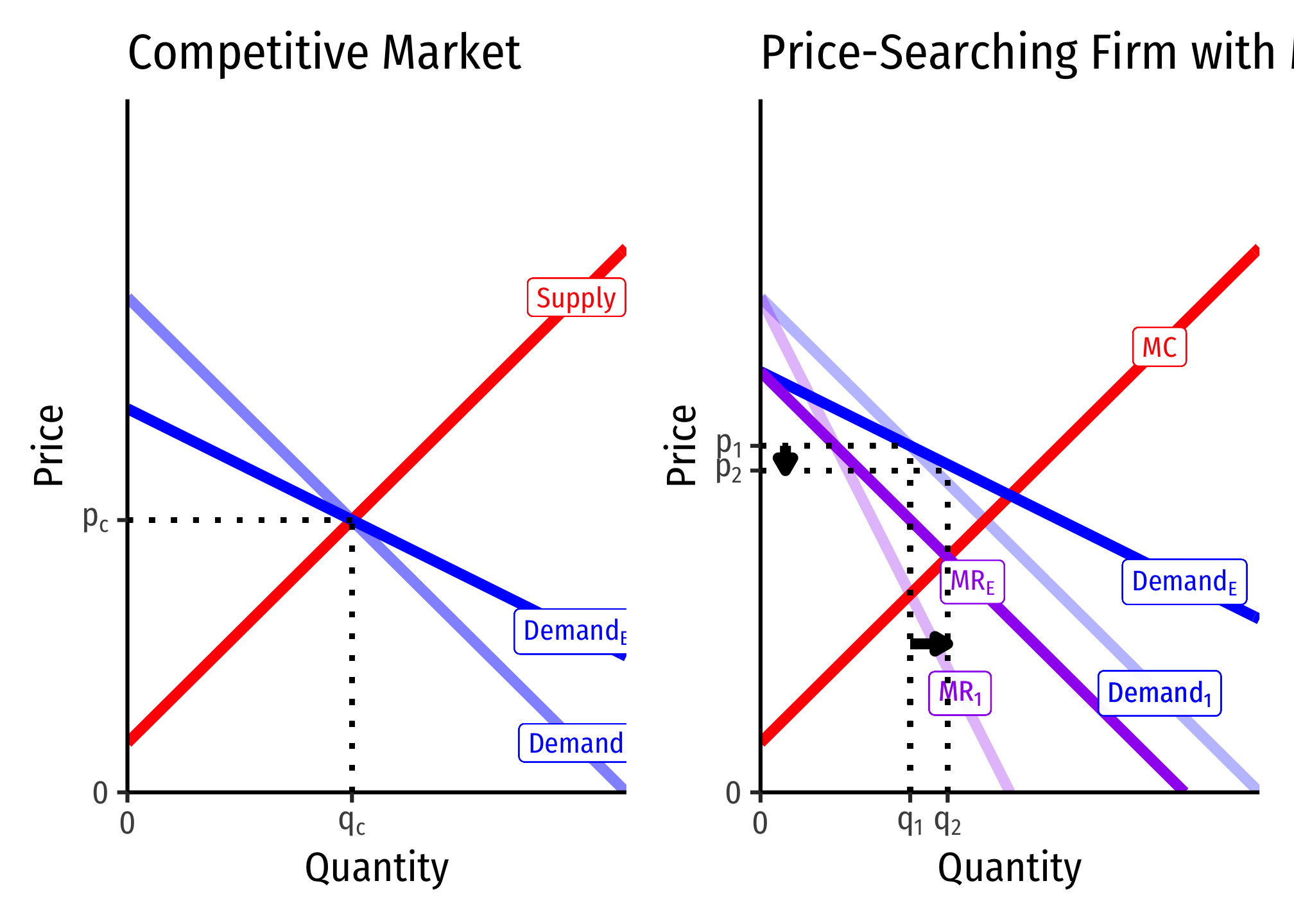

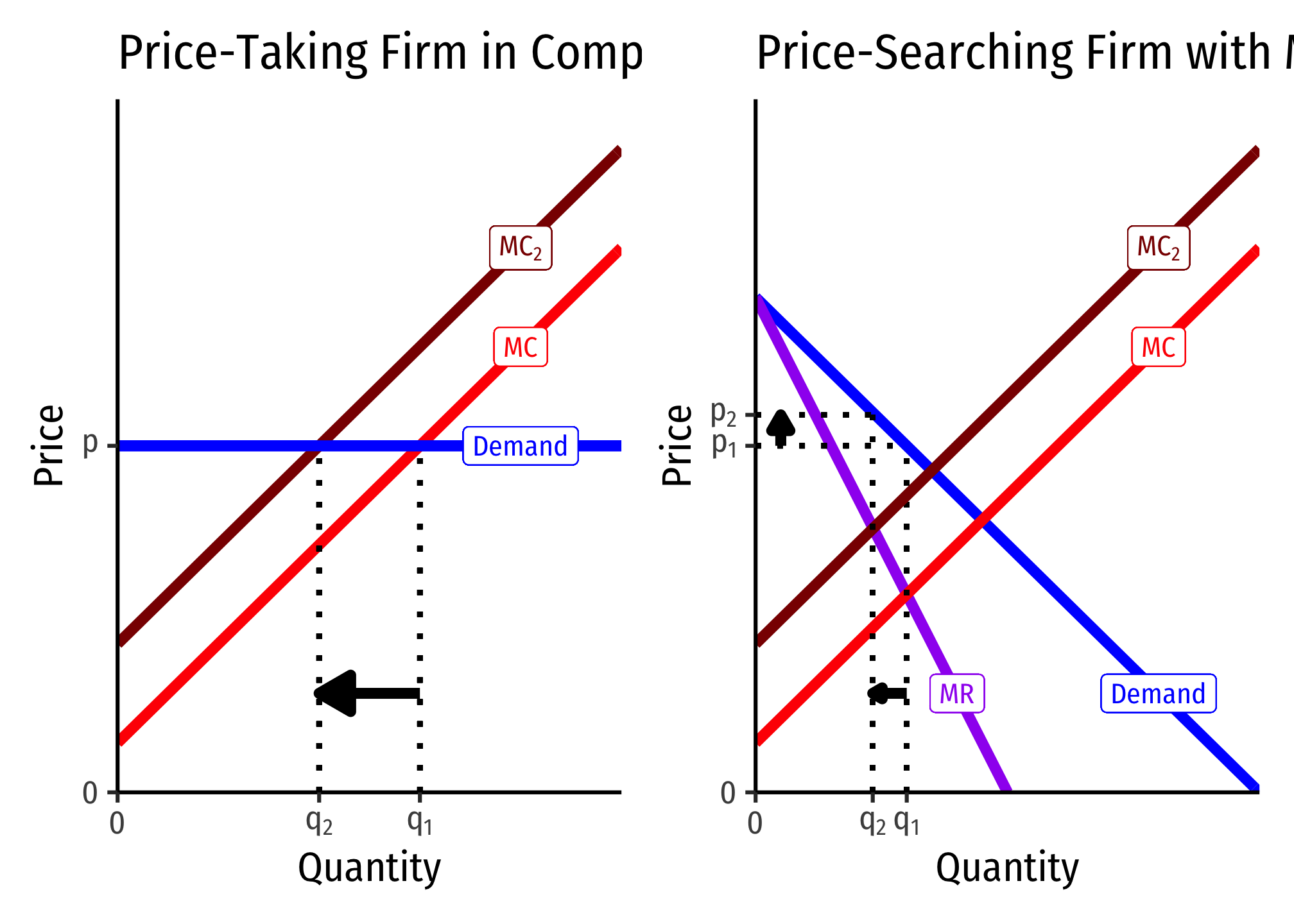

Consider a firm in a competitive market (left) and a firm with market power (right):

An Increase in Firms’ Marginal Cost

A competitive firm responds by only changing its output q⋆ (since it cannot control price), whereas the firm with market power changes both its p⋆ and q⋆.

I sometimes simplify it as ED=1slope×pq, where “slope” is the slope of the inverse demand curve (graph), since the slope is ΔpΔq=riserun.↩︎