2.3 — Cost Minimization

ECON 306 • Microeconomic Analysis • Spring 2022

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS22

microS22.classes.ryansafner.com

Recall: The Firm's Two Problems

1st Stage: firm's profit maximization problem:

Choose: < output >

In order to maximize: < profits >

- We'll cover this later...first we'll explore:

2nd Stage: firm's cost minimization problem:

Choose: < inputs >

In order to minimize: < cost >

Subject to: < producing the optimal output >

- Minimizing costs ⟺ maximizing profits

Solving the Cost Minimization Problem

The Firm's Cost Minimization Problem

- The firm's cost minimization problem is:

Choose: < inputs: l,k>

In order to minimize: < total cost: wl+rk >

Subject to: < producing the optimal output: q∗=f(l,k) >

The Cost Minimization Problem: Tools

Our tools for firm's input choices:

Choice: combination of inputs (l,k)

Production function/isoquants: firm's technological constraints

- How the firm trades off between inputs

- Isocost line: firm's total cost (for given output and input prices)

- How the market trades off between inputs

The Cost Minimization Problem: Verbally

- The firms's cost minimization problem:

choose a combination of l and k to minimize total cost that produces the optimal amount of output

The Cost Minimization Problem: Math

minl,kwl+rk s.t.q∗=f(l,k)

- This requires calculus to solve. We will look at graphs instead!

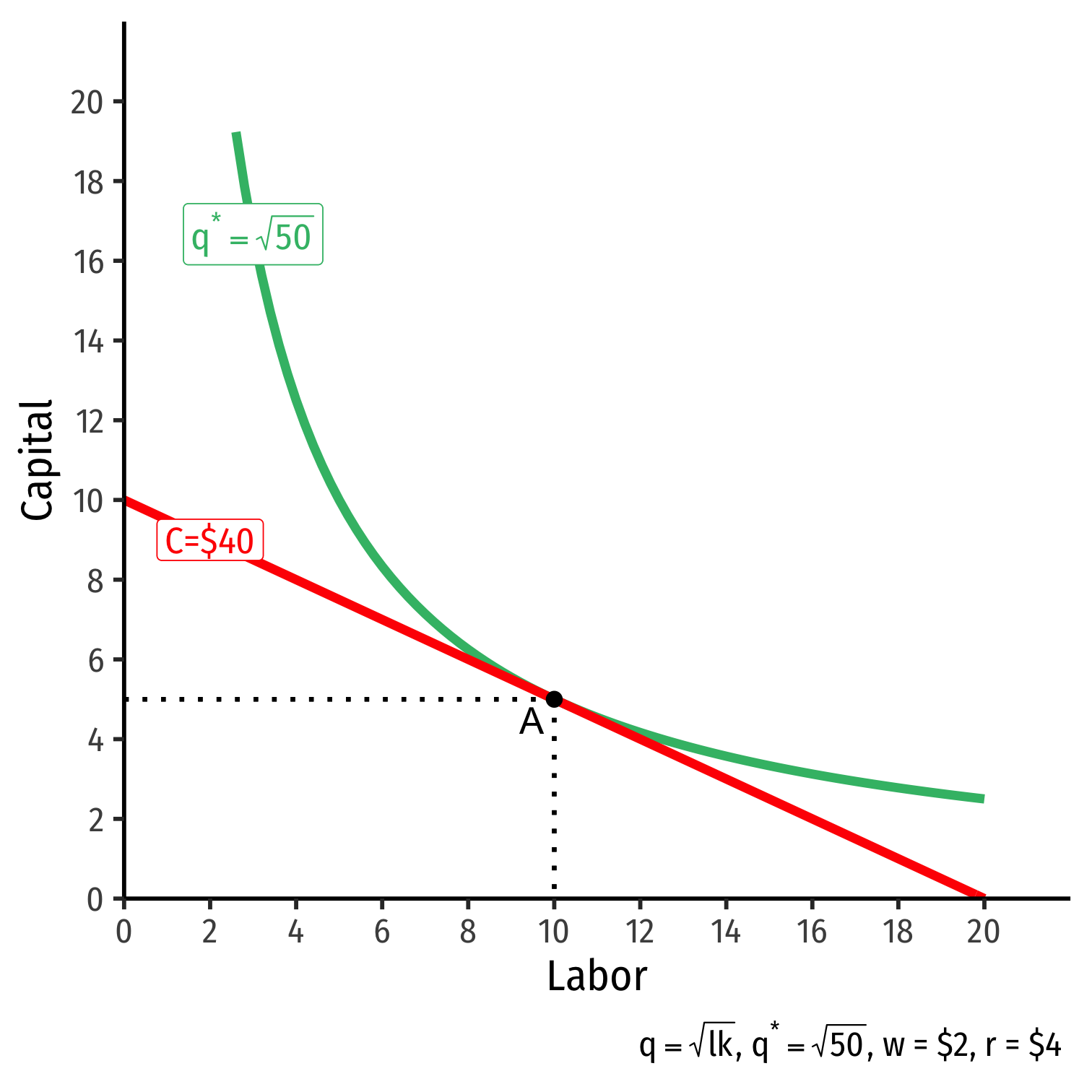

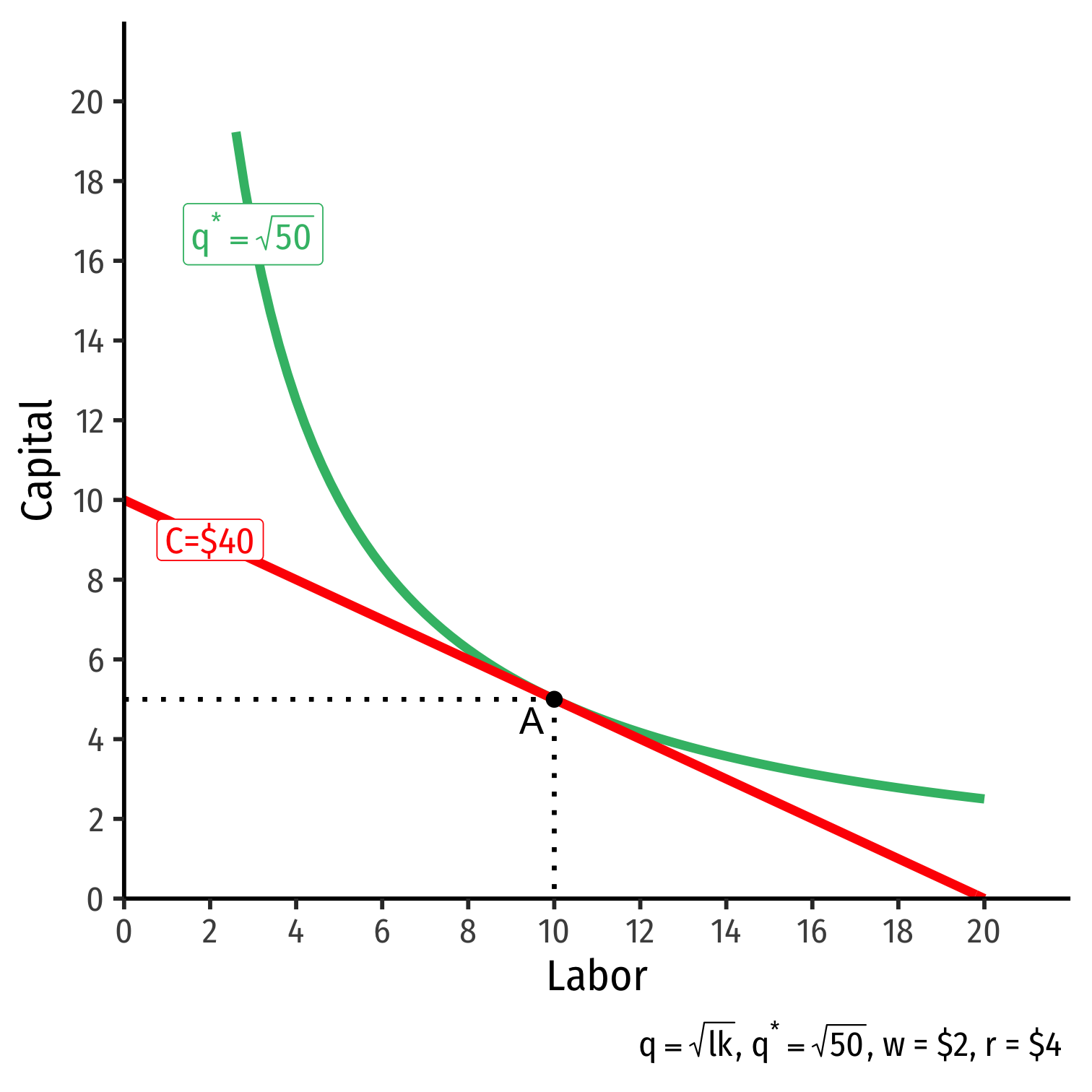

The Firm's Least-Cost Input Combination: Graphically

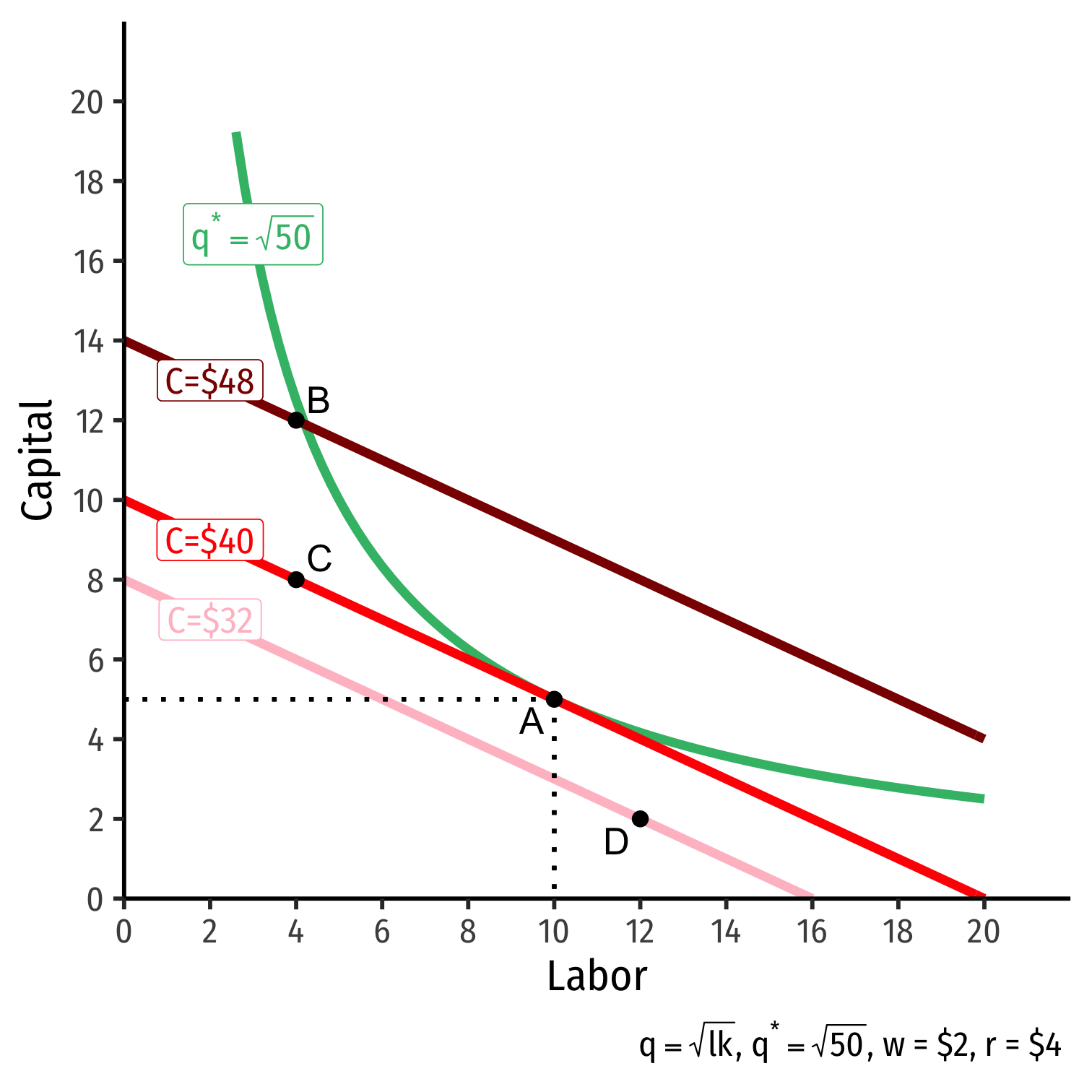

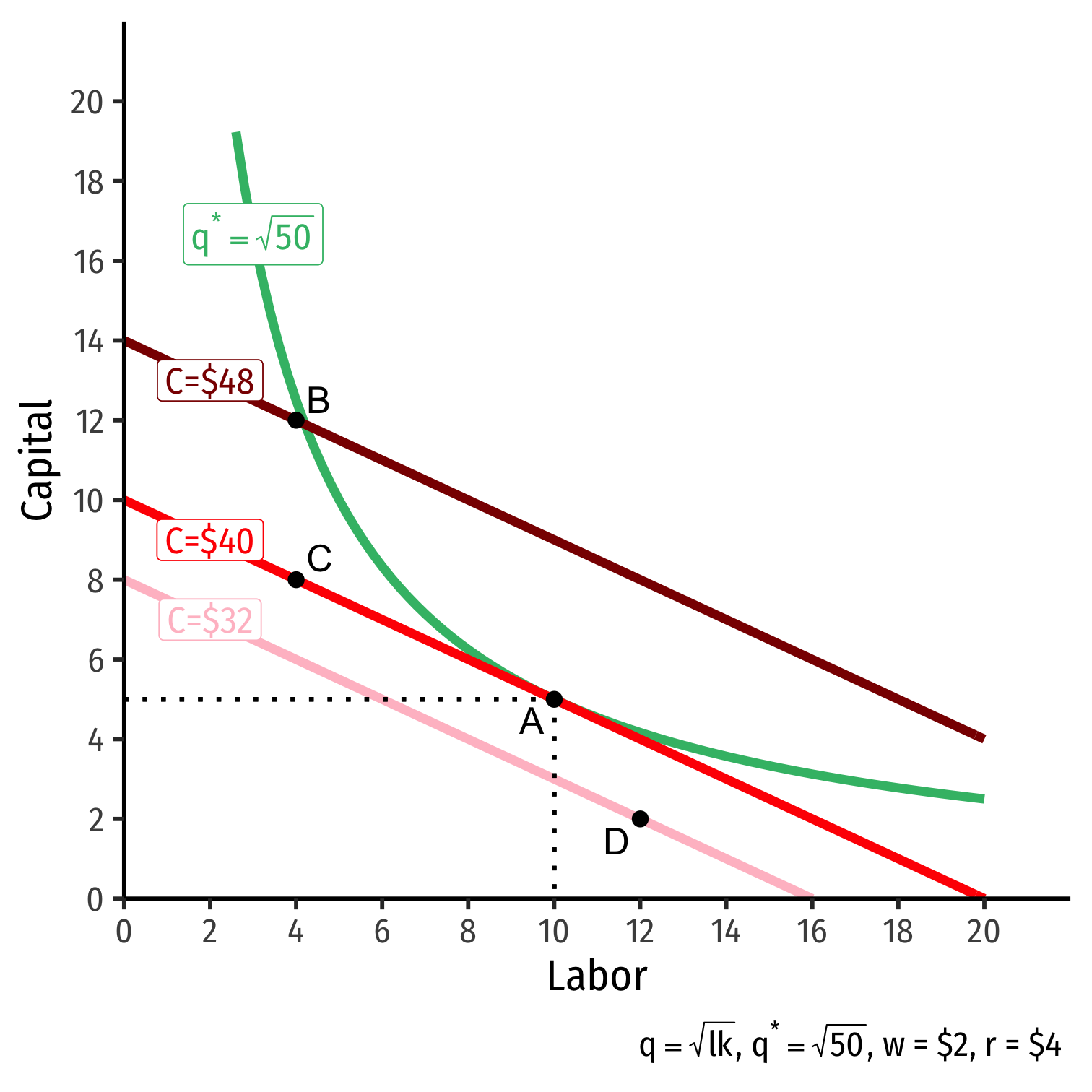

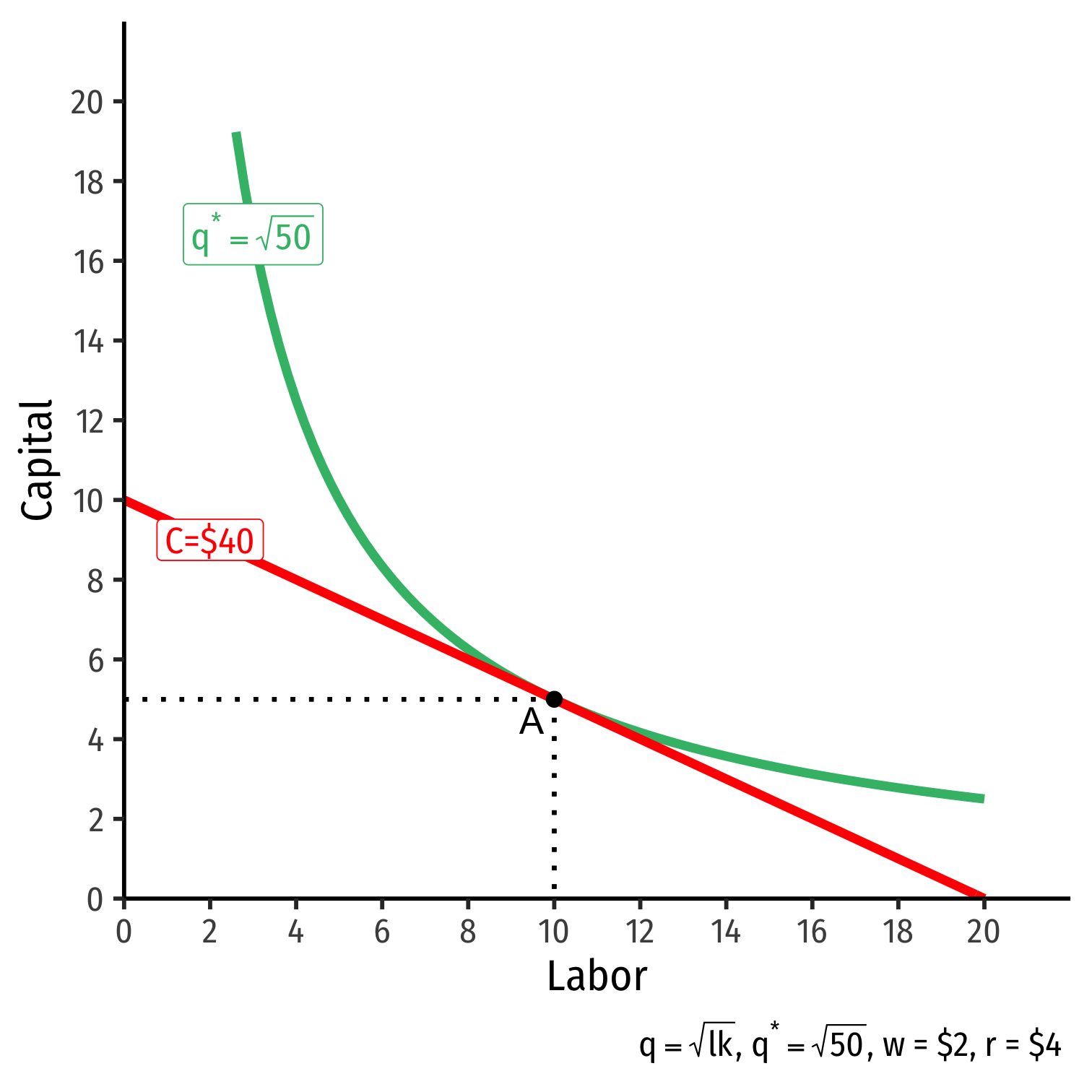

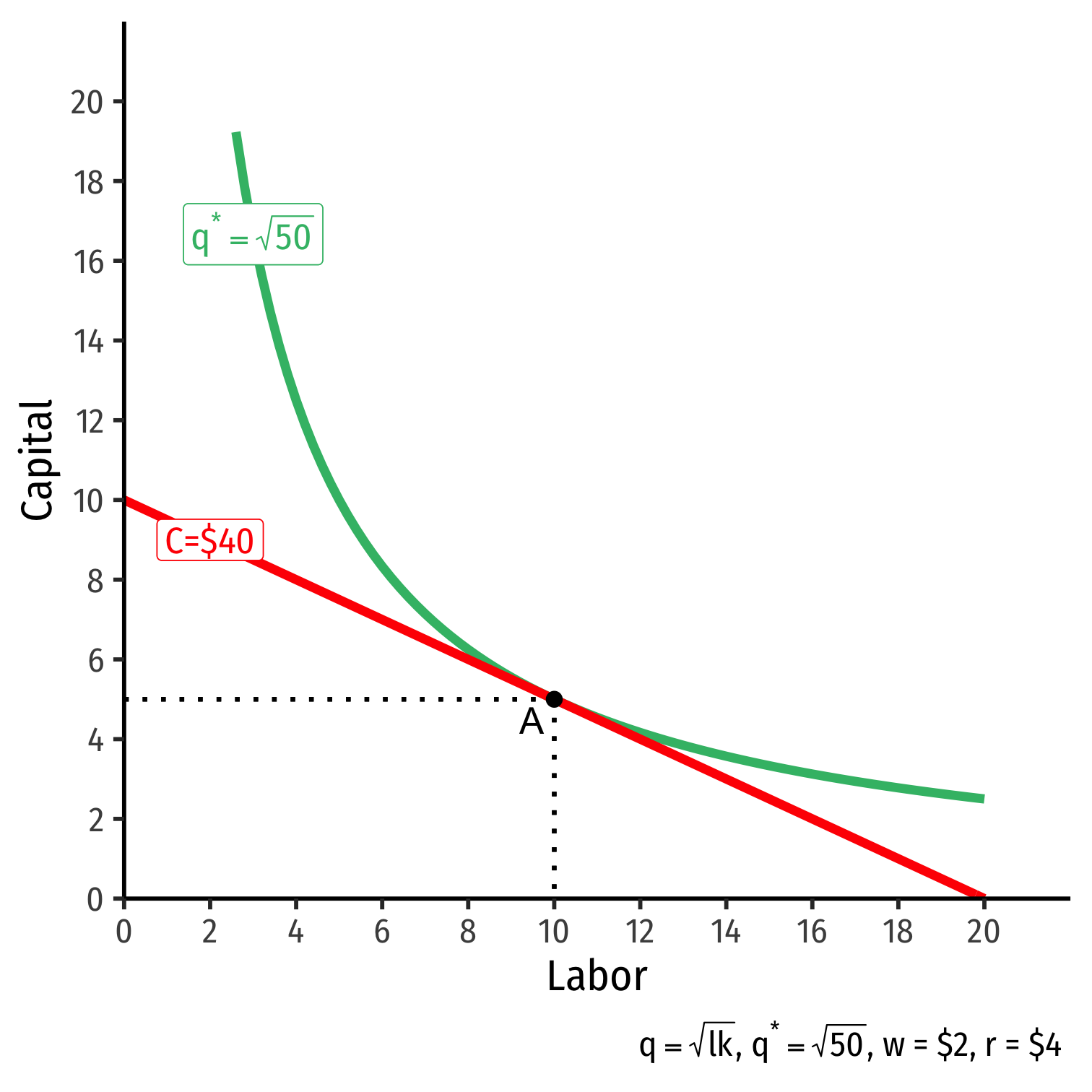

- Graphical solution: Lowest isocost line tangent to desired isoquant (A)

The Firm's Least-Cost Input Combination: Graphically

Graphical solution: Lowest isocost line tangent to desired isoquant (A)

B produces same output as A, but higher cost

C is same cost as A, but does not produce desired output

D is cheaper, does not produce desired output

The Firm's Least-Cost Input Combination: Why A?

Isoquant curve slope=Isocost line slope

The Firm's Least-Cost Input Combination: Why A?

Isoquant curve slope=Isocost line slopeMRTSl,k=wrMPlMPk=wr0.5=0.5

Marginal benefit = Marginal cost

- Firm would exchange at same rate as market

No other combination of (l,k) exists at current prices & output that could produce q⋆ at lower cost!

Two Equivalent Rules

Rule 1

MPlMPk=wr

- Easier for calculation (slopes)

Two Equivalent Rules

Rule 1

MPlMPk=wr

- Easier for calculation (slopes)

Rule 2

MPlw=MPkr

- Easier for intuition (next slide)

The Equimarginal Rule Again I

MPlw=MPkr=⋯=MPnpn

Equimarginal Rule: the cost of production is minimized where the marginal product per dollar spent is equalized across all n possible inputs

Firm will always choose an option that gives higher marginal product (e.g. if MPl>MPk)

- But each option has a different cost, so we weight each option by its price, hence MPnpn

The Equimarginal Rule Again II

Any optimum in economics: no better alternatives exist under current constraints

No possible change in your inputs to produce q∗ that would lower cost

The Firm's Least-Cost Input Combination: Example

Example:

Your firm can use labor l and capital k to produce output according to the production function: q=2lk

The marginal products are:

MPl=2kMPk=2l

You want to produce 100 units, the price of labor is $10, and the price of capital is $5.

- What is the least-cost combination of labor and capital that produces 100 units of output?

- How much does this combination cost?

Returns to Scale

Returns to Scale

- The returns to scale of production: change in output when all inputs are increased at the same rate (scale)

Returns to Scale

The returns to scale of production: change in output when all inputs are increased at the same rate (scale)

Constant returns to scale: output increases at same proportionate rate to inputs change

- e.g. double all inputs, output doubles

Returns to Scale

The returns to scale of production: change in output when all inputs are increased at the same rate (scale)

Constant returns to scale: output increases at same proportionate rate to inputs change

- e.g. double all inputs, output doubles

Increasing returns to scale: output increases more than proportionately to inputs change

- e.g. double all inputs, output more than doubles

Returns to Scale

The returns to scale of production: change in output when all inputs are increased at the same rate (scale)

Constant returns to scale: output increases at same proportionate rate to inputs change

- e.g. double all inputs, output doubles

Increasing returns to scale: output increases more than proportionately to inputs change

- e.g. double all inputs, output more than doubles

Decreasing returns to scale: output increases less than proportionately to inputs change

- e.g. double all inputs, output less than doubles

Returns to Scale: Example

Example: Do the following production functions exhibit constant returns to scale, increasing returns to scale, or decreasing returns to scale?

q=4l+2k

q=2lk

q=2l0.3k0.3

Returns to Scale: Cobb-Douglas

One reason Cobb-Douglas functions are great: easy to determine returns to scale:

q=Akαlβα+β=1: constant returns to scale

- α+β>1: increasing returns to scale

α+β<1: decreasing returns to scale

Note this trick only works for Cobb-Douglas functions!

Cobb-Douglas: Constant Returns Case

A common case of Cobb-Douglas is often written as:

q=Akαl1−α (i.e., the exponents sum to 1, constant returns)α is the output elasticity of capital

- A 1% increase in k leads to an α% increase in q

1−α is the output elasticity of labor

- A 1% increase in l leads to a (1−α)% increase in q

Output-Expansion Paths & Cost Curves

Goolsbee et. al (2011: 246)

Output Expansion Path: curve illustrating the changes in the optimal mix of inputs and the total cost to produce an increasing amount of output

Total Cost curve: curve showing the total cost of producing different amounts of output (next class)

See next class' notes page to see how we go from our least-cost combinations over a range of outputs to derive a total cost function