2.7 — External Economies & Industry Supply

ECON 306 • Microeconomic Analysis • Spring 2022

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS22

microS22.classes.ryansafner.com

Entry Effects & External Economies

Entry/Exit Effects on Market Price

When all firms produce more/less; or firms enter or exit an industry, this affects the equilibrium market price

Think about basic supply & demand graphs:

- Entry: \(\color{red}{\uparrow}\) industry supply \(\implies\) \(\uparrow q, \downarrow p\)

- Exit: \(\color{red}{\downarrow}\) industry supply \(\implies\) \(\downarrow q, \uparrow p\)

External Economies

How large this change in price will be from entry/exit depends on industry-wide costs and external economies

Economies of scale are internal to the firm (a firm's own average cost curve)

External economies have to do with how the size of the entire industry affects all individual firm's costs

- These are externalities that spill over across all firms in an industry

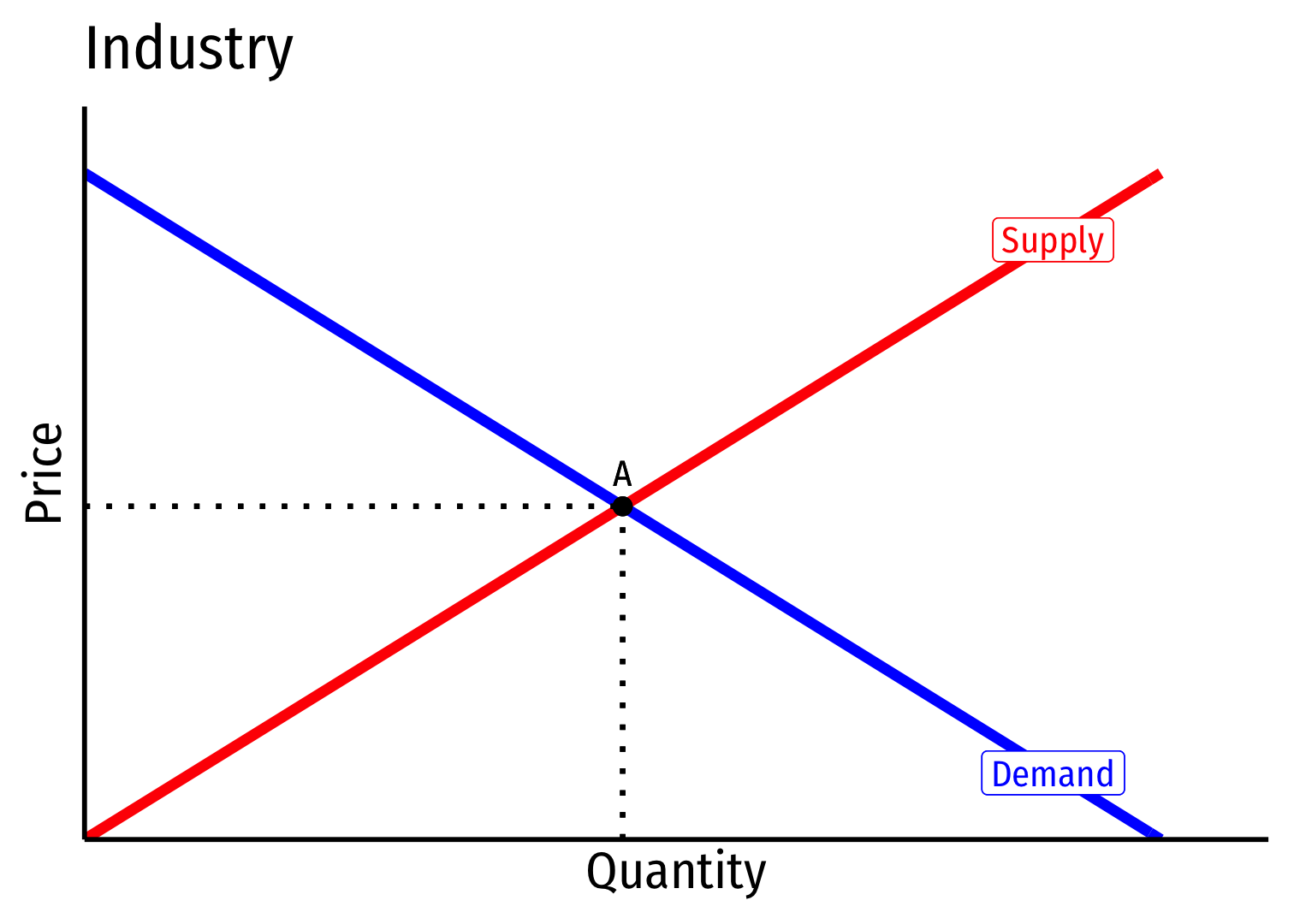

Constant Cost Industry (No External Economies) I

Constant cost industry has no external economies, no change in costs as industry output increases (firms enter & incumbents produce more)

A perfectly elastic long-run industry supply curve

Determinants:

- Industry's purchases are not a large share of input markets

- Often constant marginal costs, insignificant fixed costs

Examples: toothpicks, domain name registration, waitstaff

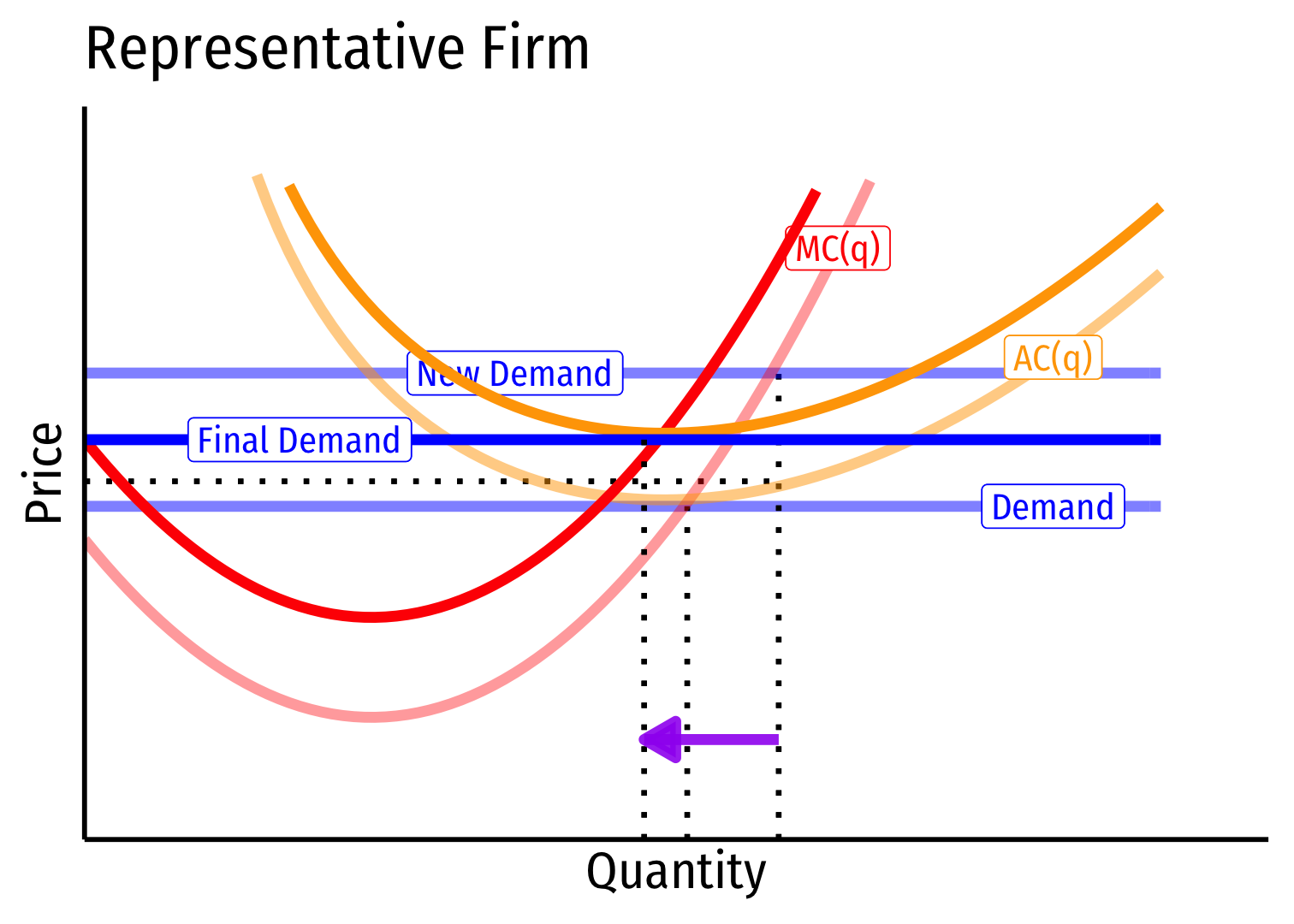

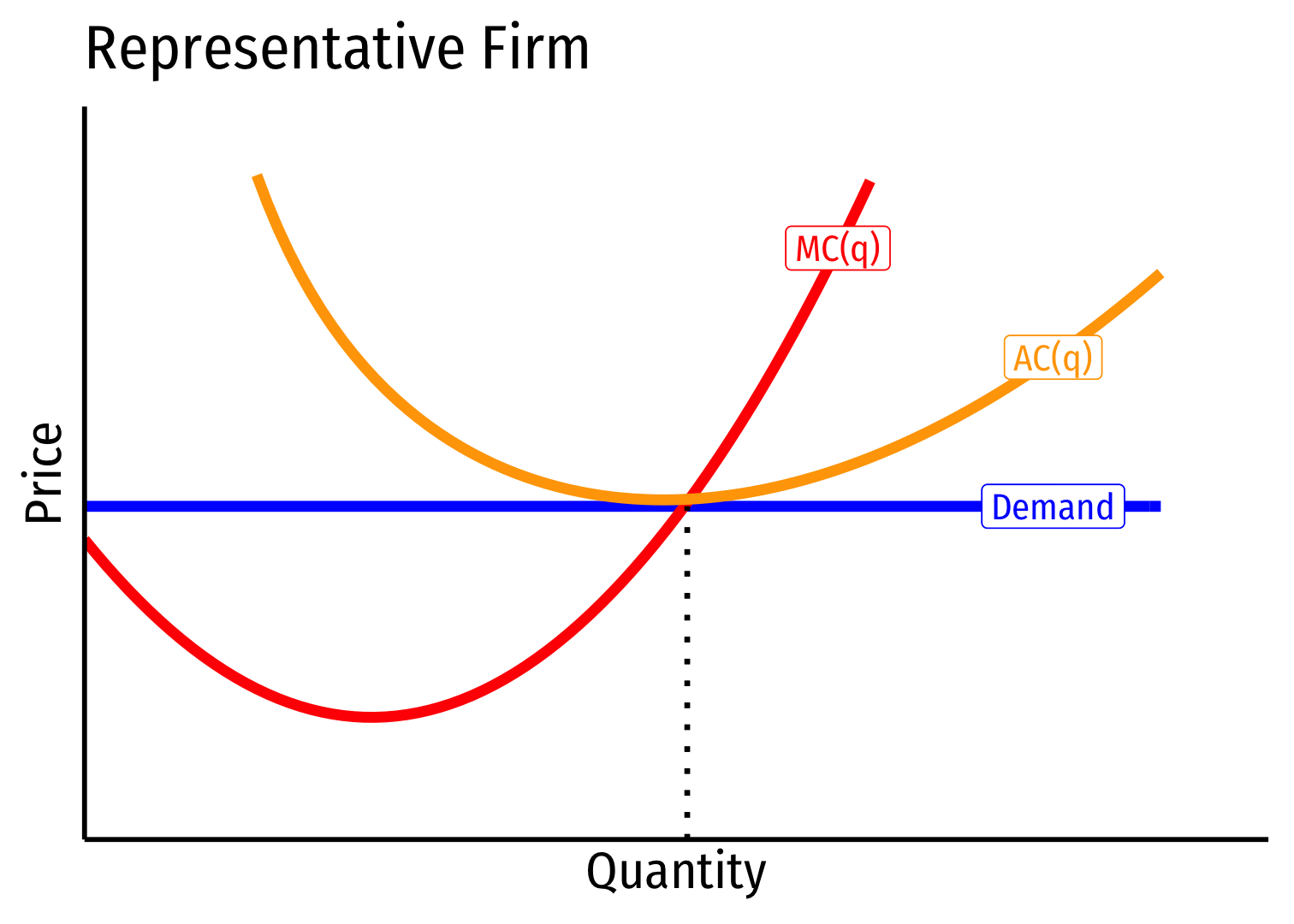

Constant Cost Industry (No External Economies) II

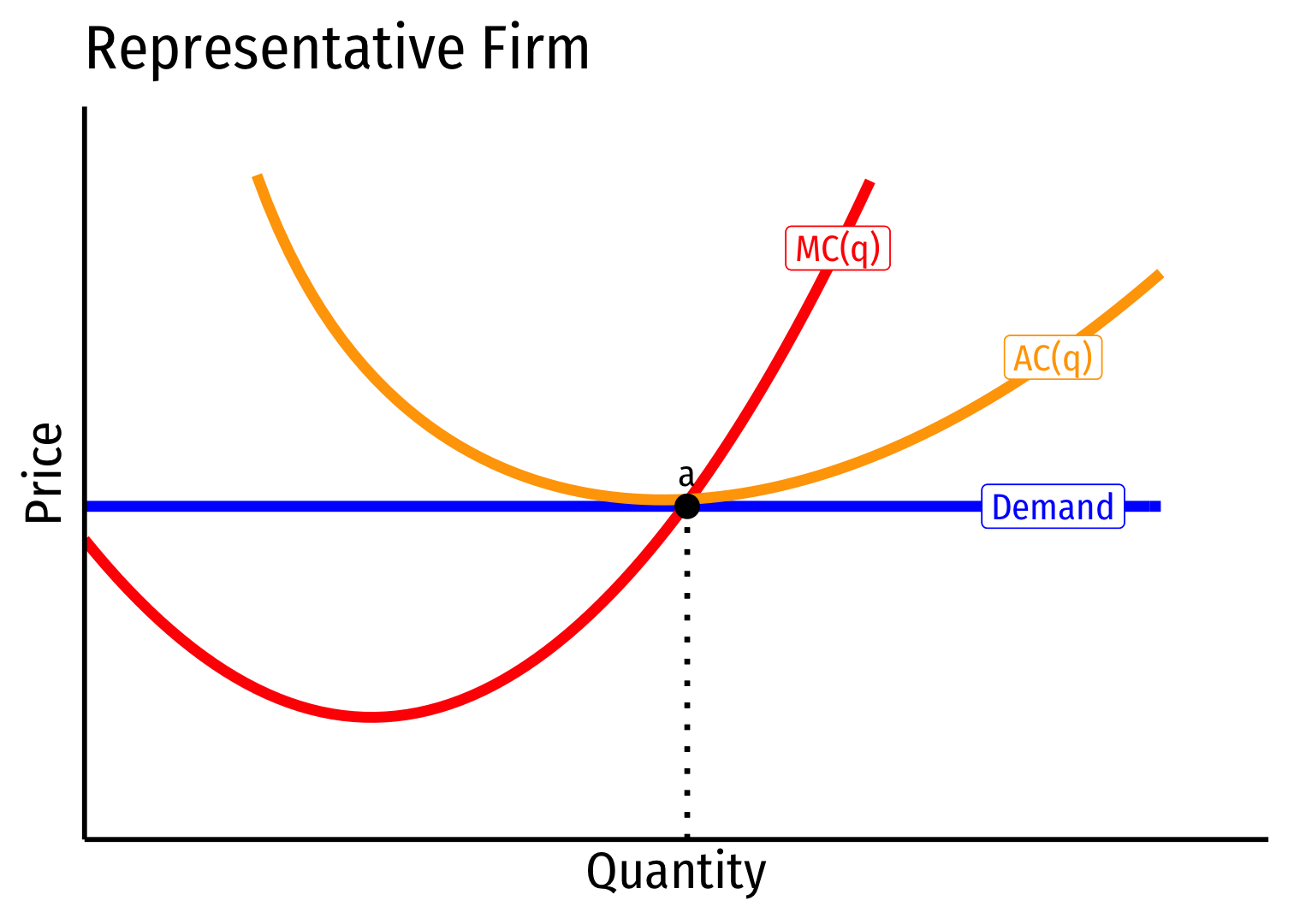

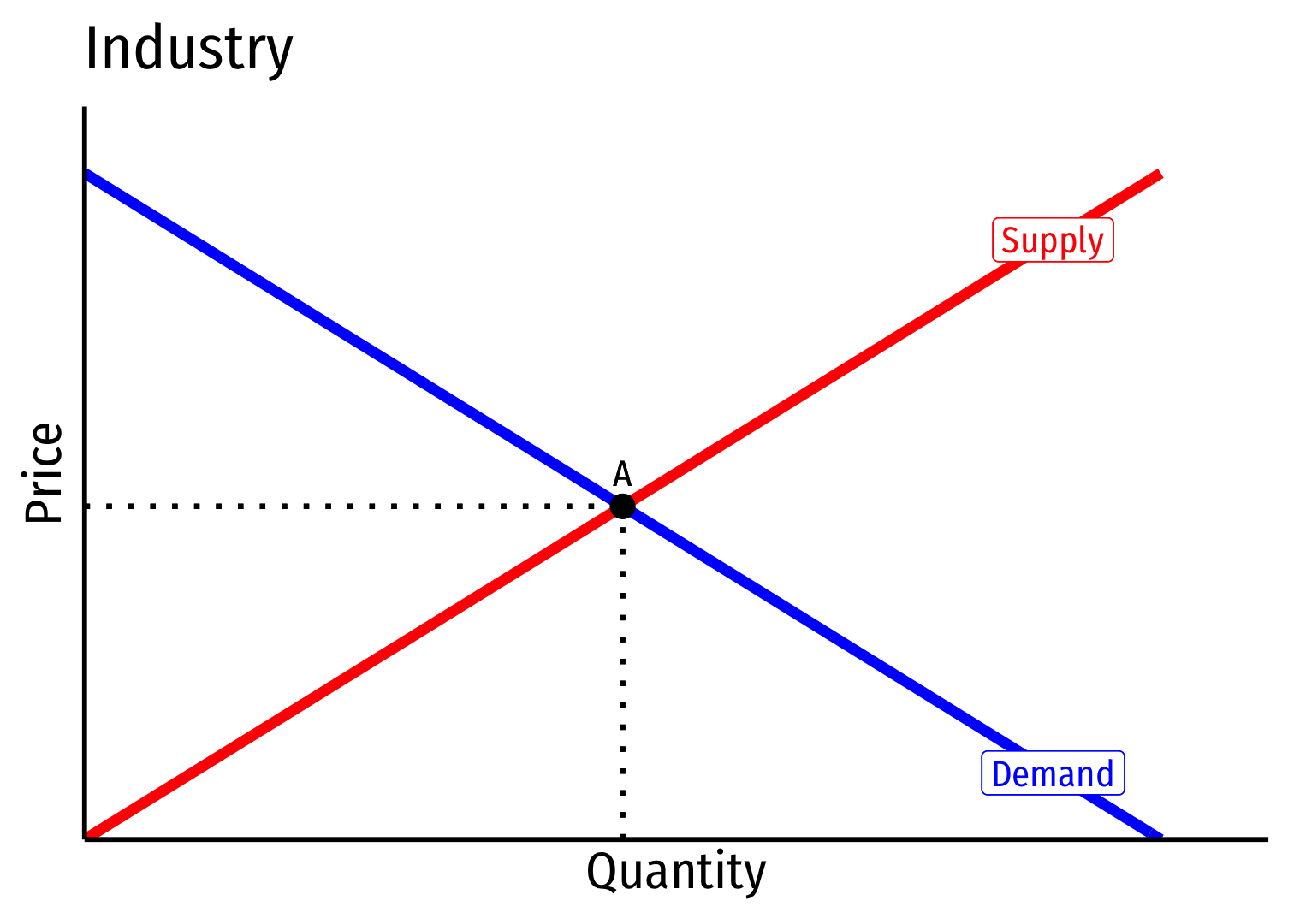

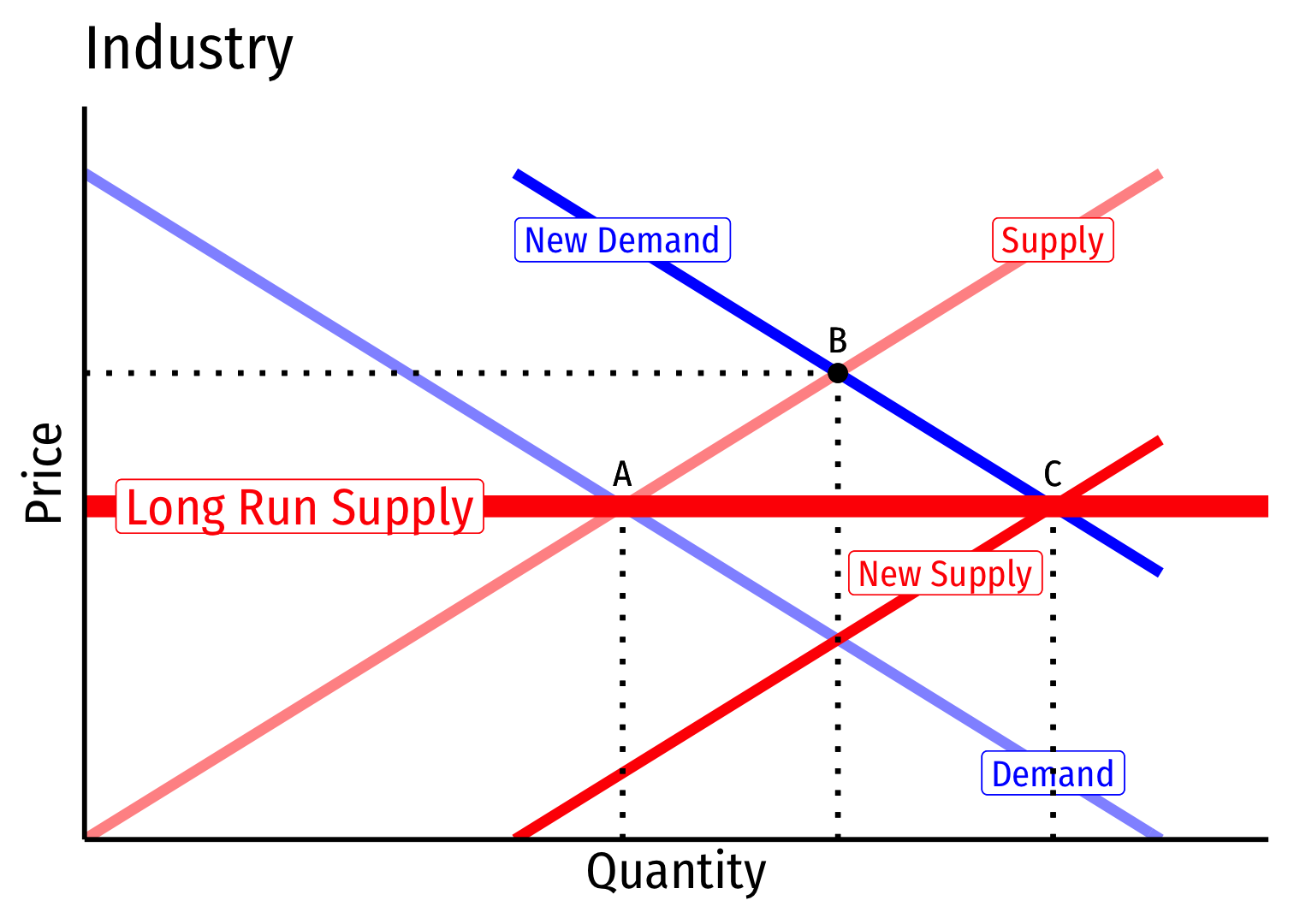

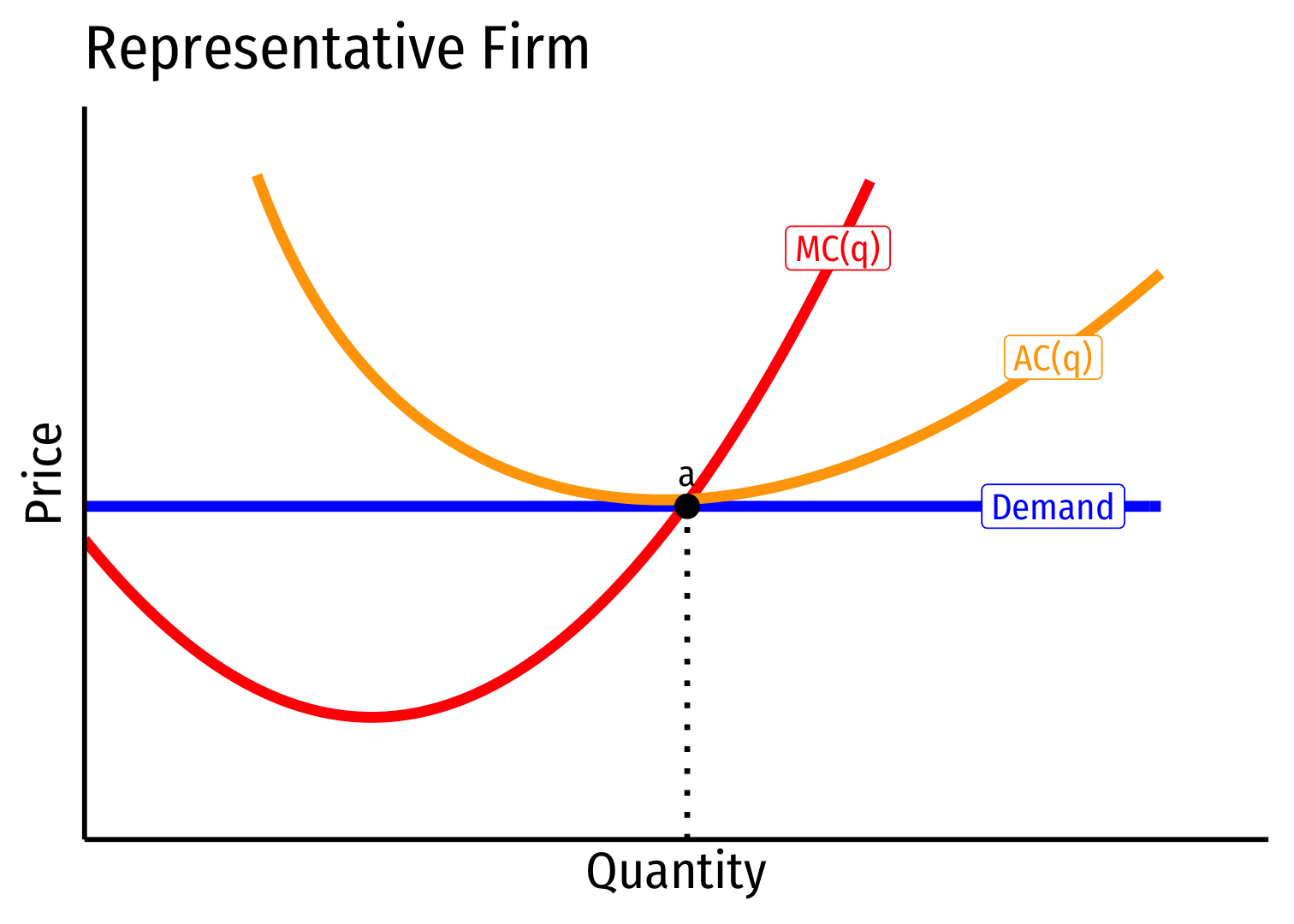

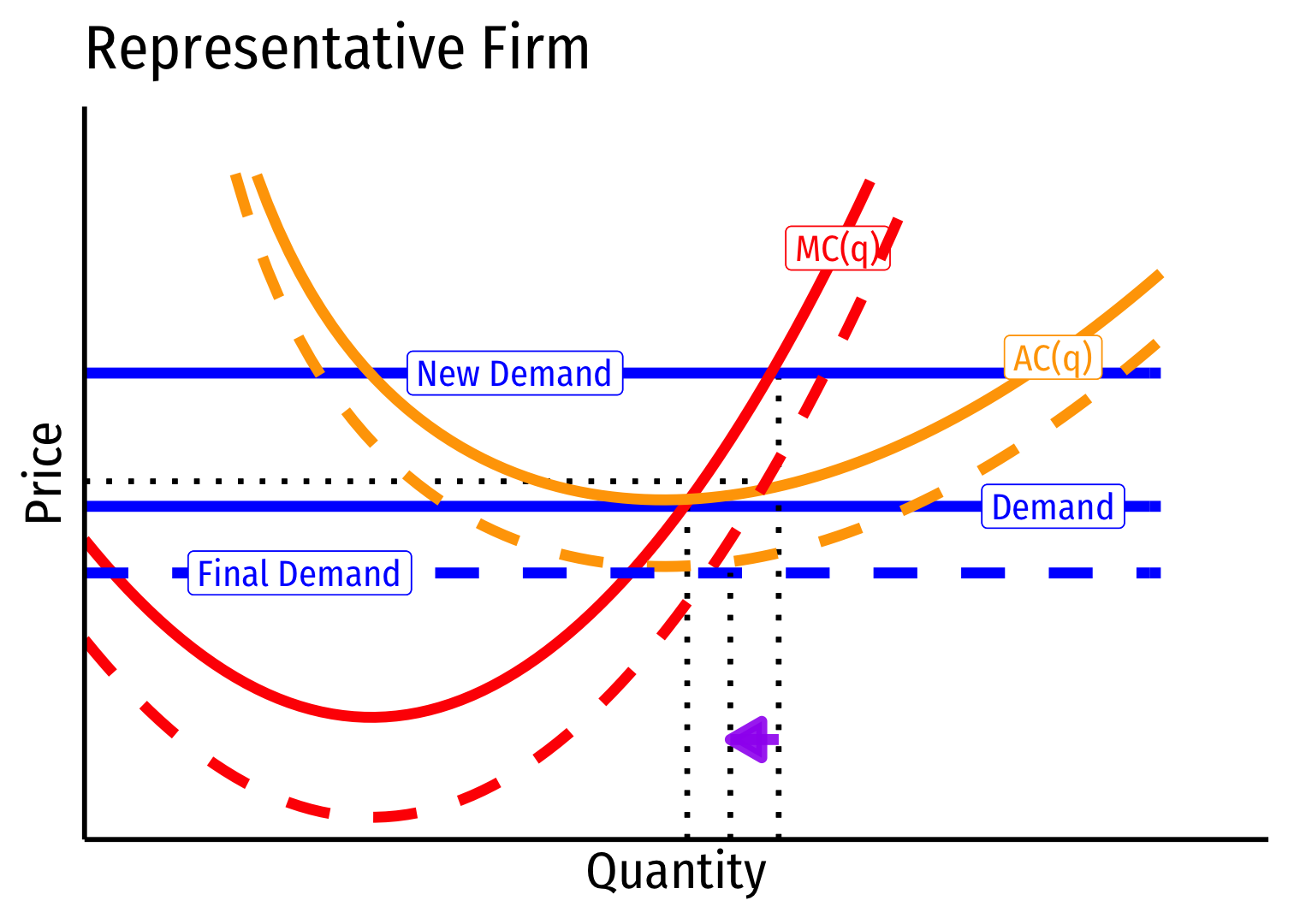

- Industry equilibrium: firms earning normal \(\color{#047806}{\pi=0}, \color{blue}{p}=\color{red}{MC(q)}=\color{orange}{AC(q)}\) at points a, A

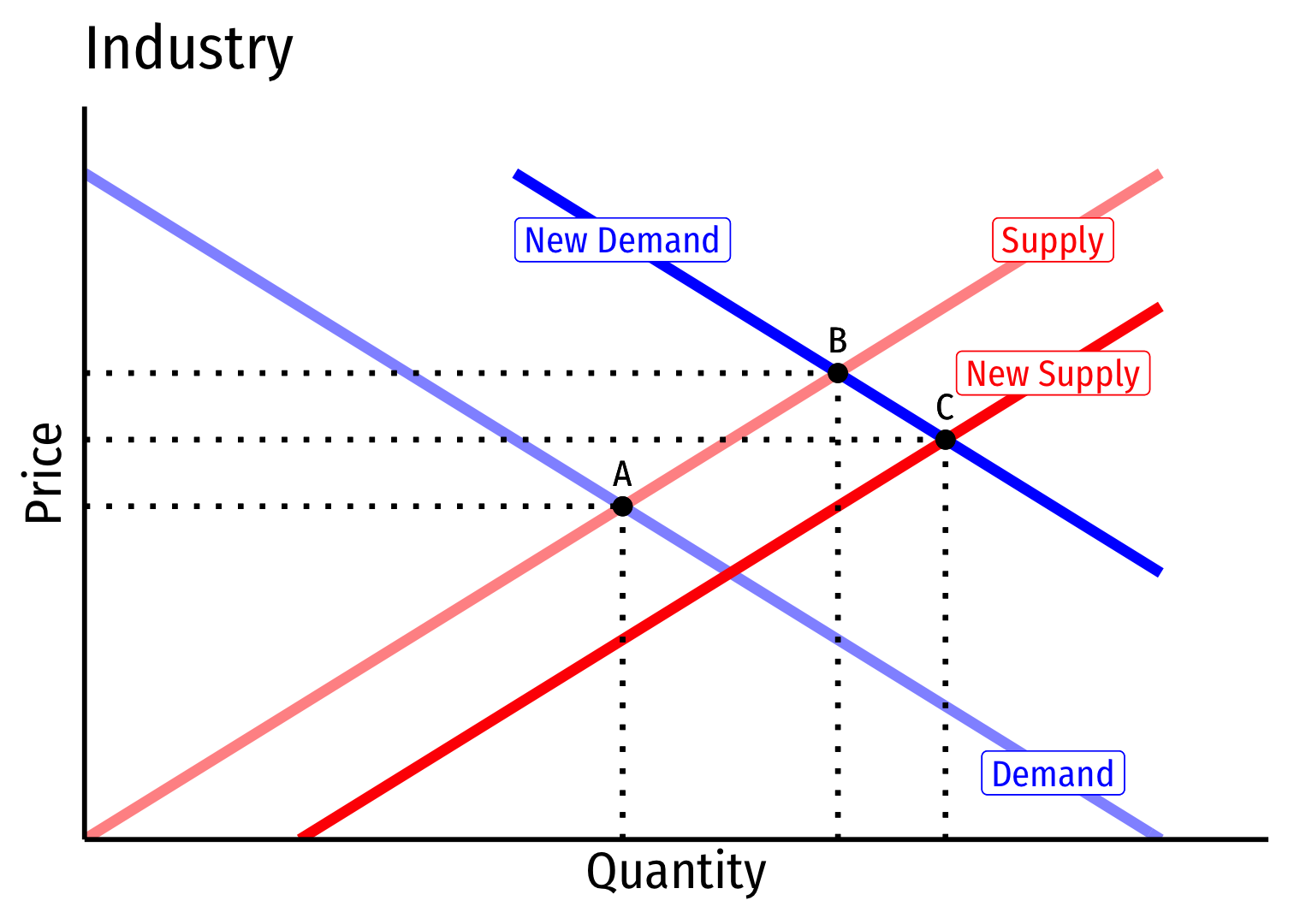

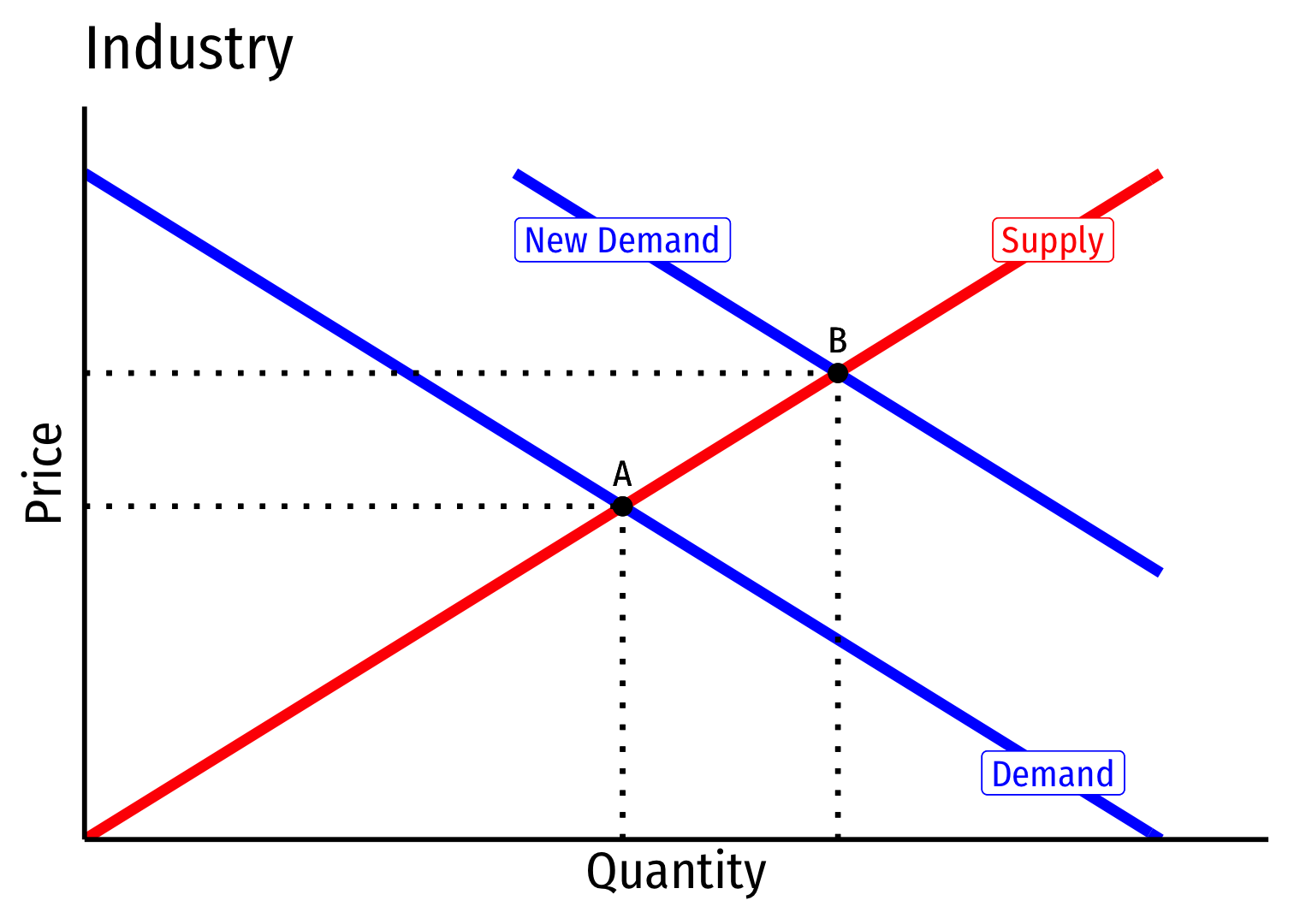

Constant Cost Industry (No External Economies) III

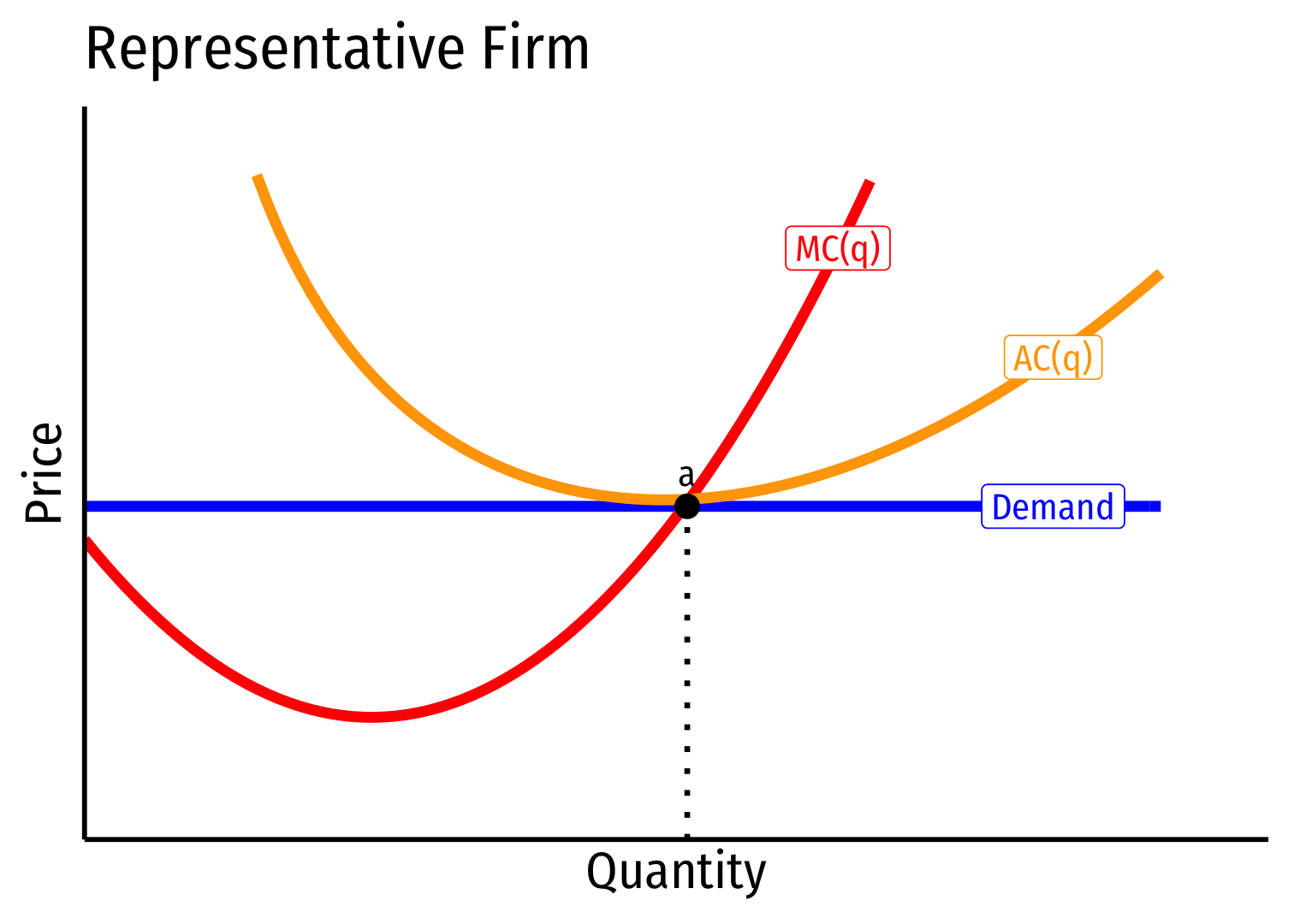

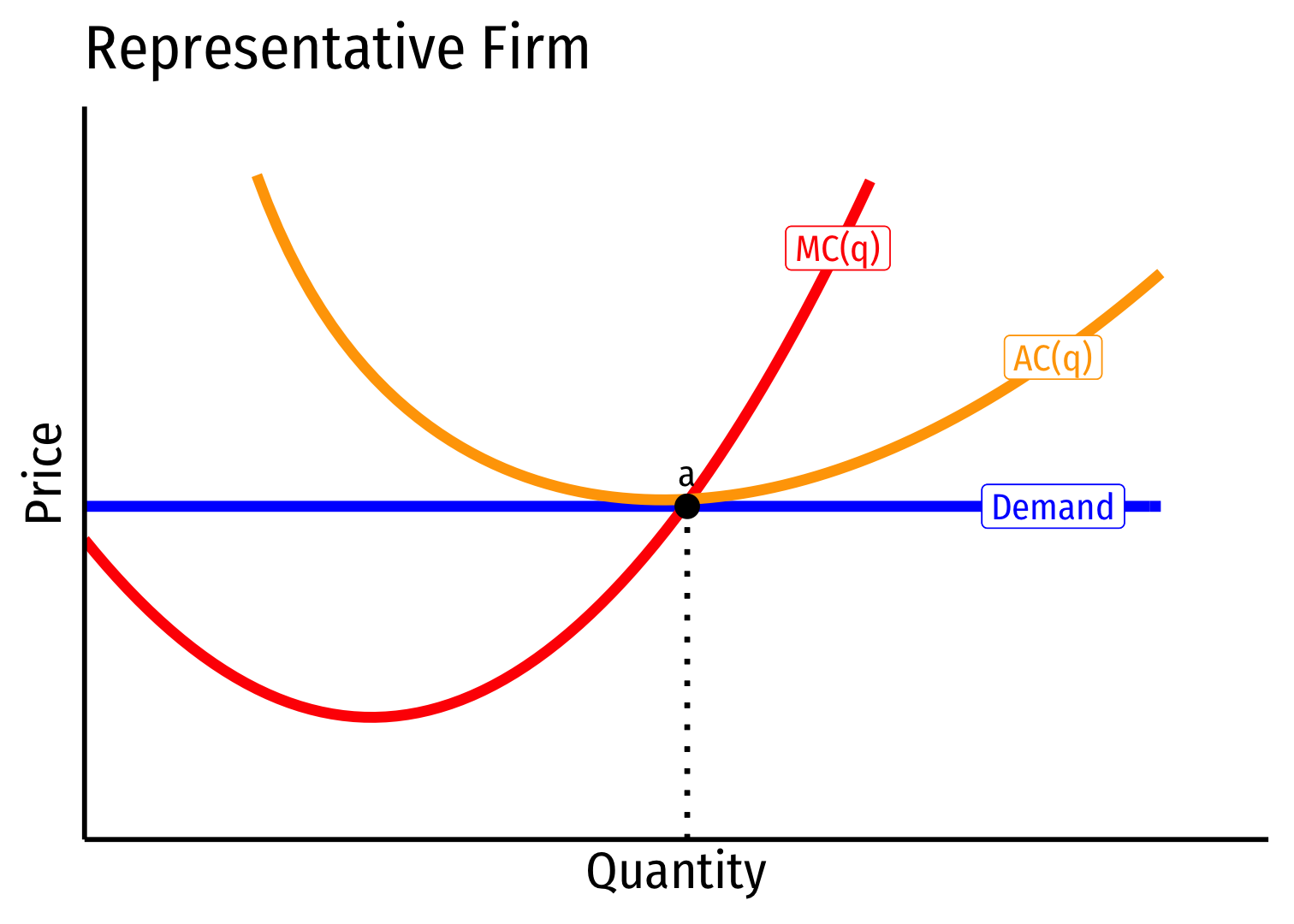

Industry equilibrium: firms earning normal \(\color{#047806}{\pi=0}, \color{blue}{p}=\color{red}{MC(q)}=\color{orange}{AC(q)}\) at points a, A

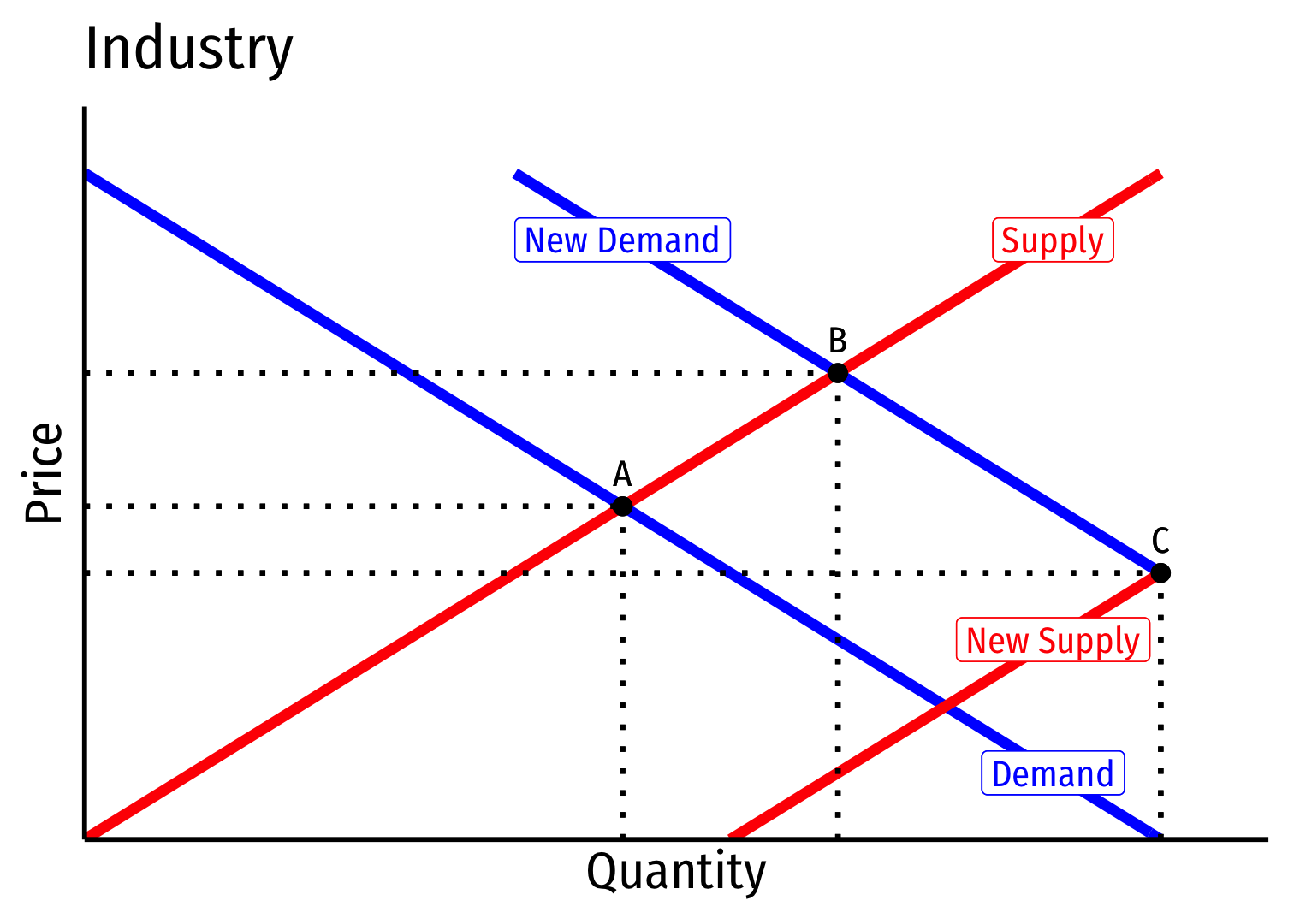

Consider an increase in market demand

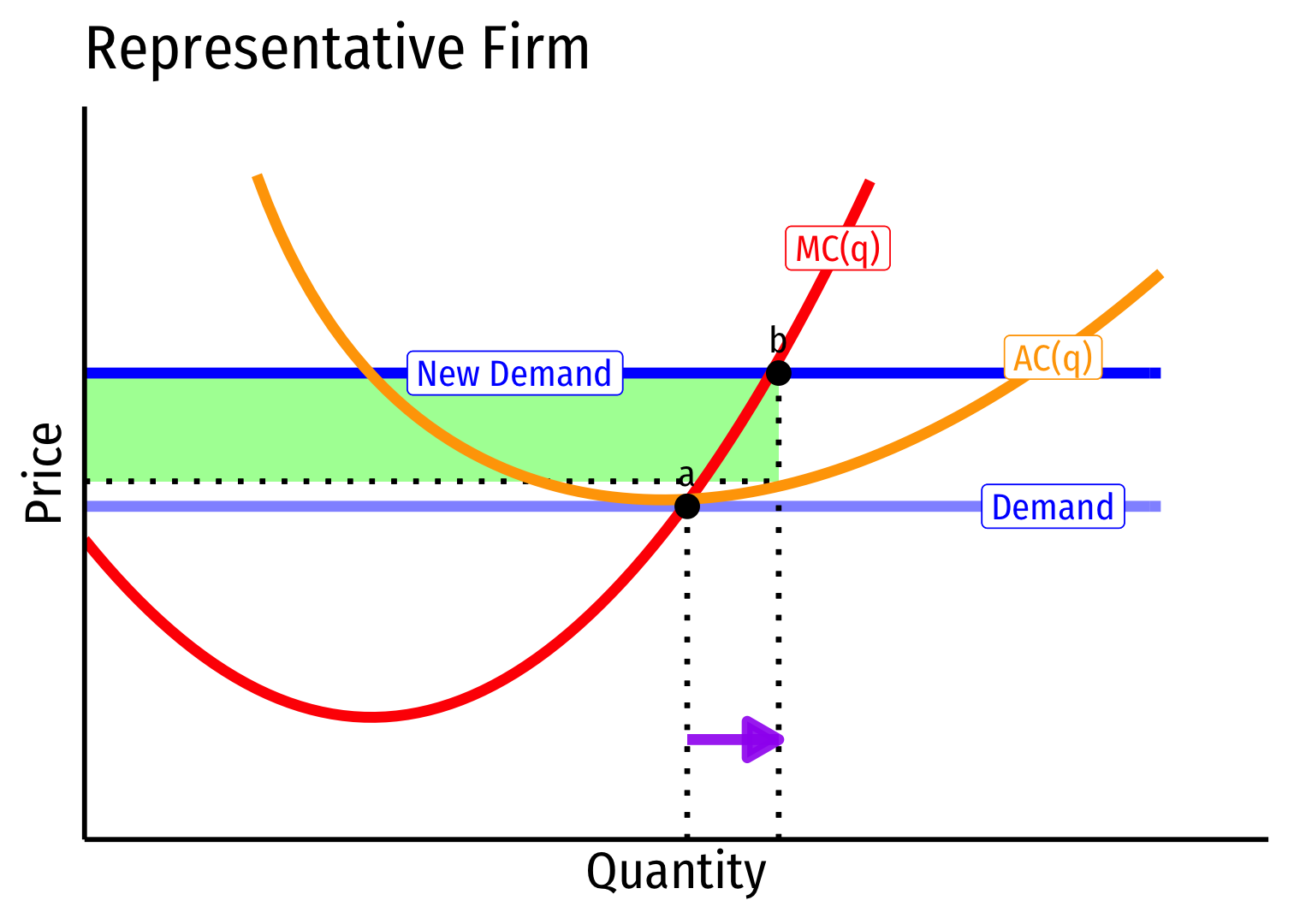

Constant Cost Industry (No External Economies) IV

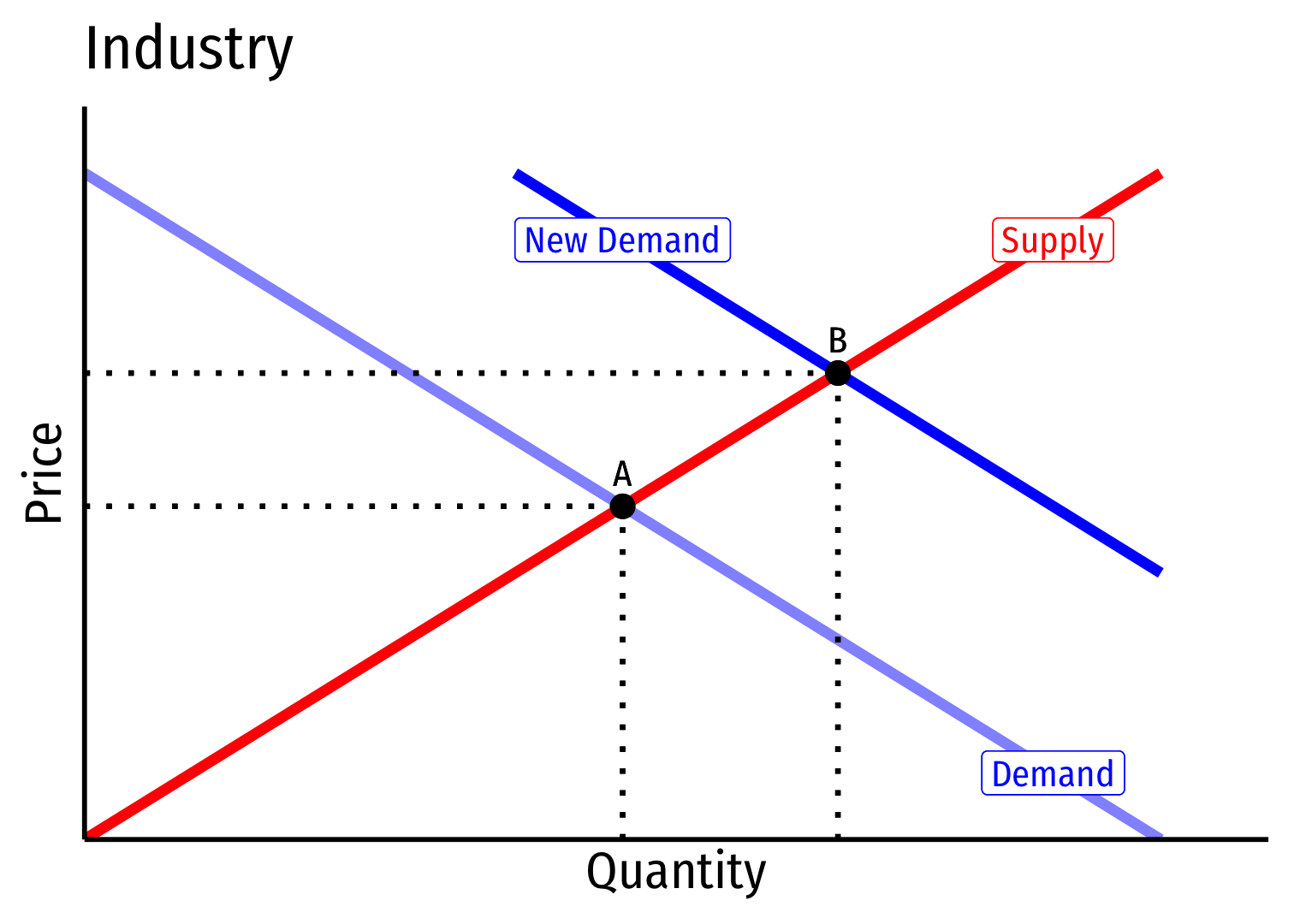

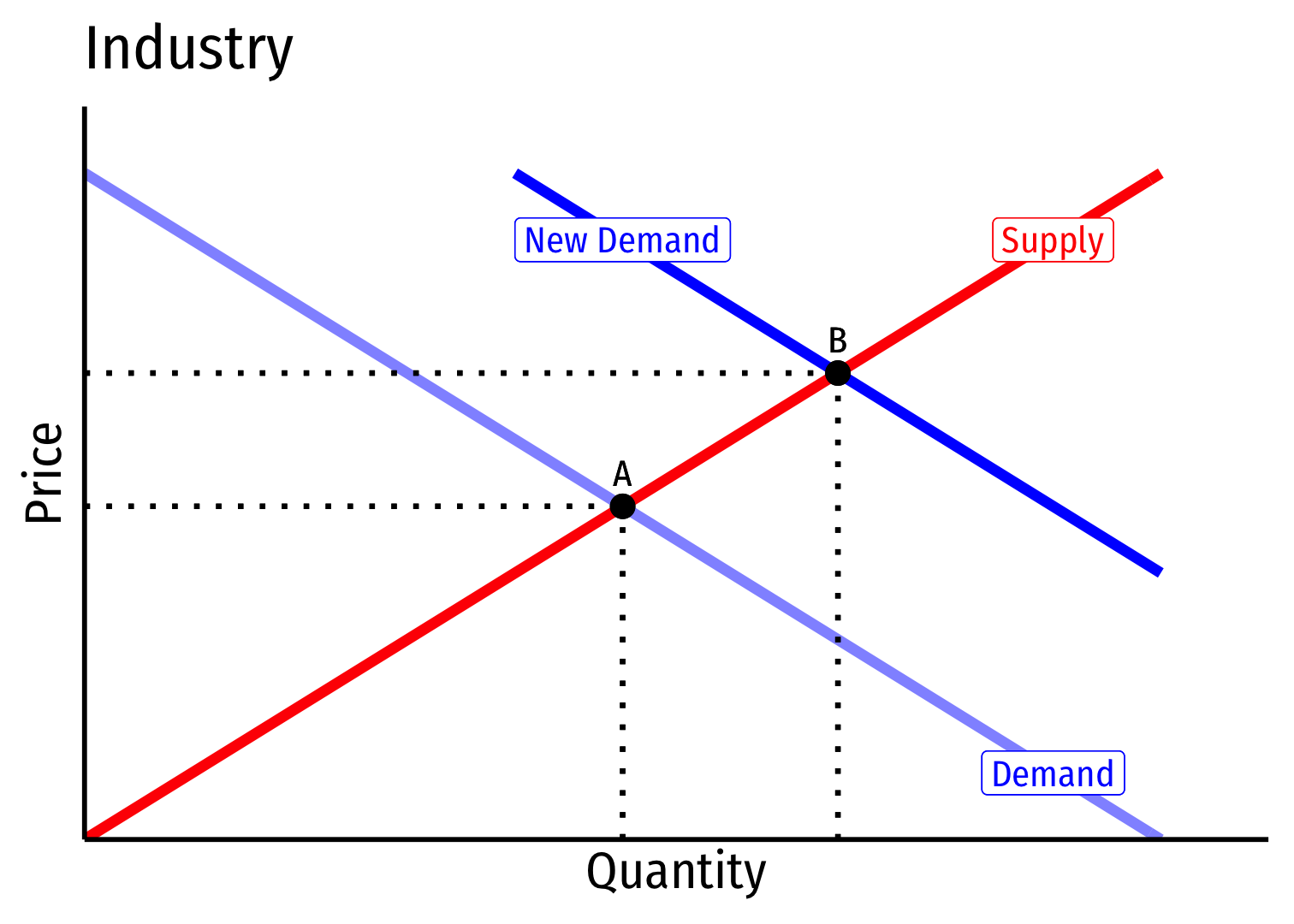

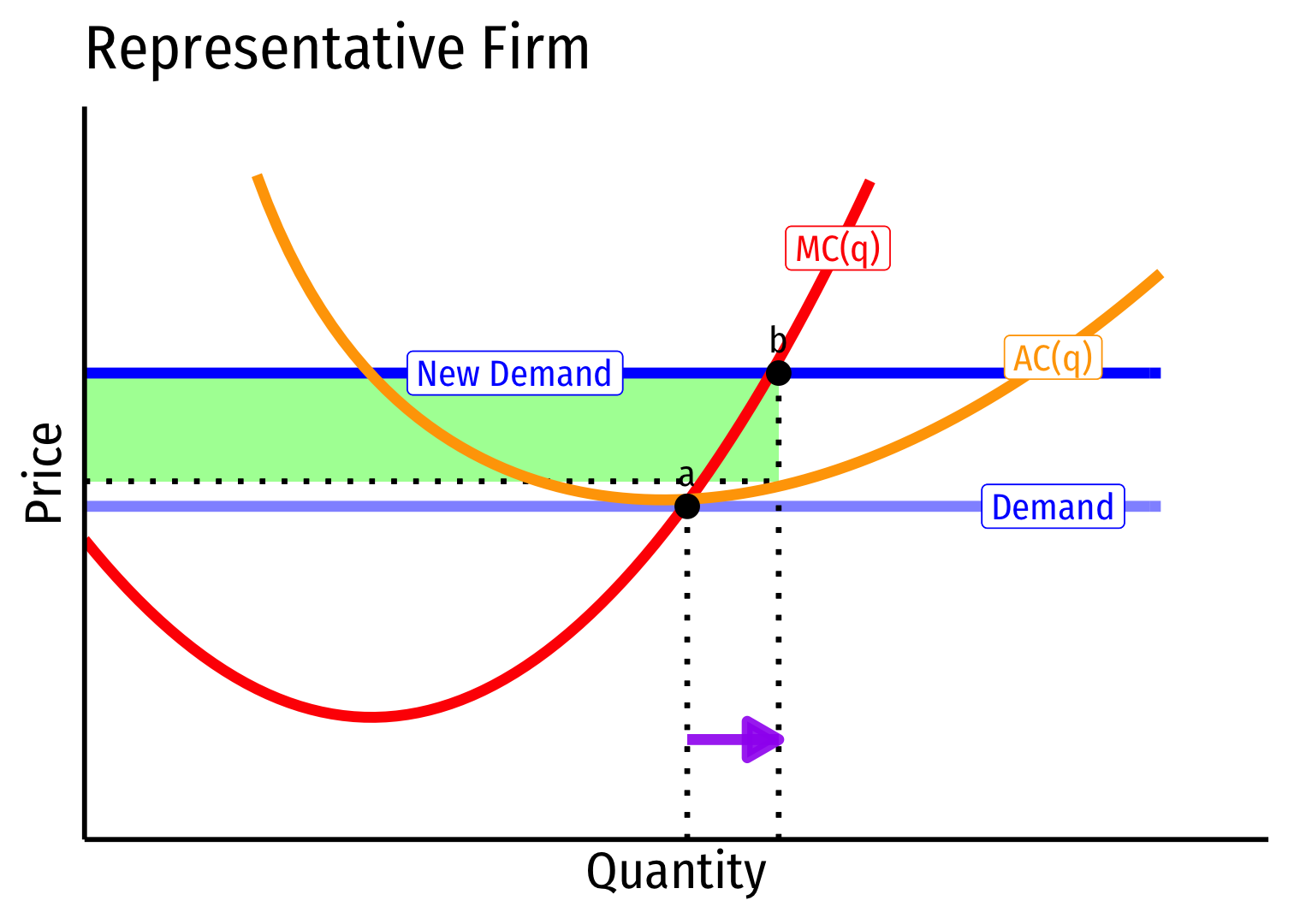

Short run \((A \rightarrow B)\): industry reaches new equilibrium at higher price

Firms charge higher price, produce more output, earn \(\color{#047806}{\pi}\) at point b

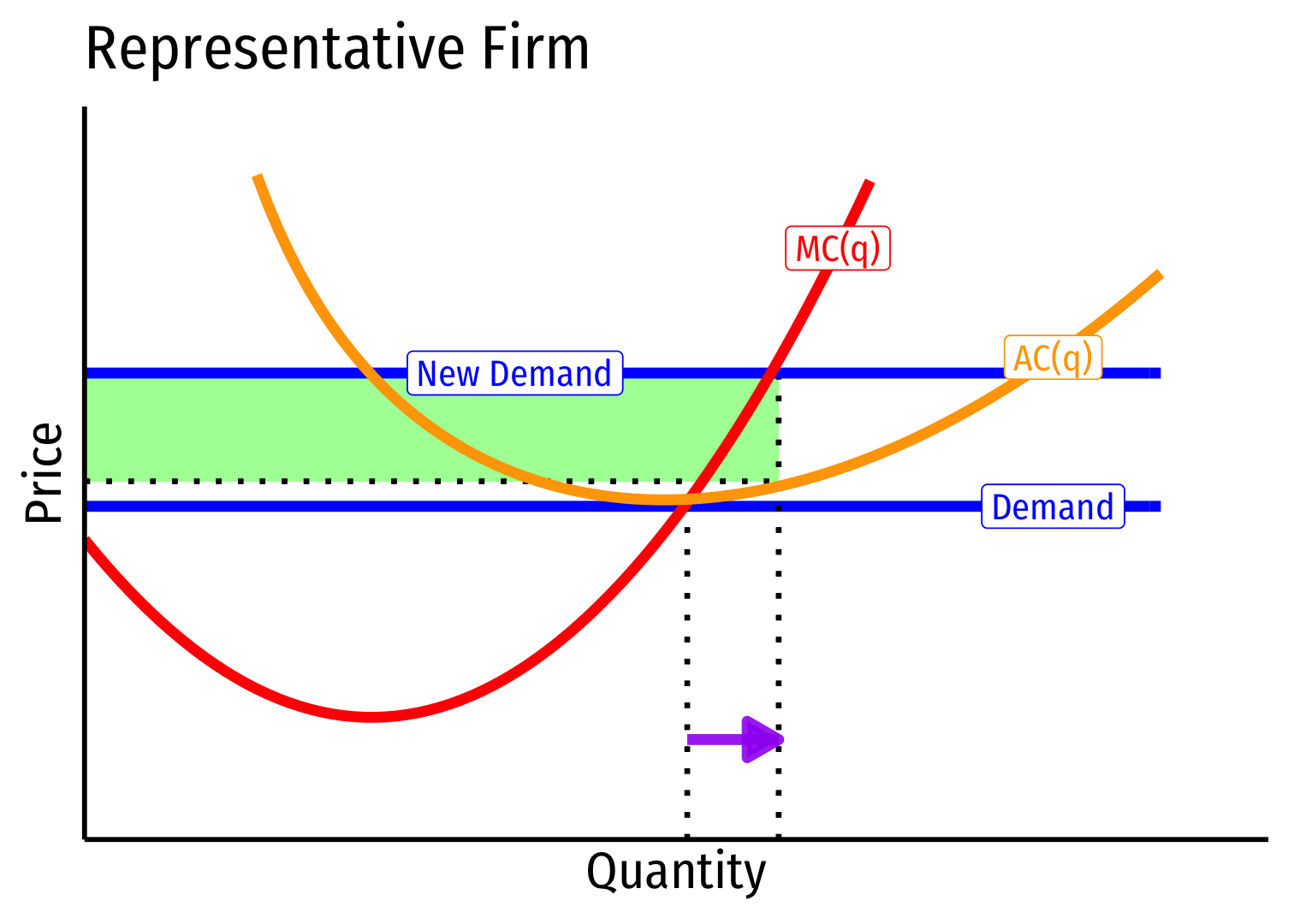

Constant Cost Industry (No External Economies) V

Long run \((B \rightarrow C)\): profit attracts entry \(\implies\) industry supply increases (pushing down price)

No change in costs to firms in industry, new firms continue to enter until \(\color{#047806}{\pi=0}\) at \(\color{blue}{p}=\color{orange}{AC(q)}\) for firms

Firms return to point a, original price, output, and \(\color{#047806}{\pi=0}\)

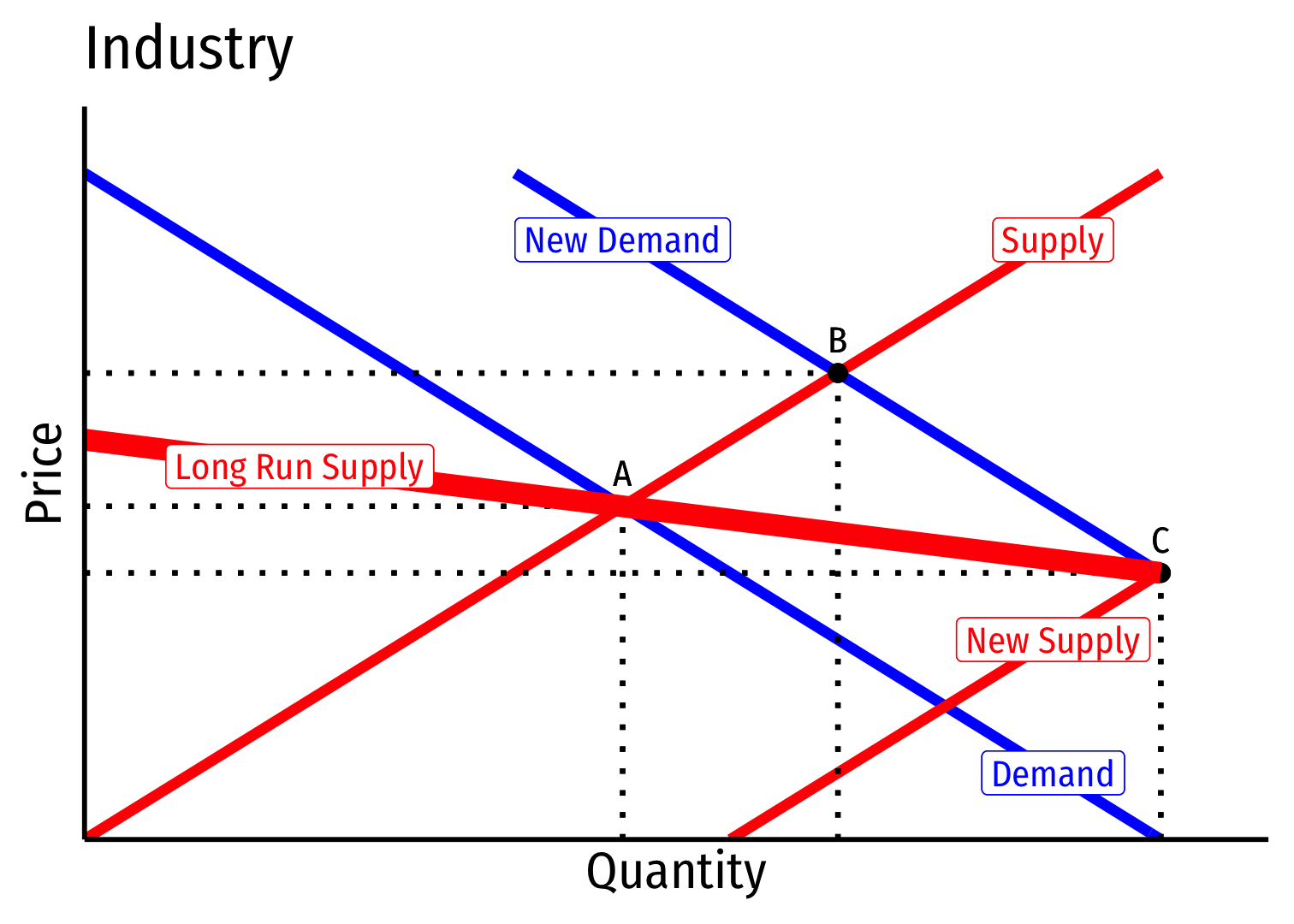

Constant Cost Industry (No External Economies) VI

- Long Run Industry Supply is perfectly elastic

- Long run price is not affected in any way by Market Demand!

Increasing Cost Industry (External Diseconomies) I

Increasing cost industry has external diseconomies, costs rise for all firms in the industry as industry output increases (firms enter & incumbents produce more)

An upward sloping long-run industry supply curve

Determinants:

- Finding more resources in harder-to-reach places

- Diminishing marginal products

- Greater complexity and administrative costs at larger scales

Examples: oil, mining, particle physics

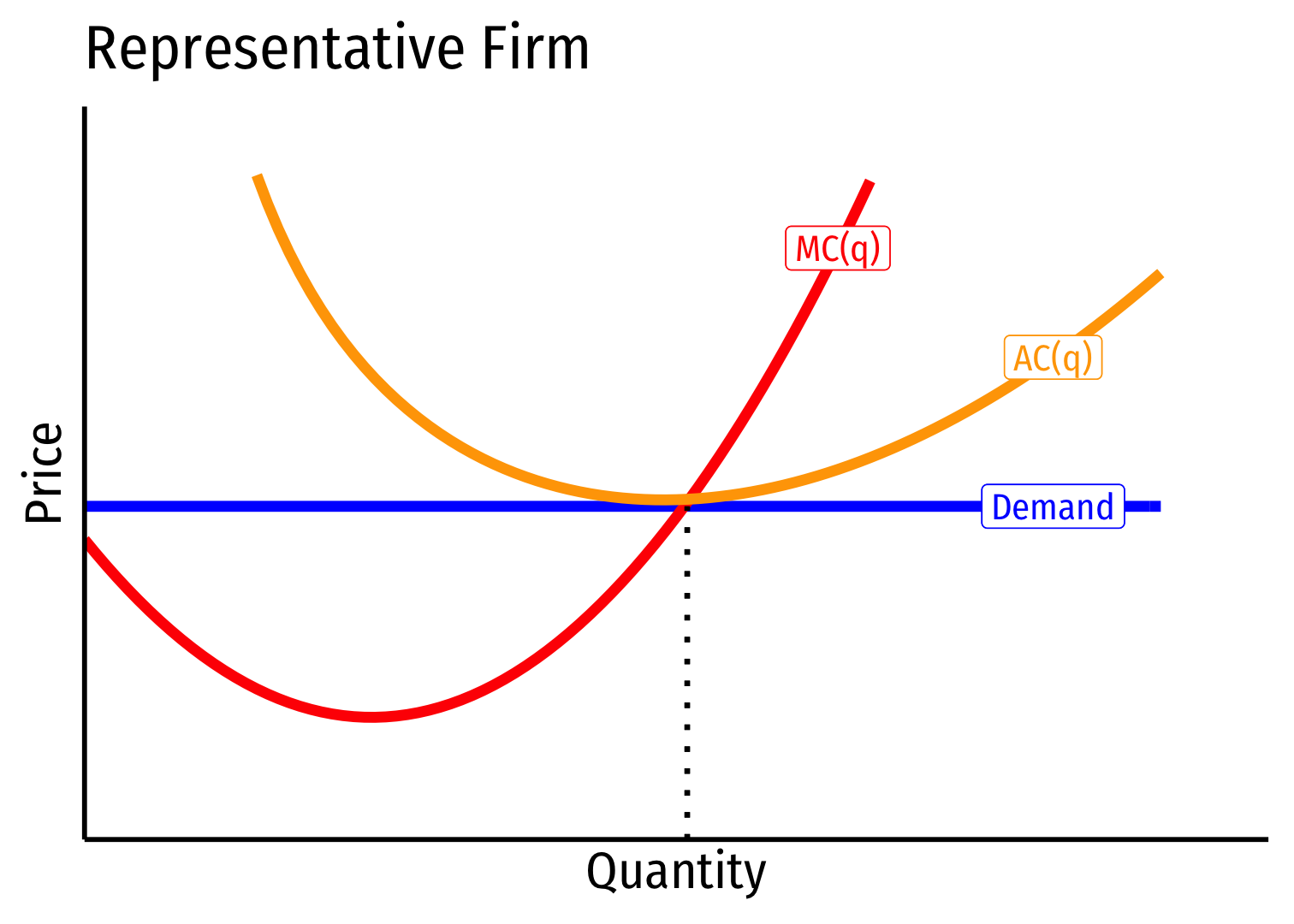

Increasing Cost Industry (External Diseconomies) II

- Industry equilibrium: firms earning normal \(\pi=0, p=MC(q)=AC(q)\)

Increasing Cost Industry (External Diseconomies) III

Industry equilibrium: firms earning normal \(\pi=0, p=MC(q)=AC(q)\)

Exogenous increase in market demand

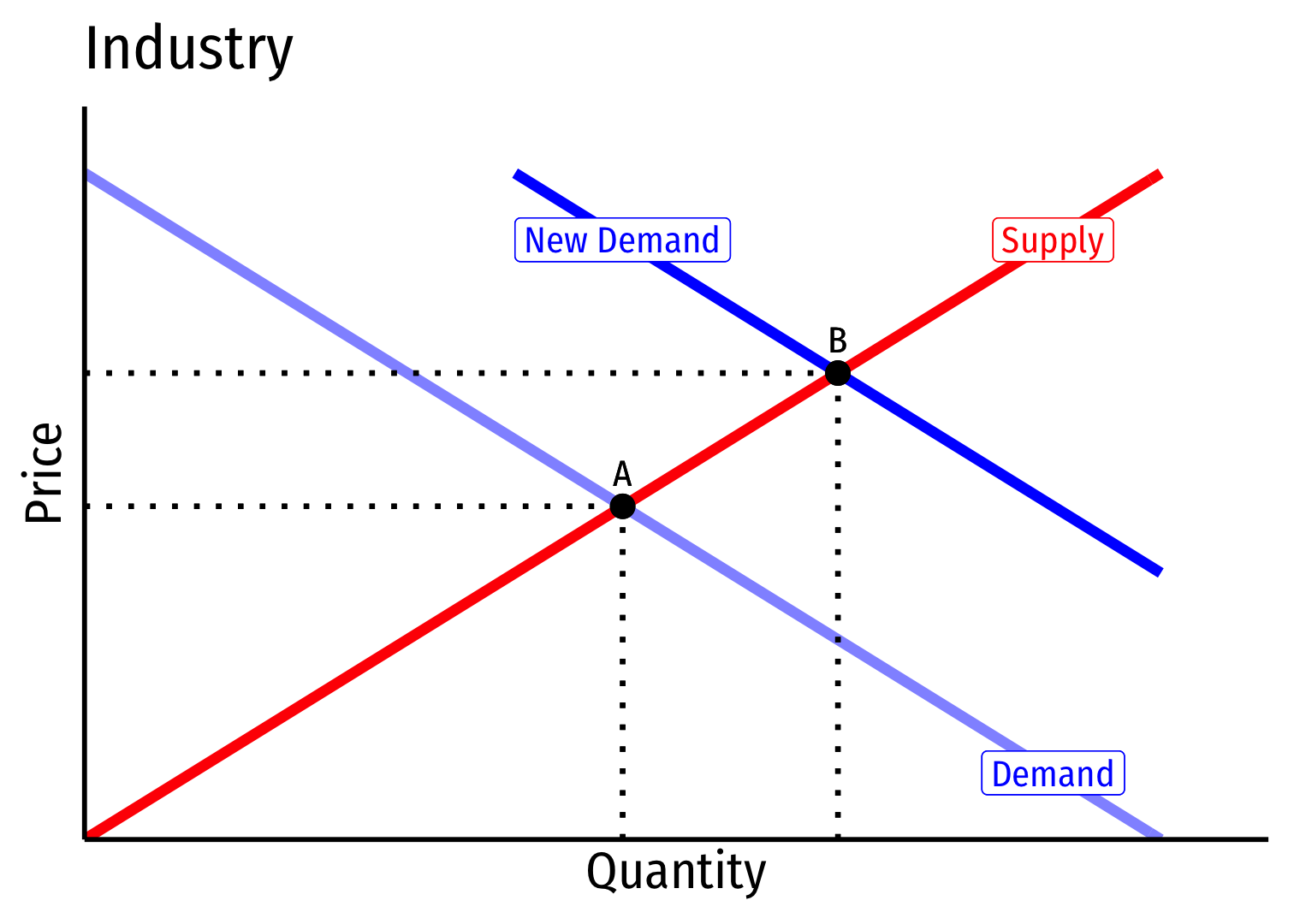

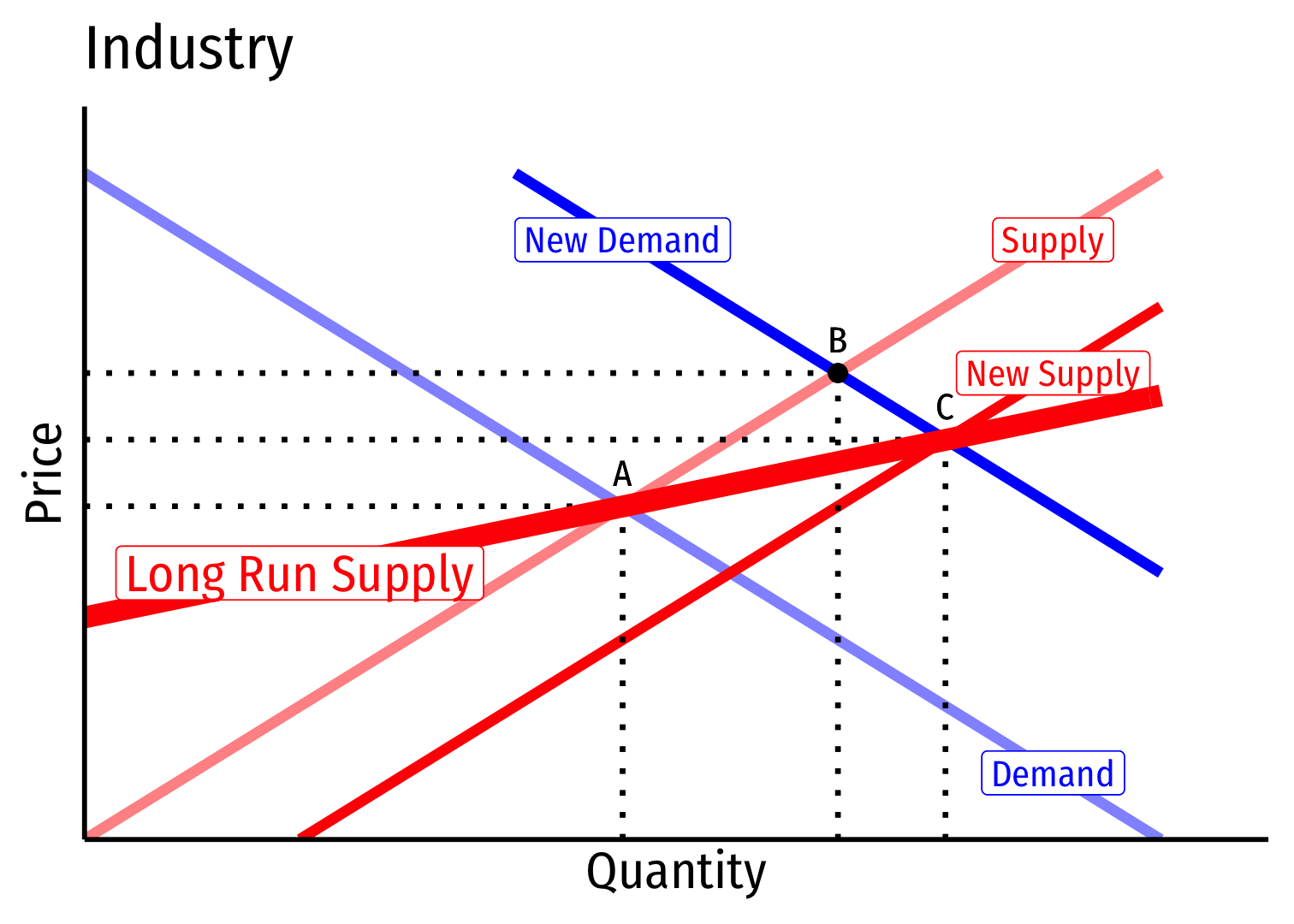

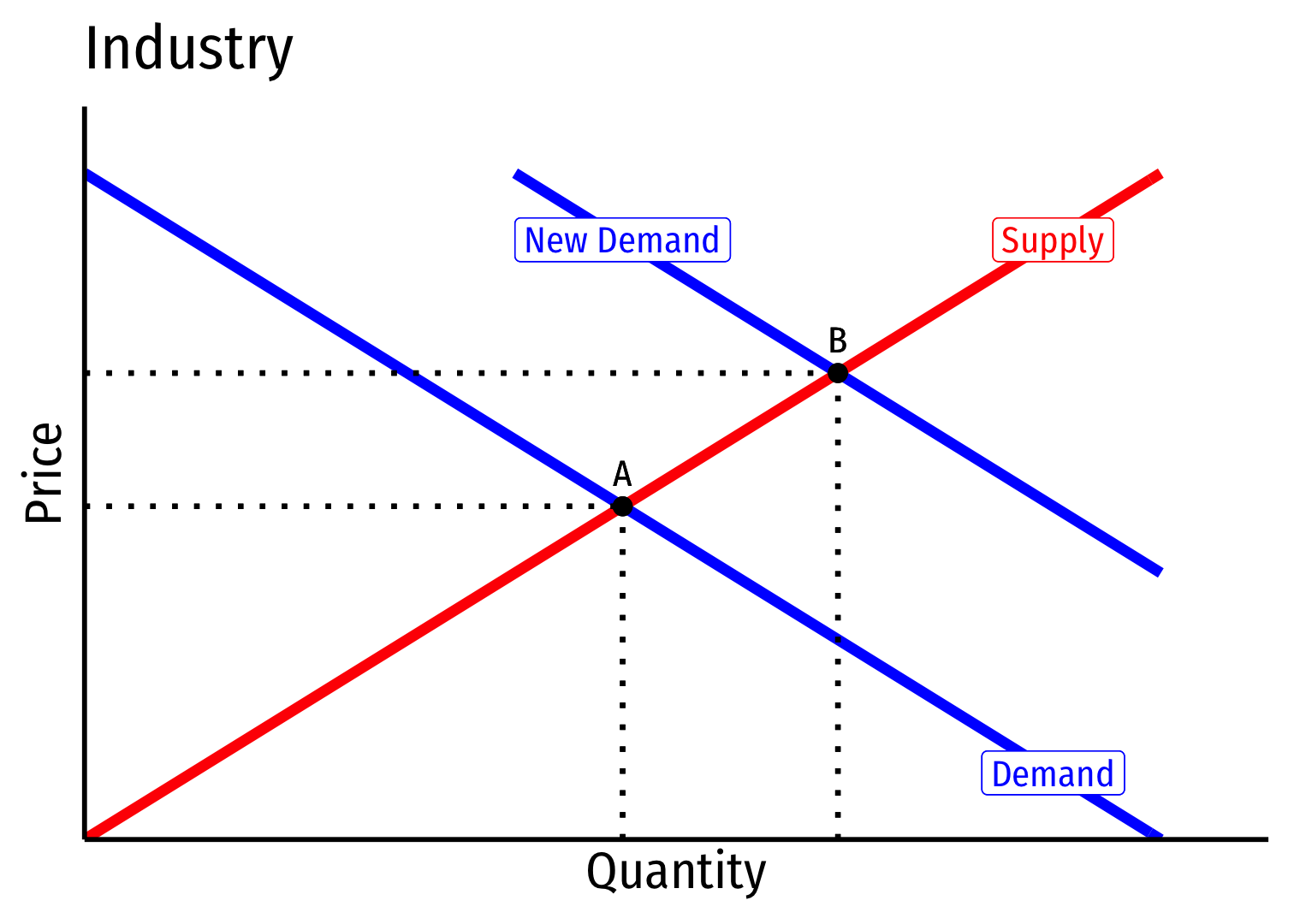

Increasing Cost Industry (External Diseconomies) IV

Short run \((A \rightarrow B)\): industry reaches new equilibrium

Firms charge higher \(p^*\), produce more \(q^*\), earn \(\pi\)

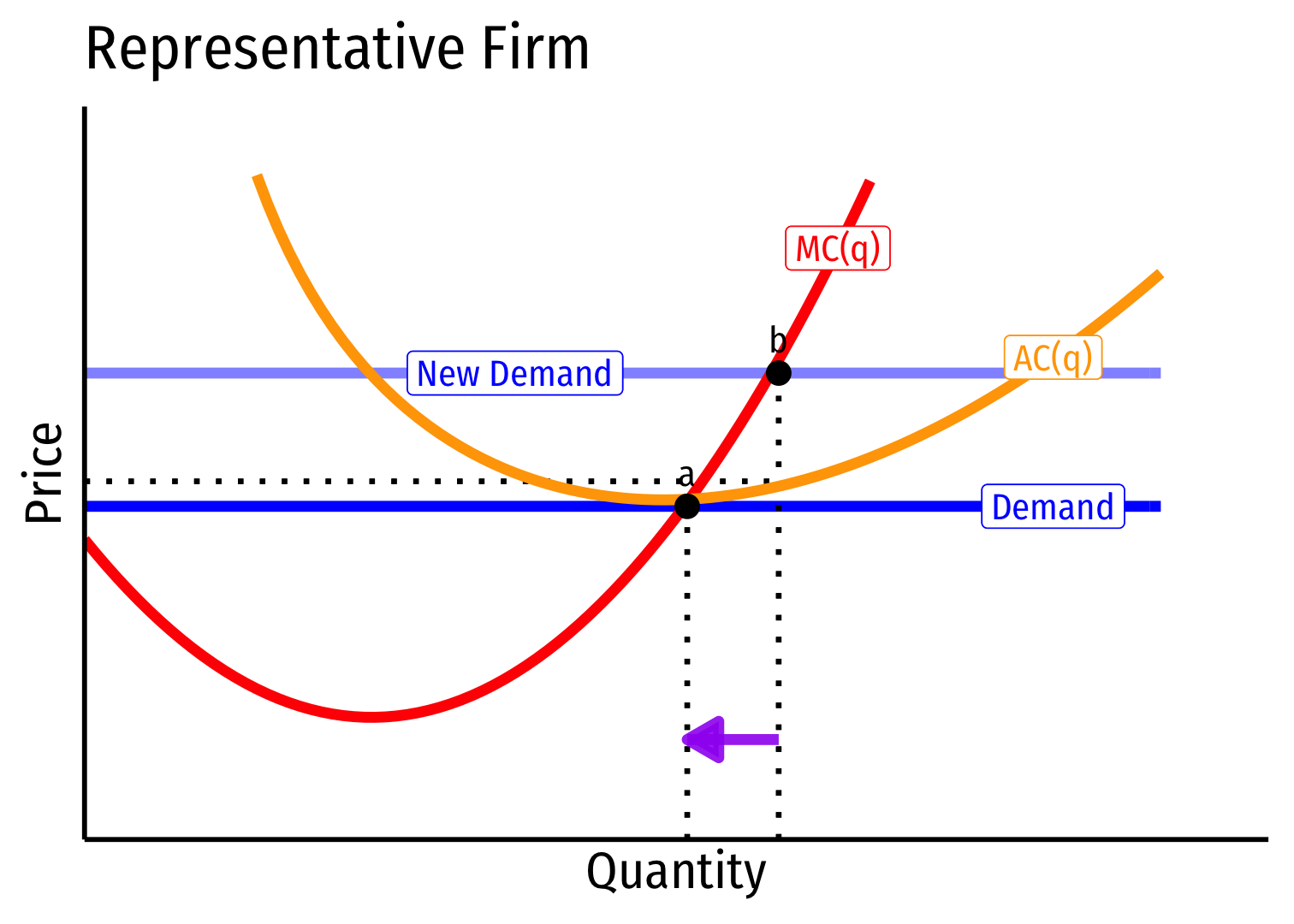

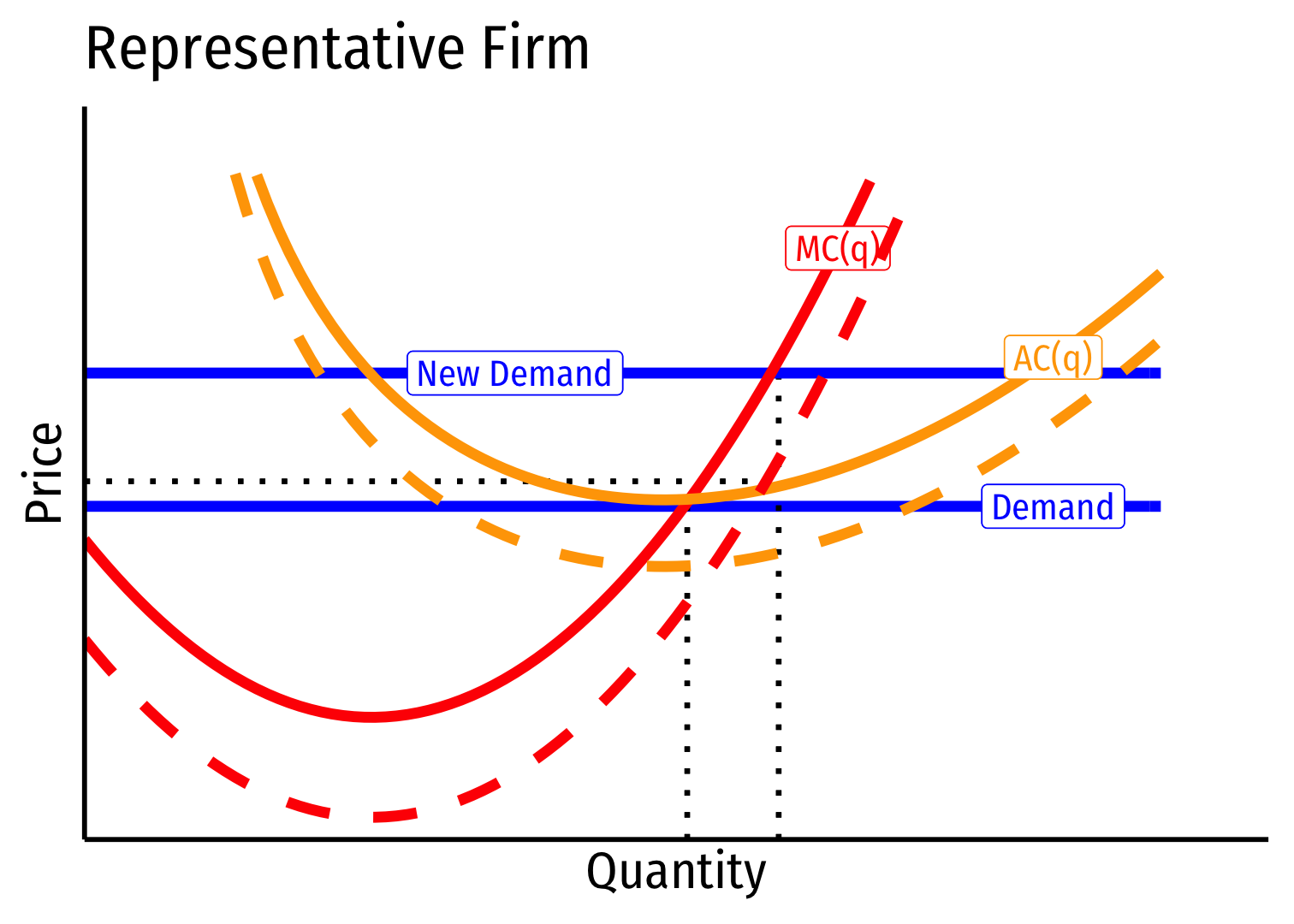

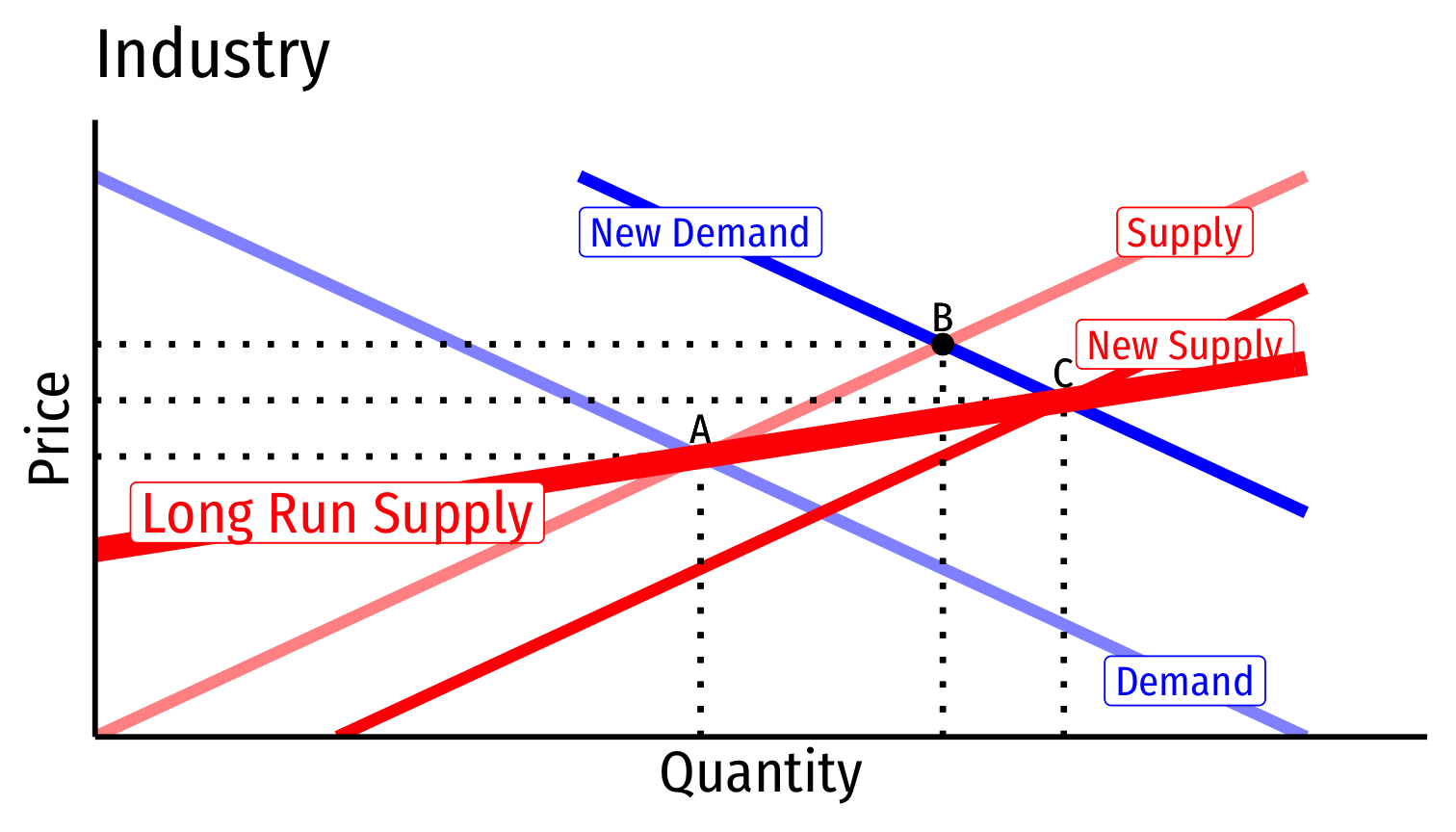

Increasing Cost Industry (External Diseconomies) V

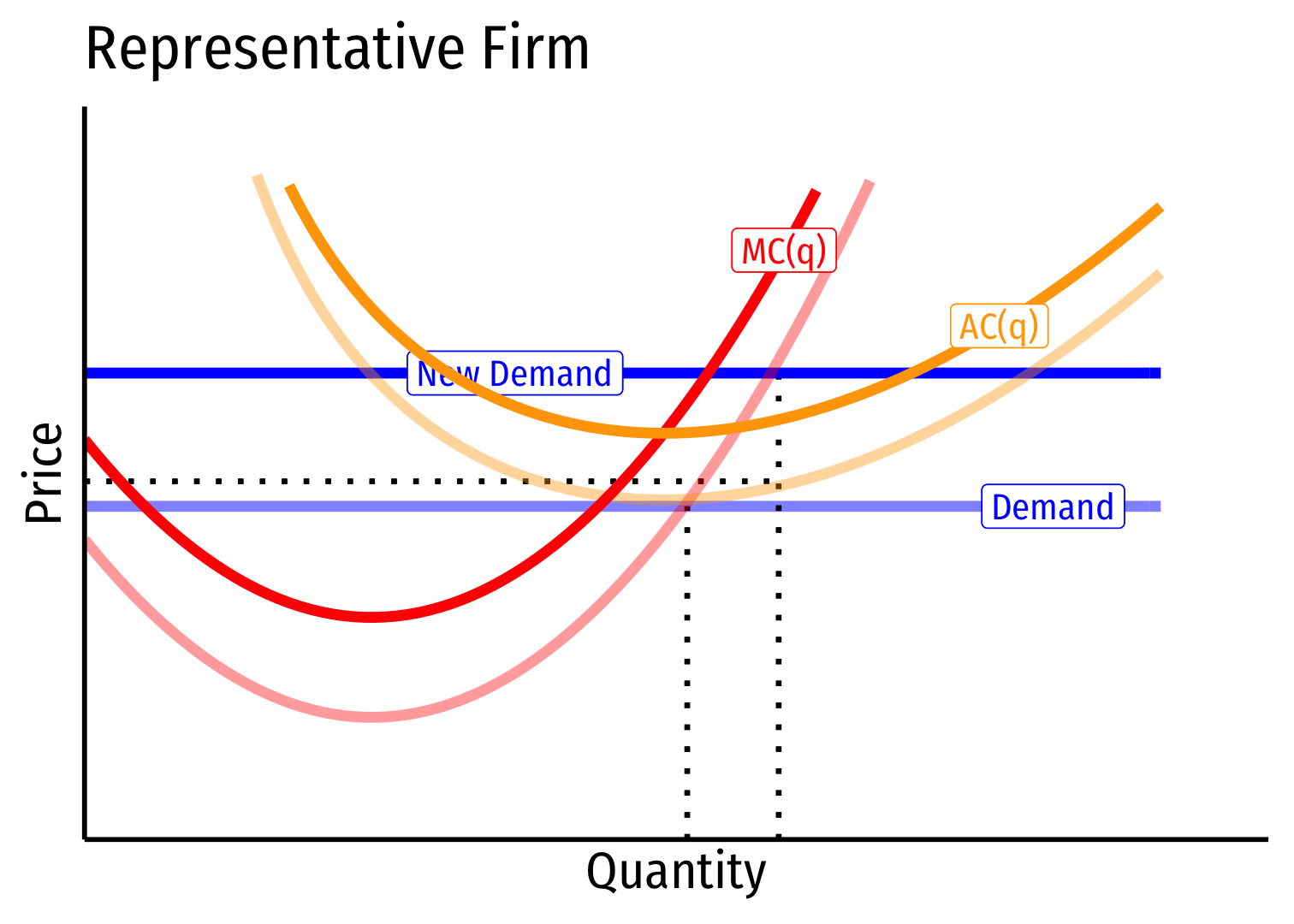

Long run: profit attracts entry \(\implies\) industry supply will increase

But more industry-wide output increases costs (MC(q), AC(q)) for all firms in industry

Increasing Cost Industry (External Diseconomies) VI

Long run \((B \rightarrow C)\): firms enter until \(\pi=0\) at \(p=AC(q)\)

Firms charge higher \(p^*\), producer lower \(q^*\), earn \(\pi=0\)

Increasing Cost Industry (External Diseconomies) VII

- Long run industry supply curve is upward sloping

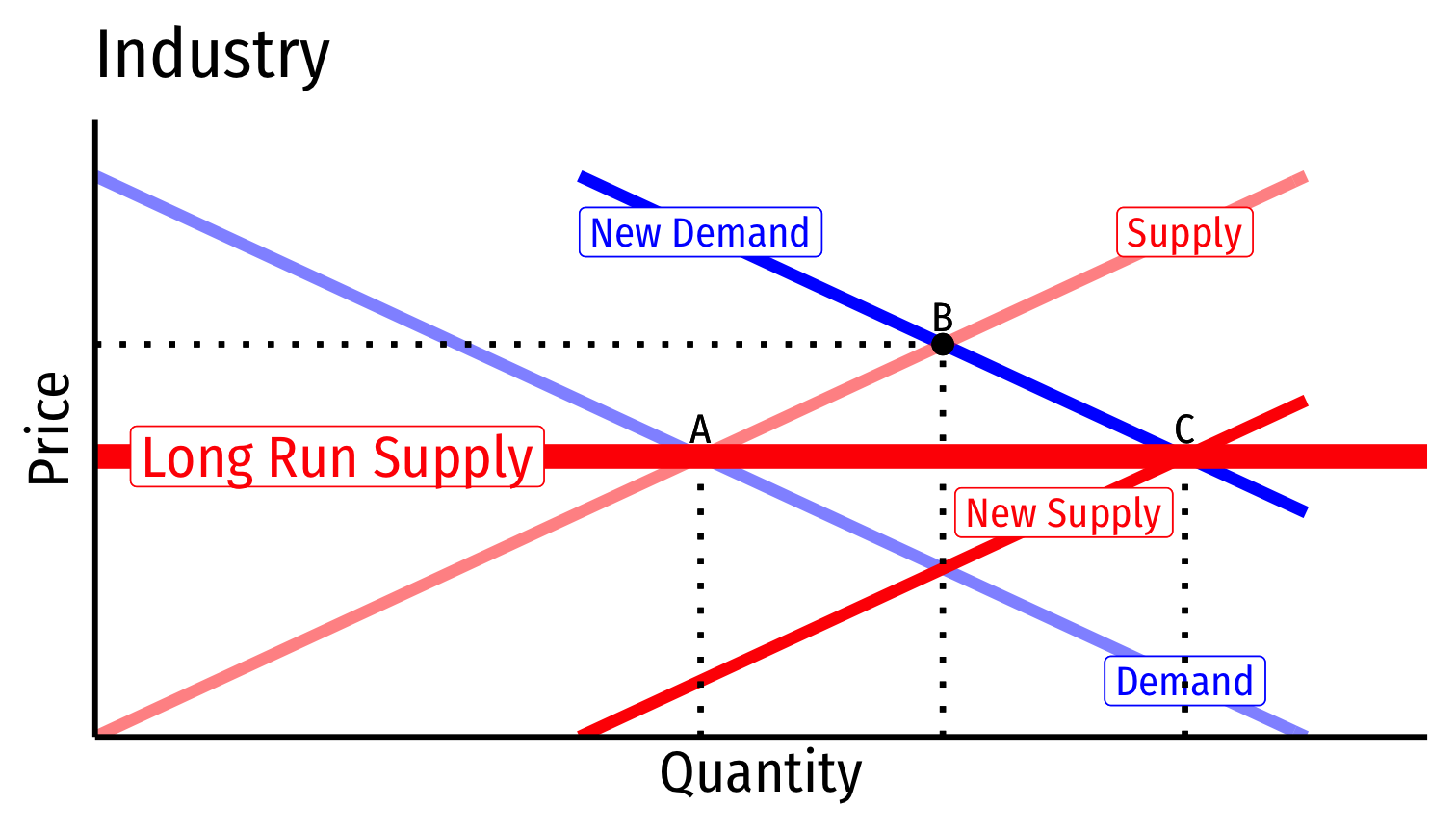

Decreasing Cost Industry (External Economies) I

Decreasing cost industry has external economies, costs fall for all firms in the industry as industry output increases (firms enter & incumbents produce more)

A downward sloping long-run industry supply curve!

Determinants:

- High fixed costs, low marginal costs

- Economies of scale

Examples: geographic clusters, public utilities, infrastructure, entertainment

Tends towards "natural" monopoly

Decreasing Cost Industry (External Economies) II

- Industry equilibrium: firms earning normal \(\pi=0, p=MC(q)=AC(q)\)

Decreasing Cost Industry (External Economies) III

Industry equilibrium: firms earning normal \(\pi=0, p=MC(q)=AC(q)\)

Exogenous increase in market demand

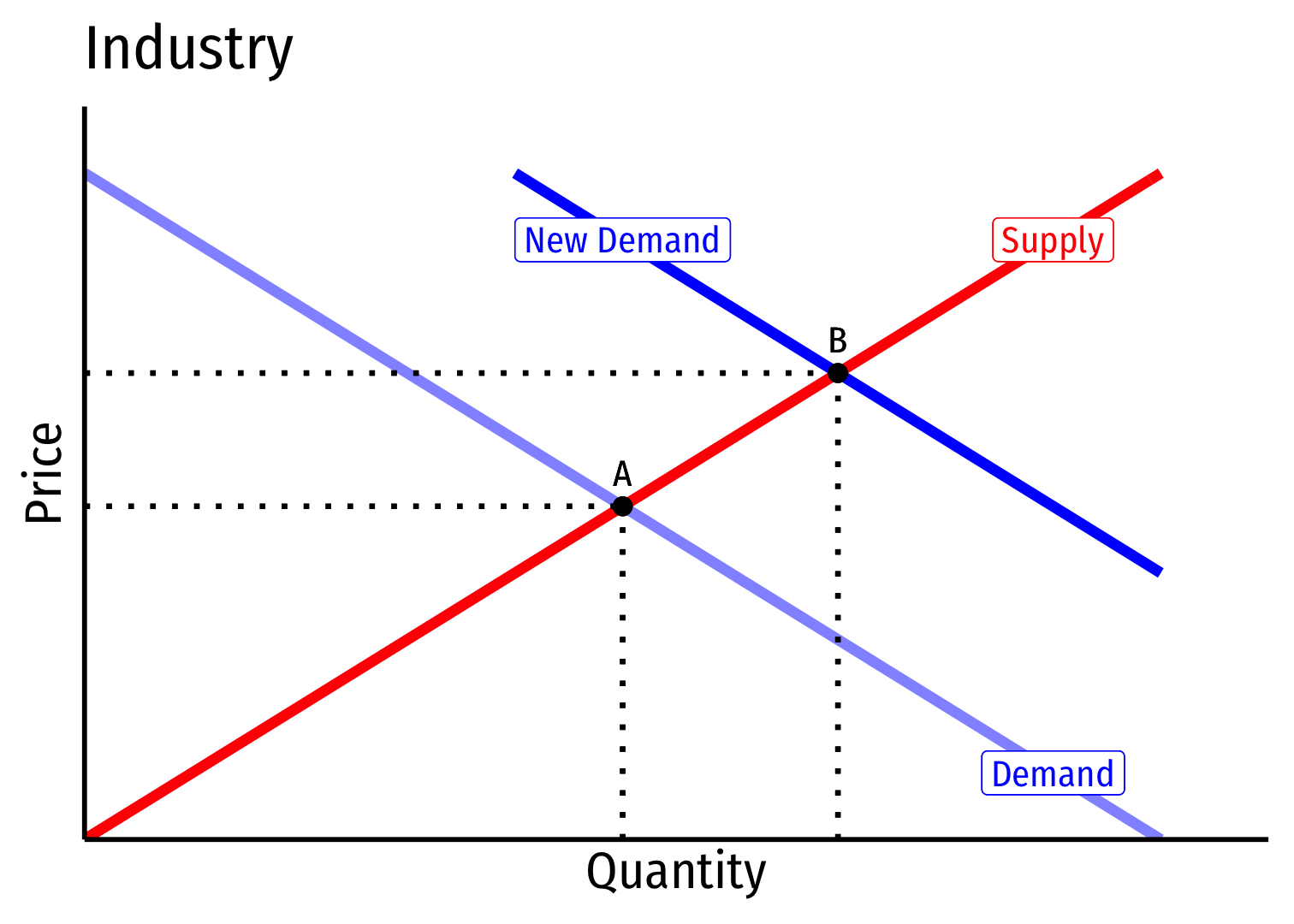

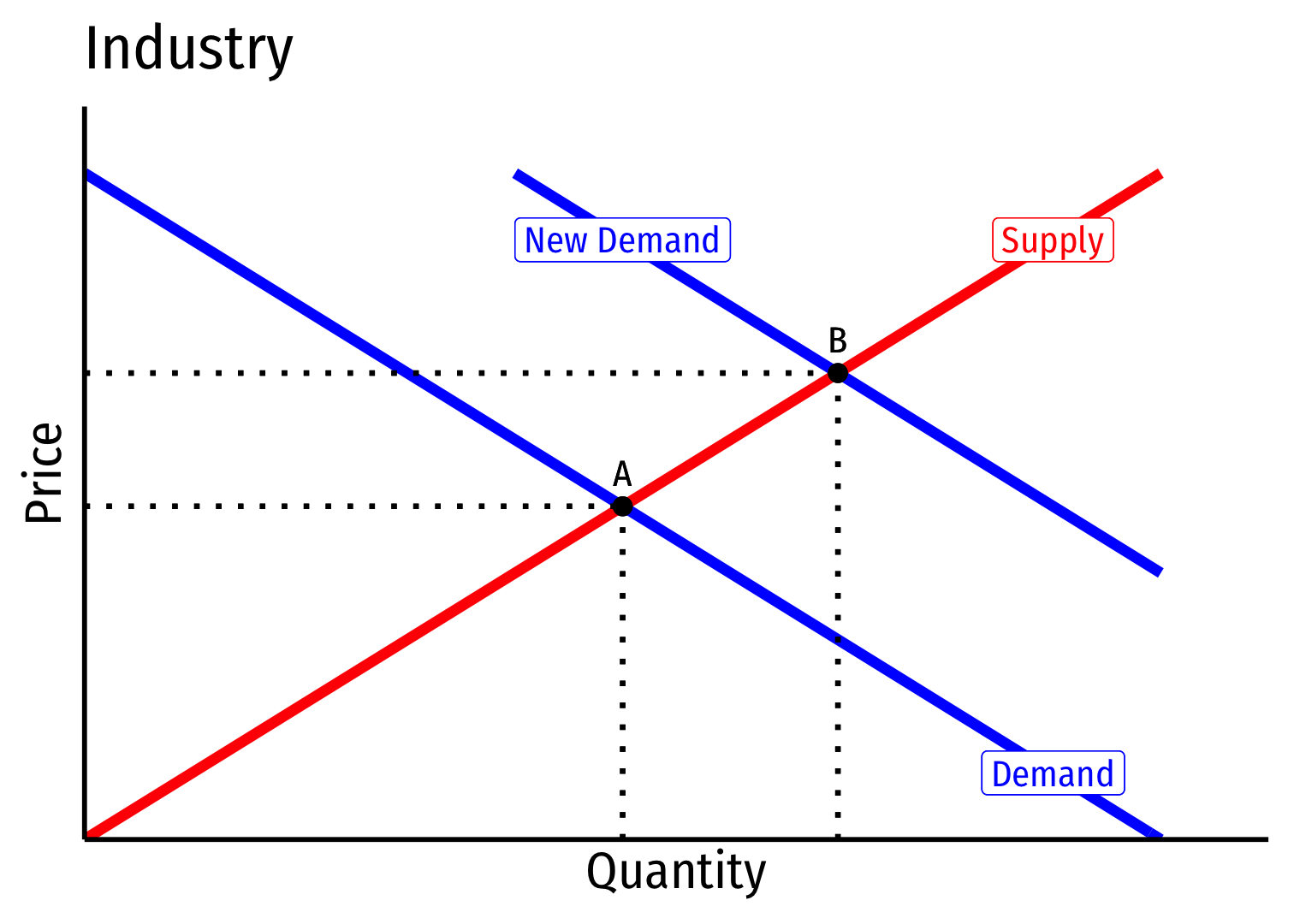

Decreasing Cost Industry (External Economies) IV

Short run \((A \rightarrow B)\): industry reaches new equilibrium

Firms charge higher \(p^*\), produce more \(q^*\), earn \(\pi\)

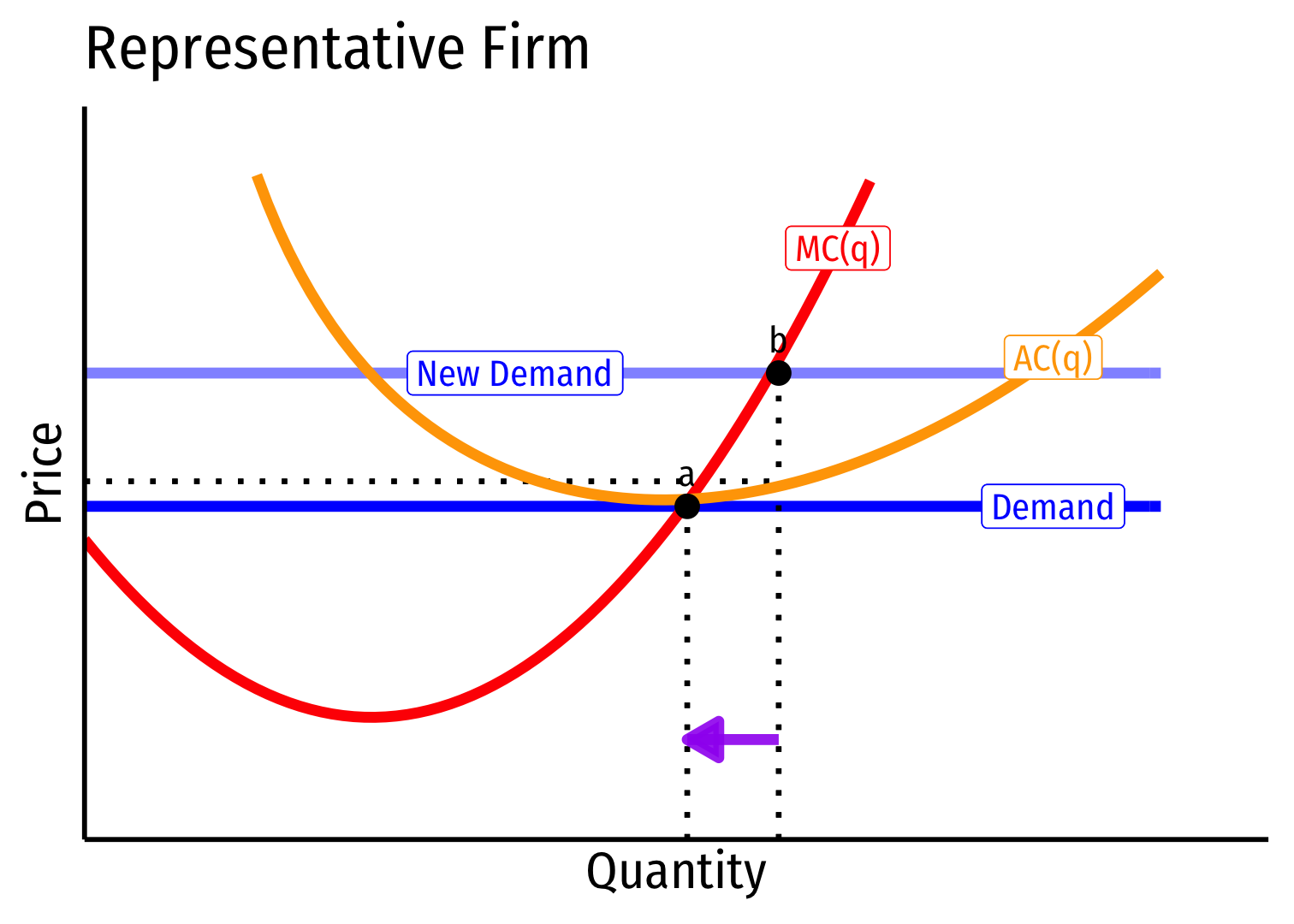

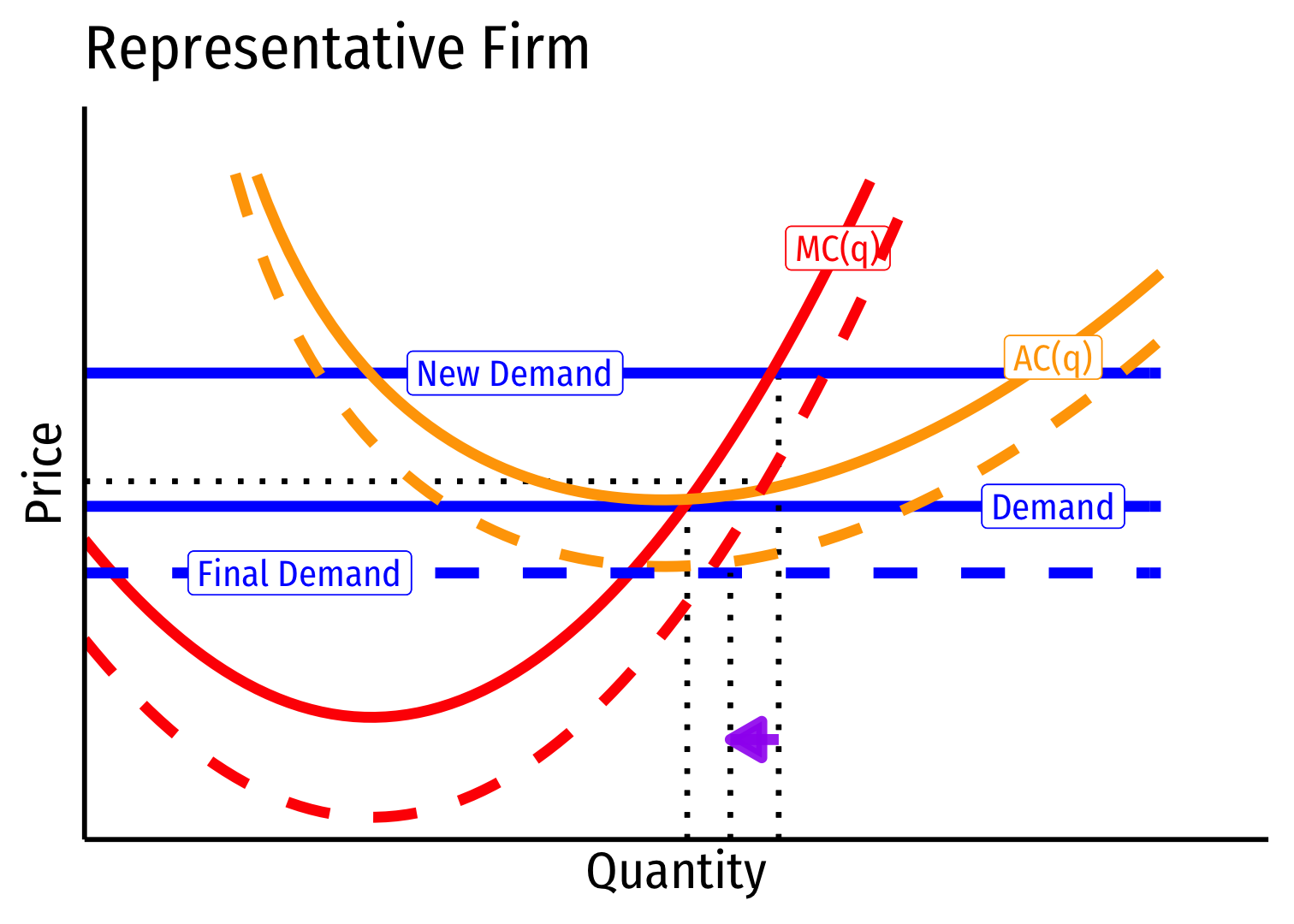

Decreasing Cost Industry (External Economies) V

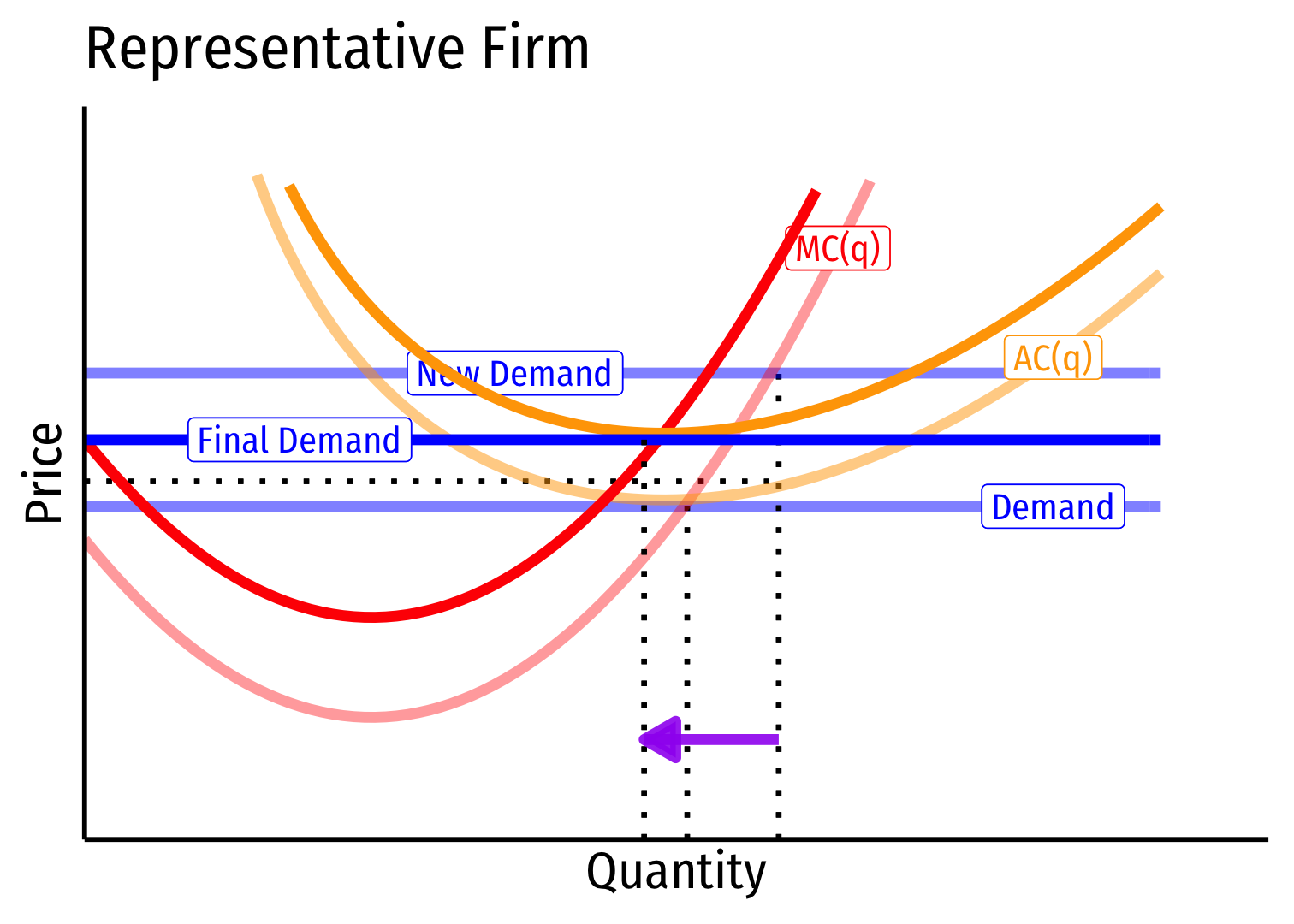

Long run: profit attracts entry \(\implies\) industry supply will increase

But more production lowers costs \((MC, AC)\) for all firms in industry

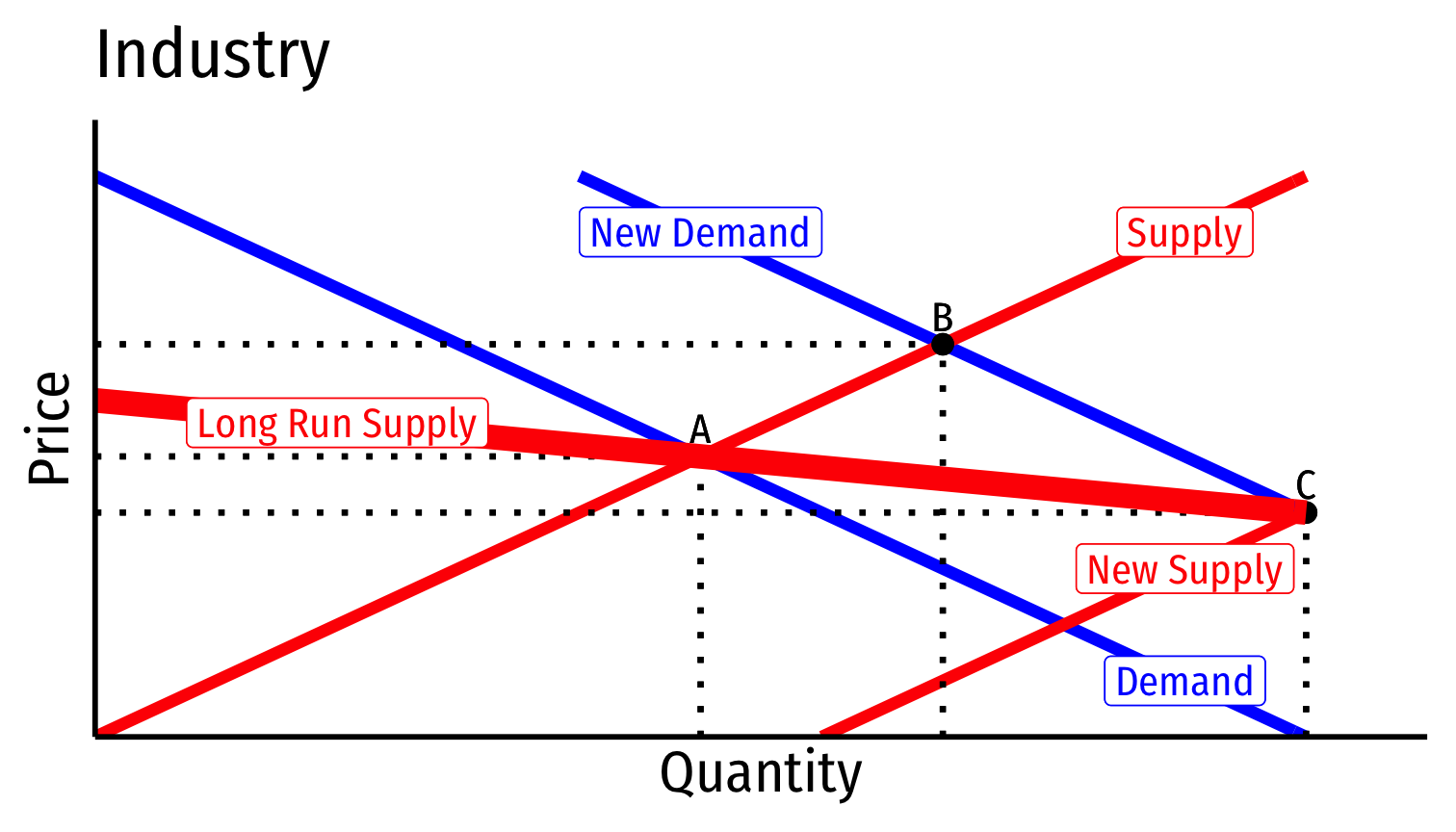

Decreasing Cost Industry (External Economies) VI

Long run \((B \rightarrow C)\): firms enter until \(\pi=0\) at \(p=AC(q)\)

Firms charge higher \(p^*\), producer lower \(q^*\), earn \(\pi=0\)

Decreasing Cost Industry (External Economies) VII

- Long run industry supply curve is downward sloping!

Comparing all Industry Types

- Constant cost industry

- No external economies

- Increase in industry output has no effect on costs

- Increasing cost industry

- External diseconomies

- Increase in industry output raises all firms’ costs

- Decreasing cost industry

- External economies

- Increase in industry output lowers all firms’ costs

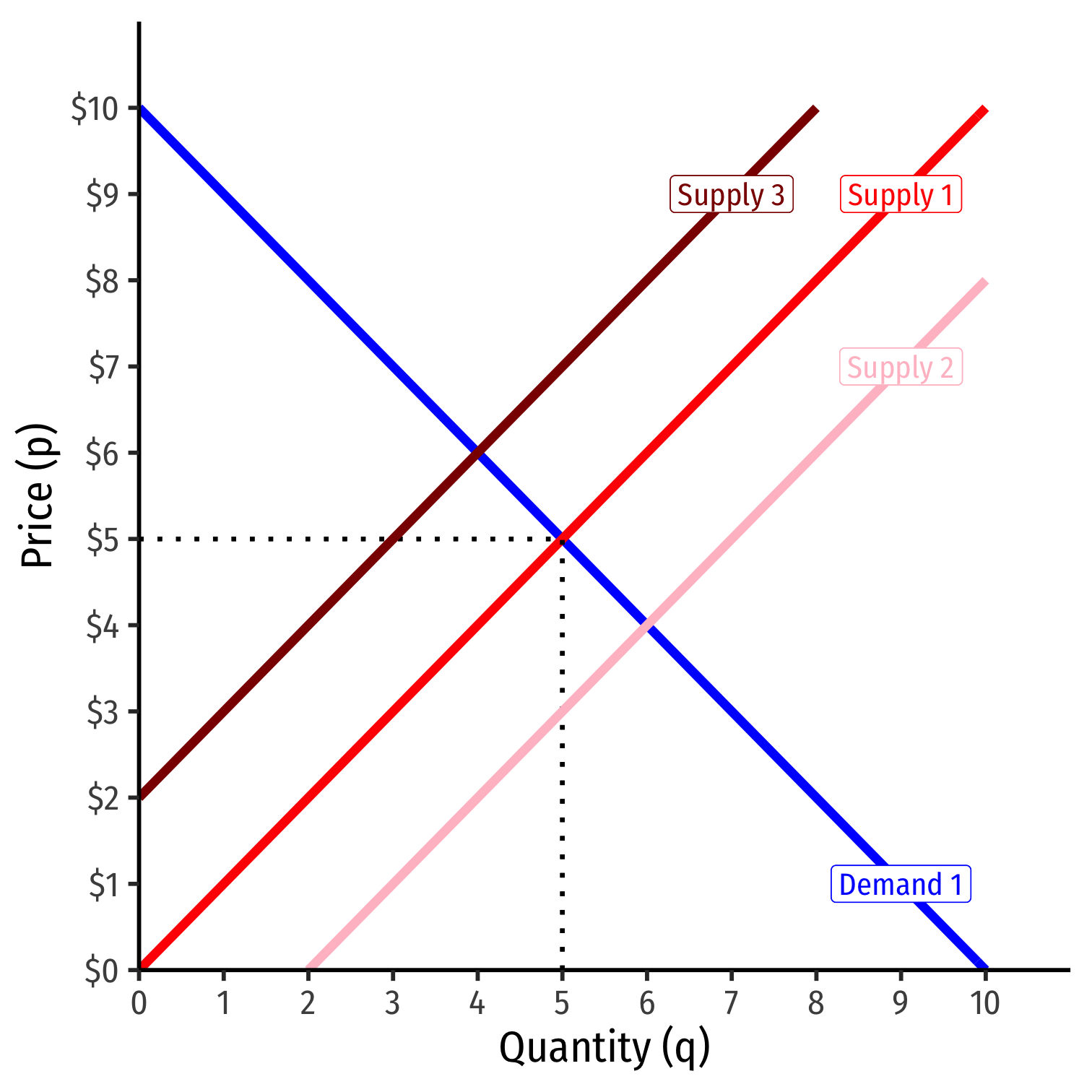

Supply Functions

Supply Function

- Supply function relates quantity to price

Example: $$q=2p-4$$

- Not graphable (wrong axes)!

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for \(p\)

Example: $$p=2+0.5q$$

- Graphable (price on vertical axis)!

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for \(p\)

Example: $$p=2+0.5q$$

- Graphable (price on vertical axis)!

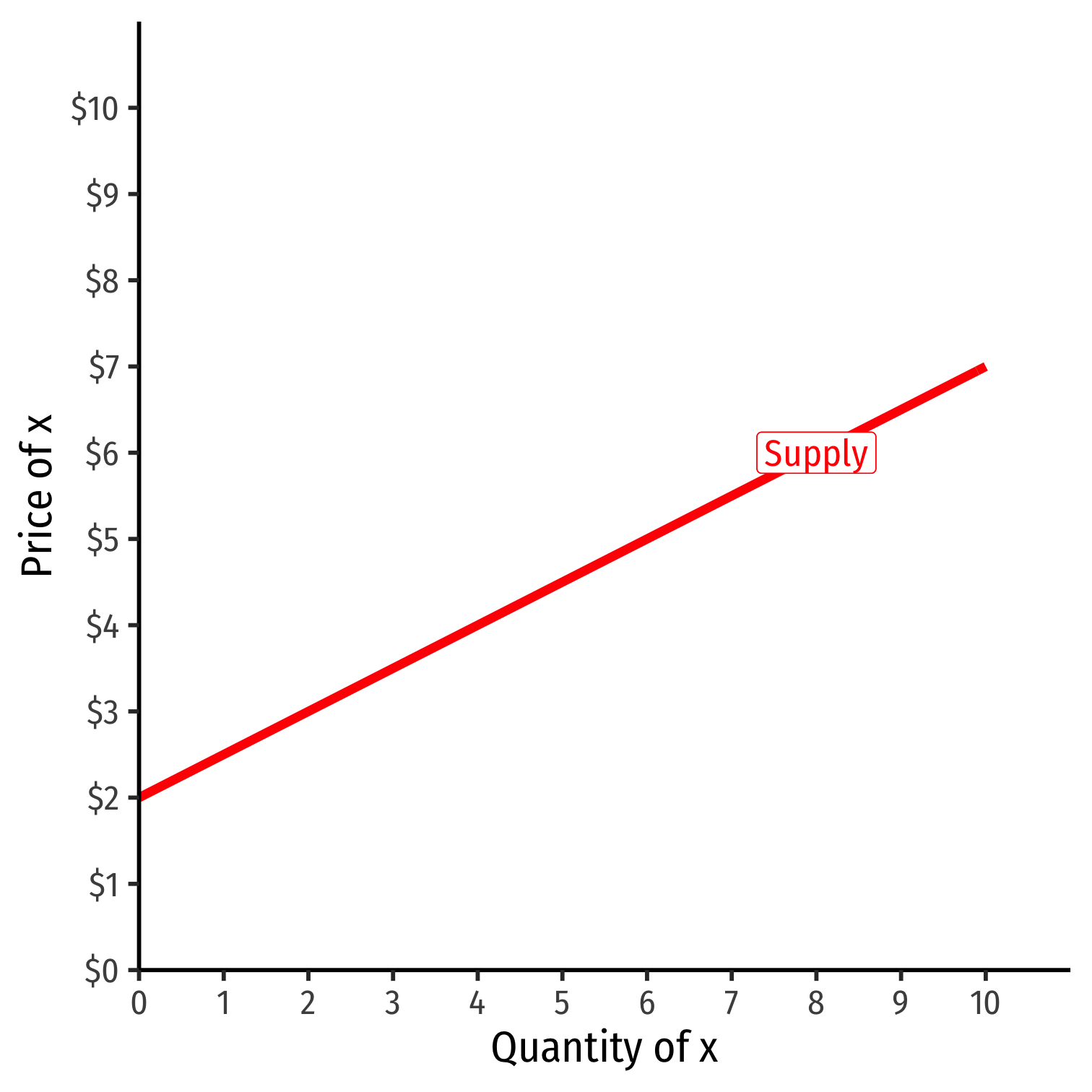

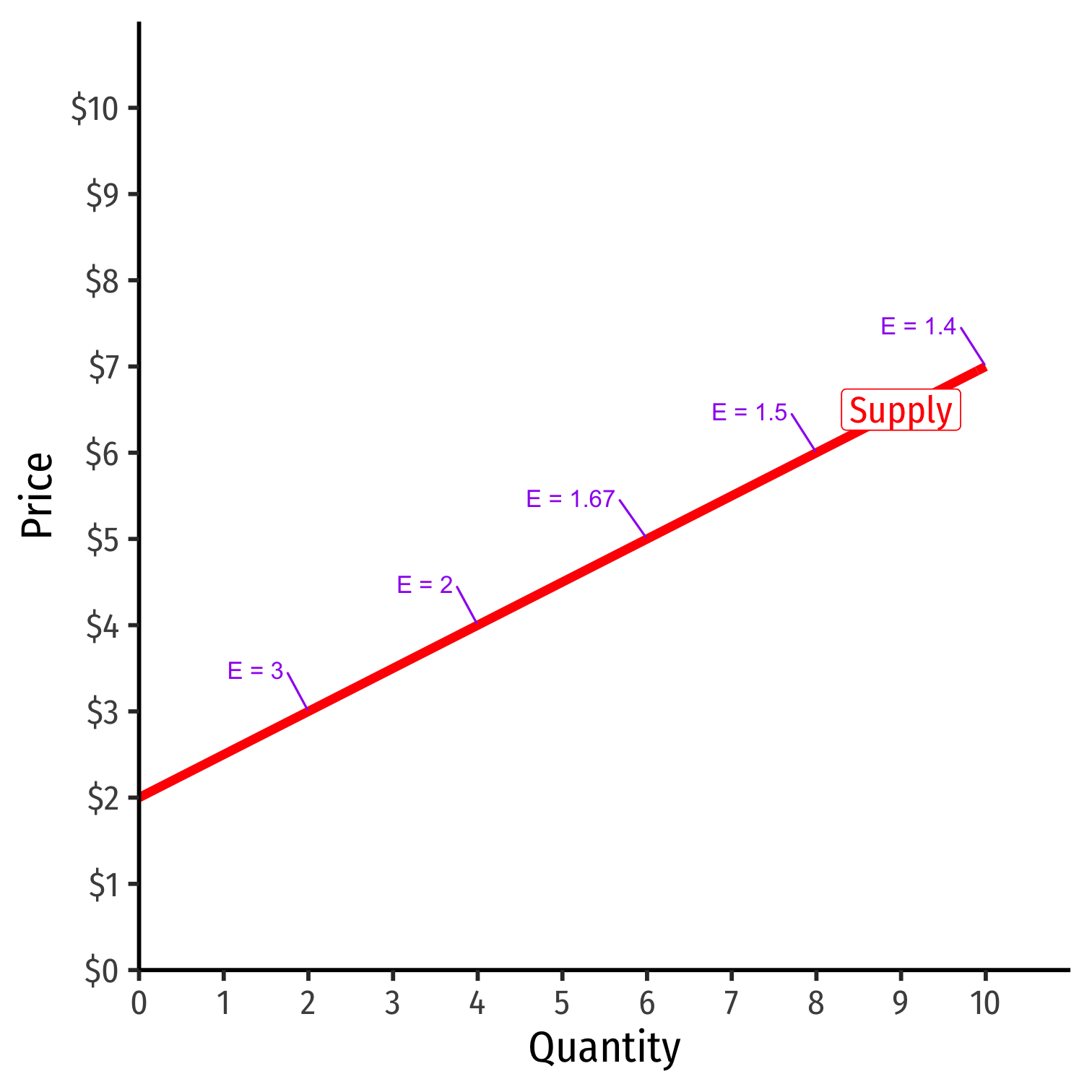

Inverse Supply Function

Example: $$p=2+0.5q$$

Slope: 0.5

Vertical intercept called the "Choke price": price where \(q_S=0\) ($2), just low enough to discourage any sales

Inverse Supply Function

Read two ways:

Horizontally: at any given price, how many units firm wants to sell

Vertically: at any given quantity, the minimum willingness to accept (WTA) for that quantity

Price Elasiticity of Supply

Price Elasticity of Supply

- Price elasticity of supply measures how much (in %) quantity supplied changes in response to a (1%) change in price

$$\epsilon_{q_S,p} = \frac{\% \Delta q_S}{\% \Delta p}$$

Price Elasticity of Supply: Elastic vs. Inelastic

$$\epsilon_{q_S,p} = \frac{\% \Delta q_S}{\% \Delta p}$$

| “Elastic” | “Unit Elastic” | “Inelastic” | |

|---|---|---|---|

| Intuitively: | Large response | Proportionate response | Little response |

| Mathematically: | \(\vert \epsilon_{q_s,p}\vert > 1\) | \(\vert \epsilon_{q_s,p}\vert = 1\) | \(\vert \epsilon_{q_s,p} \vert < 1\) |

| Numerator \(>\) Denominator | Numerator \(=\) Denominator | Numerator \(<\) Denominator | |

| 1% change in \(p\) causes | More than 1% change in \(q_s\) | Exactly 1% change in \(q_s\) | Less than 1% change in \(q_s\) |

Compare to price elasticity of demand

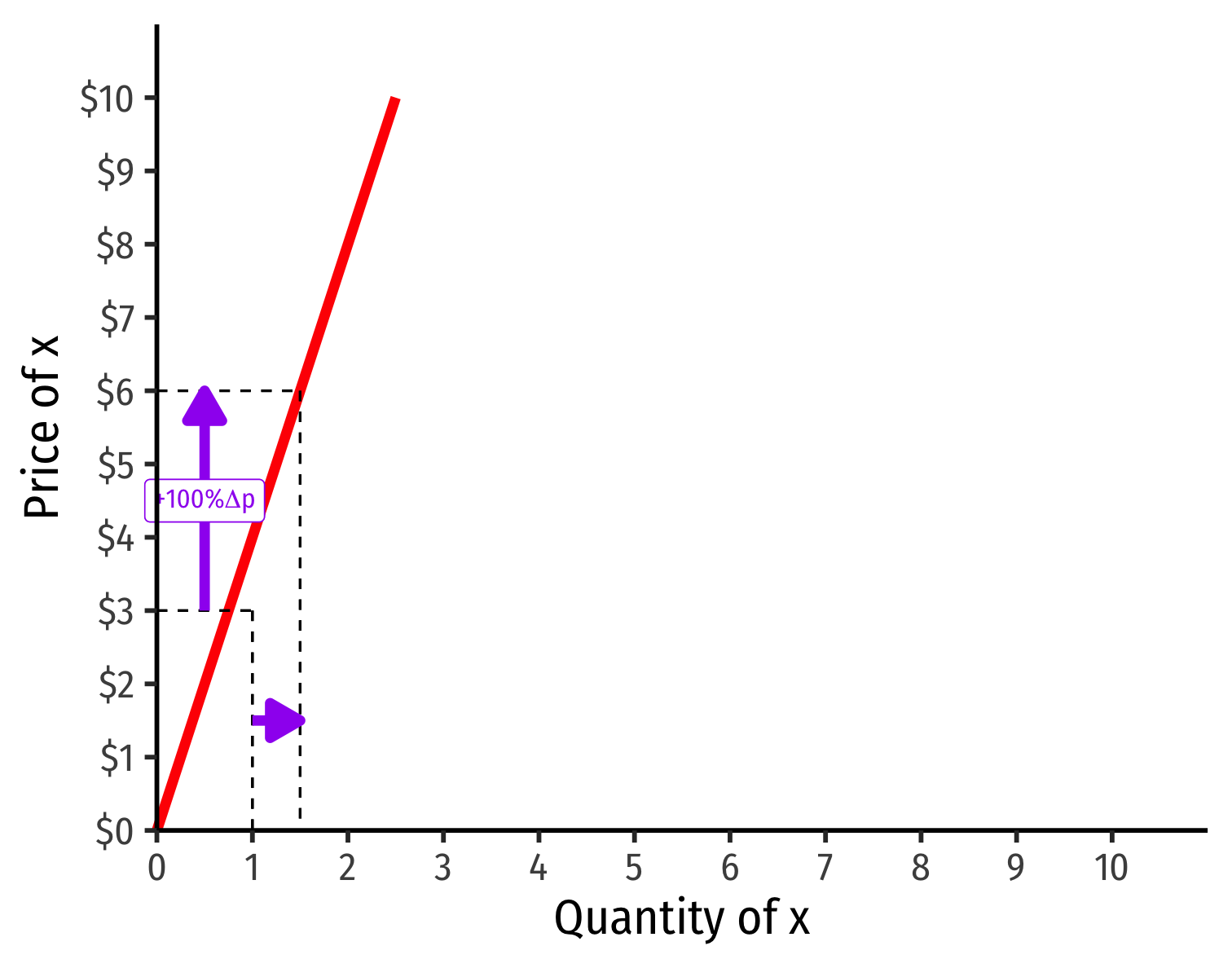

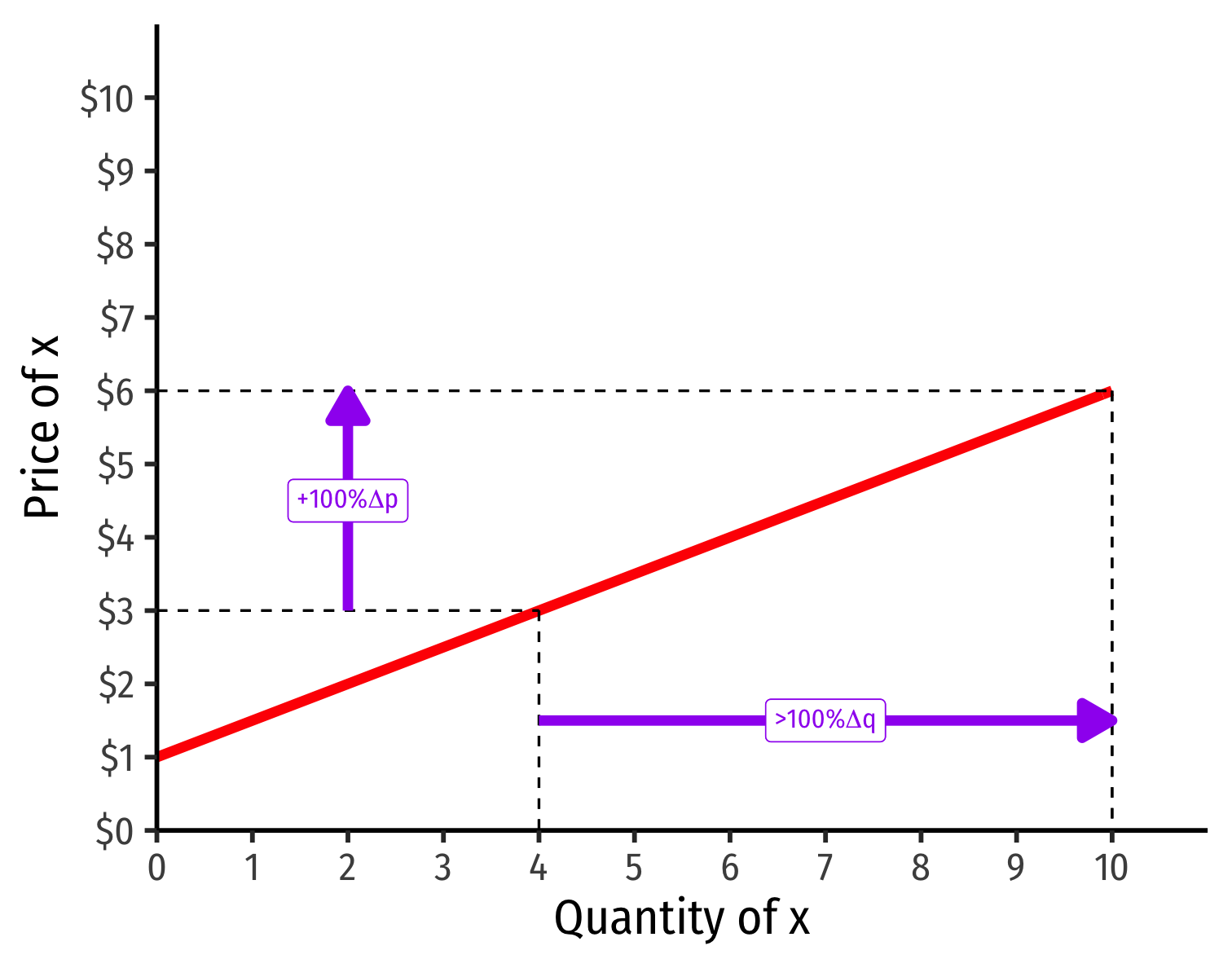

Visualizing Price Elasticity of Supply

An identical 100% price increase on an:

“Inelastic” Supply Curve

“Elastic” Supply Curve

Price Elasticity of Supply Formula

$$\color{red}{\epsilon_{q,p} = \mathbf{\frac{1}{slope} \times \frac{p}{q}}}$$

First term is the inverse of the slope of the inverse supply curve (that we graph)!

To find the elasticity at any point, we need 3 things:

- The price

- The associated quantity supplied

- The slope of the (inverse) supply curve

Example

Example: The supply of bicycle rentals in a small town is given by:

$$q_S=10p-200$$

Find the inverse supply function.

What is the price elasticity of supply at a price of $25.00?

What is the price elasticity of supply at a price of $50.00?

Price Elasticity of Supply Changes Along the Curve

$$\epsilon_{q,p} = \mathbf{\frac{1}{slope} \times \frac{p}{q}}$$

Elasticity \(\neq\) slope (but they are related)!

Elasticity changes along the supply curve

Often gets less elastic as \(\uparrow\) price \((\uparrow\) quantity)

- Harder to supply more

Determinants of Price Elasticity of Supply I

What determines how responsive your selling behavior is to a price change?

The faster (slower) costs increase with output \(\implies\) less (more) elastic supply

- Mining for natural resources vs. automated manufacturing

Smaller (larger) share of market for inputs \(\implies\) more (less) elastic

- Will your suppliers raise the price much if you buy more?

- How much competition is there in your input markets?

Determinants of Price Elasticity of Supply II

What determines how responsive your selling behavior is to a price change?

- More (less) time to adjust to price changes \(\implies\) more (less) elastic

- Supply of oil today vs. oil in 10 years

Price Elasticity of Supply: Examples

A report by @PIIE found an N-95 respirator mask still faces a 7% U.S. tariff.

— Chad P. Bown (@ChadBown) April 21, 2020

Remaining US duties include

• 5% on hand sanitizer

• 4.5% on protective medical clothing

• 2.5% on goggles

• 6.4-8.3% on other medical headwear

By @ABehsudi 1/https://t.co/LcxE0FFlXO

Price Elasticity of Supply: Examples

Source: Washington Post (Oct 2, 2021): “Inside America’s Broken Supply Chain”

Price Elasticity of Supply: Examples

Yesterday I rented a boat and took the leader of one of Flexport's partners in Long Beach on a 3 hour of the port complex. Here's a thread about what I learned.

— Ryan Petersen (@typesfast) October 22, 2021