2.1 — Production, Specialization, Firms

ECON 306 • Microeconomic Analysis • Spring 2022

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS22

microS22.classes.ryansafner.com

Producer Behavior

How do producers decide:

- which products to produce

- in what quantity

- using which inputs

- and sold at what price?

Answers to these questions are building blocks for supply curves

The Basics of Production

Nearly all goods must be produced before we can exchange & consume them

Consumption is the using up of value to gain utility

- Consumption is the ultimate goal of all economic activity

The Basics of Production

Production is the creation of value, by transforming lower-valued goods (resources, inputs, etc) into higher-valued goods (outputs, consumer products, etc)

Iron Ore → Steel → Buildings, Bridges, Ovens, Water Bottles

It's Demand all the Way Down!

Supply is actually Demand in disguise!

An (opportunity) cost to buy (scarce) inputs for production because other people demand those same inputs to consume or produce other valuable things!

- Price necessary to pull them out of other valuable productive uses in the economy!

Production, Specialization, & Comparative Advantage

Production, Specialization, & Comparative Advantage

Consider a simple example — Robinson Crusoe stranded on a deserted island

“Autarky”: complete self-sufficiency; no exchange with others

Anything he wants to consume, he must first produce by himself

Production, Specialization, & Comparative Advantage

- Suppose on this tropical island, there is the potential to produce two goods:

- Bananas

- Coconuts

Production, Specialization, & Comparative Advantage

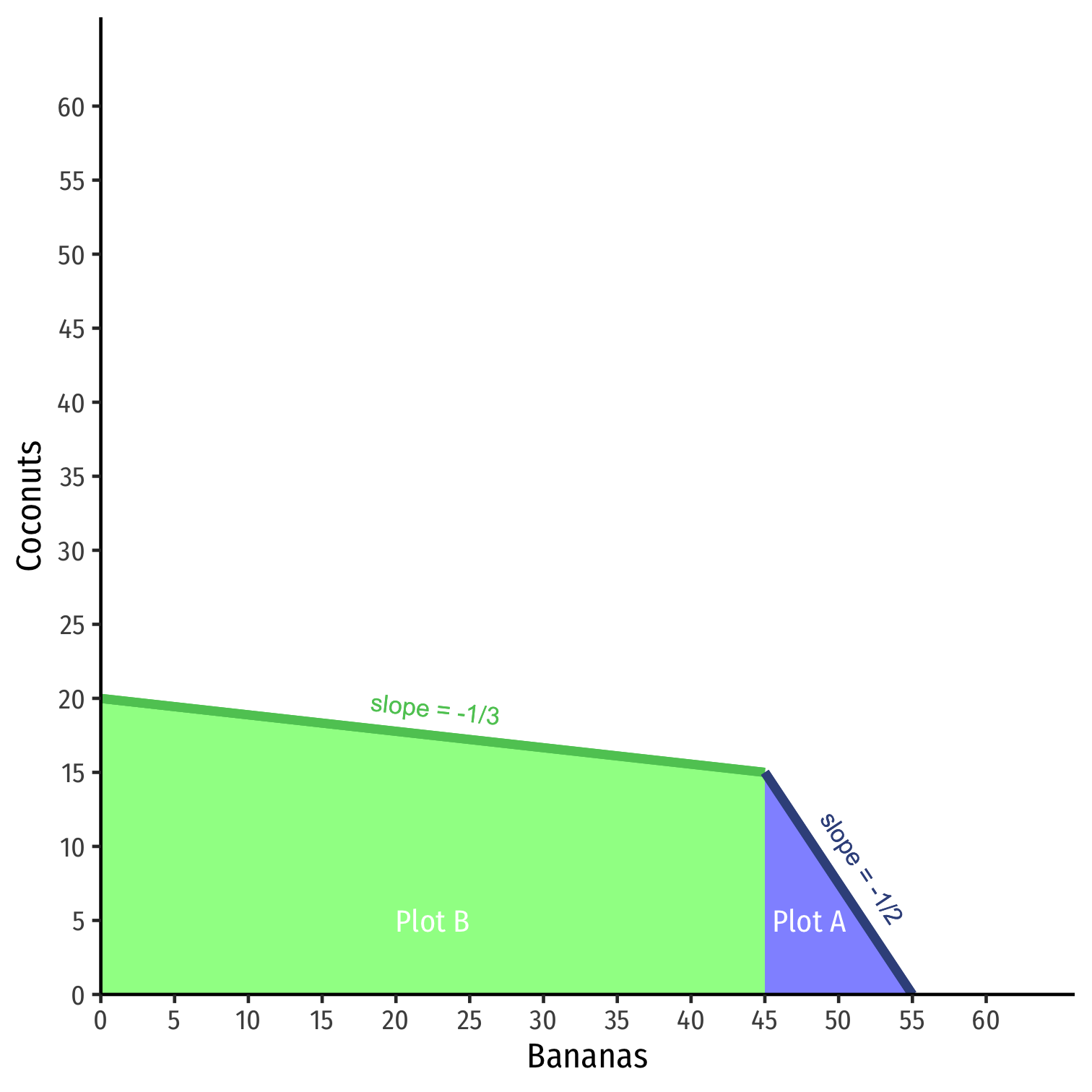

- Two plots of land, with different fertility

| Max Bananas | Max Coconuts | |

|---|---|---|

| Plot A | 10 | 5 |

| Plot B | 45 | 15 |

Production, Specialization, & Comparative Advantage

- Two plots of land, with different fertility

| Max Bananas | Max Coconuts | |

|---|---|---|

| Plot A | 10 | 5 |

| Plot B | 45 | 15 |

- For each plot, the (opportunity) cost of producing a marginal unit:†

| 1 Banana | 1 Coconut | |

|---|---|---|

| Plot A | 0.5C | 2B |

| Plot B | 0.33C | 3B |

Production, Specialization, & Comparative Advantage

- Two plots of land, with different fertility

| Max Bananas | Max Coconuts | |

|---|---|---|

| Plot A | 10 | 5 |

| Plot B | 45 | 15 |

- For each plot, the (opportunity) cost of producing a marginal unit:†

| 1 Banana | 1 Coconut | |

|---|---|---|

| Plot A | 0.5C | 2B |

| Plot B | 0.33C | 3B |

† In other words, the marginal cost!

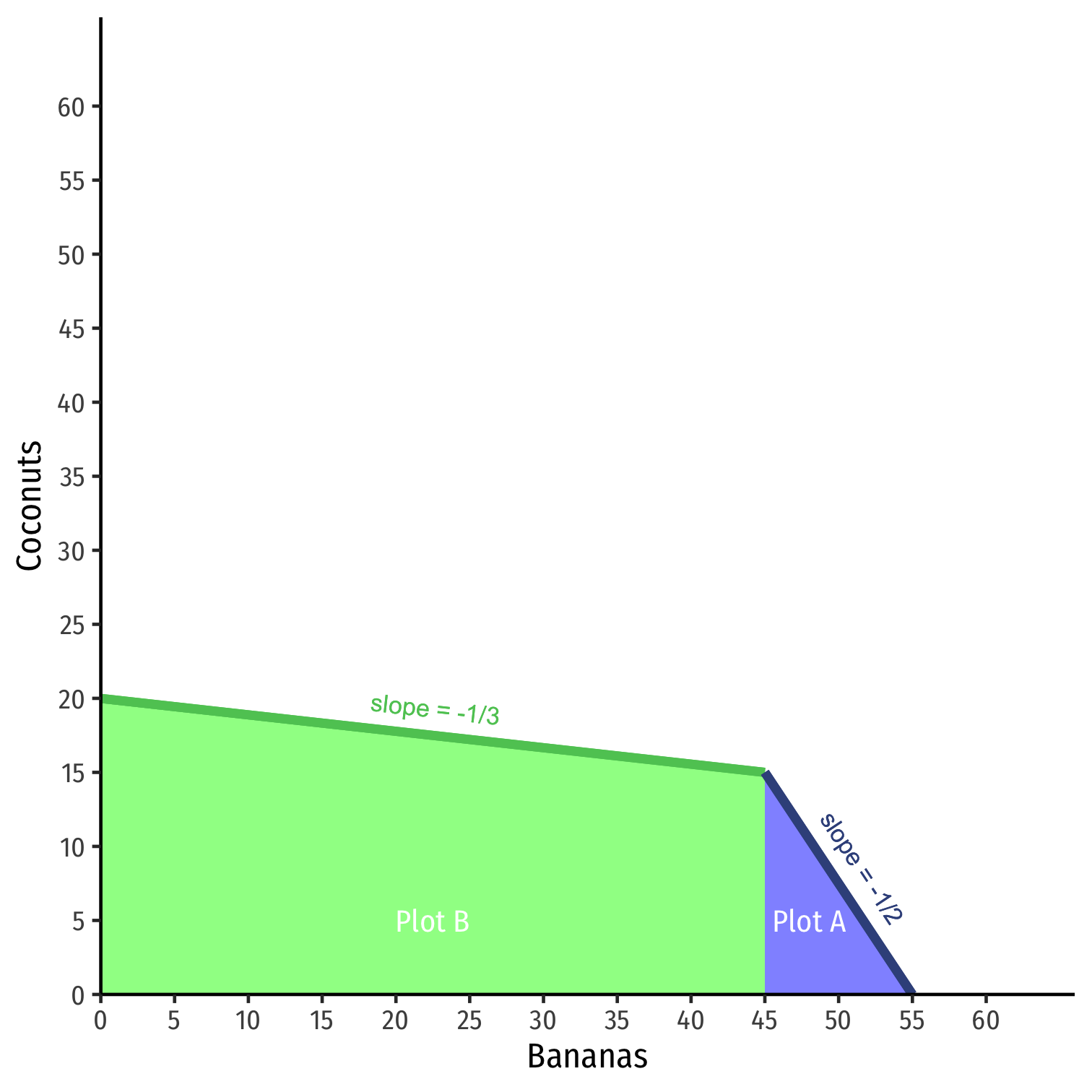

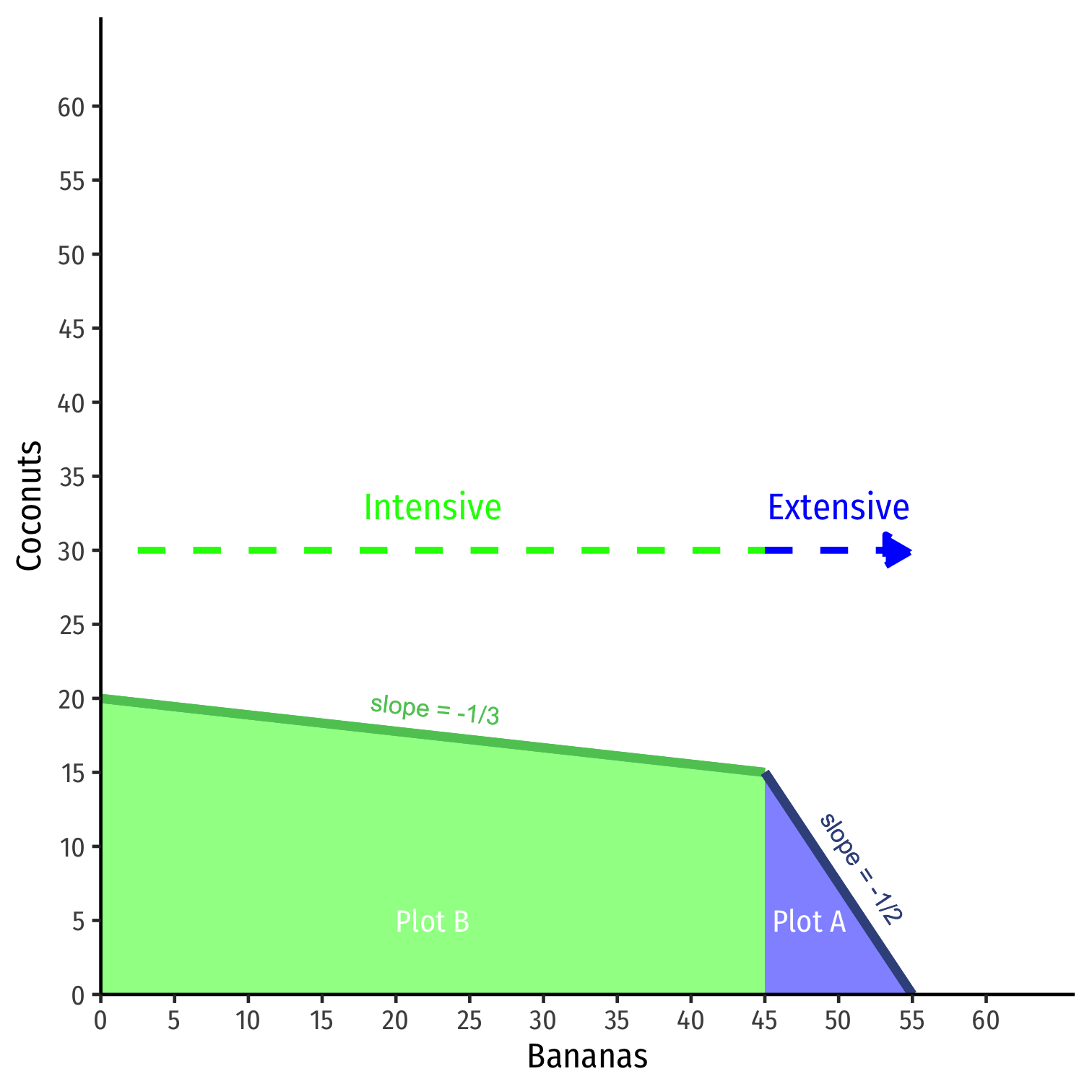

Production, Specialization, & Comparative Advantage

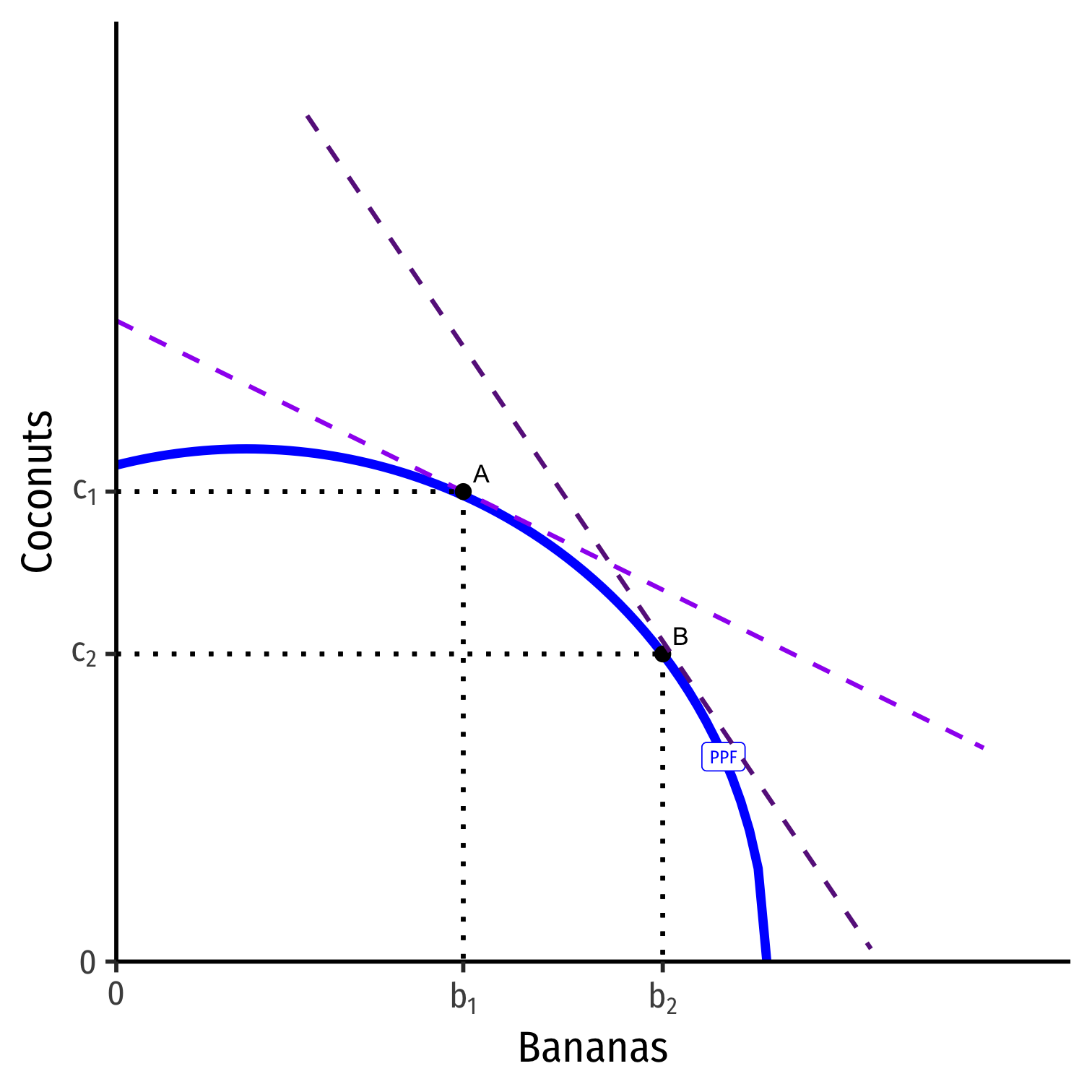

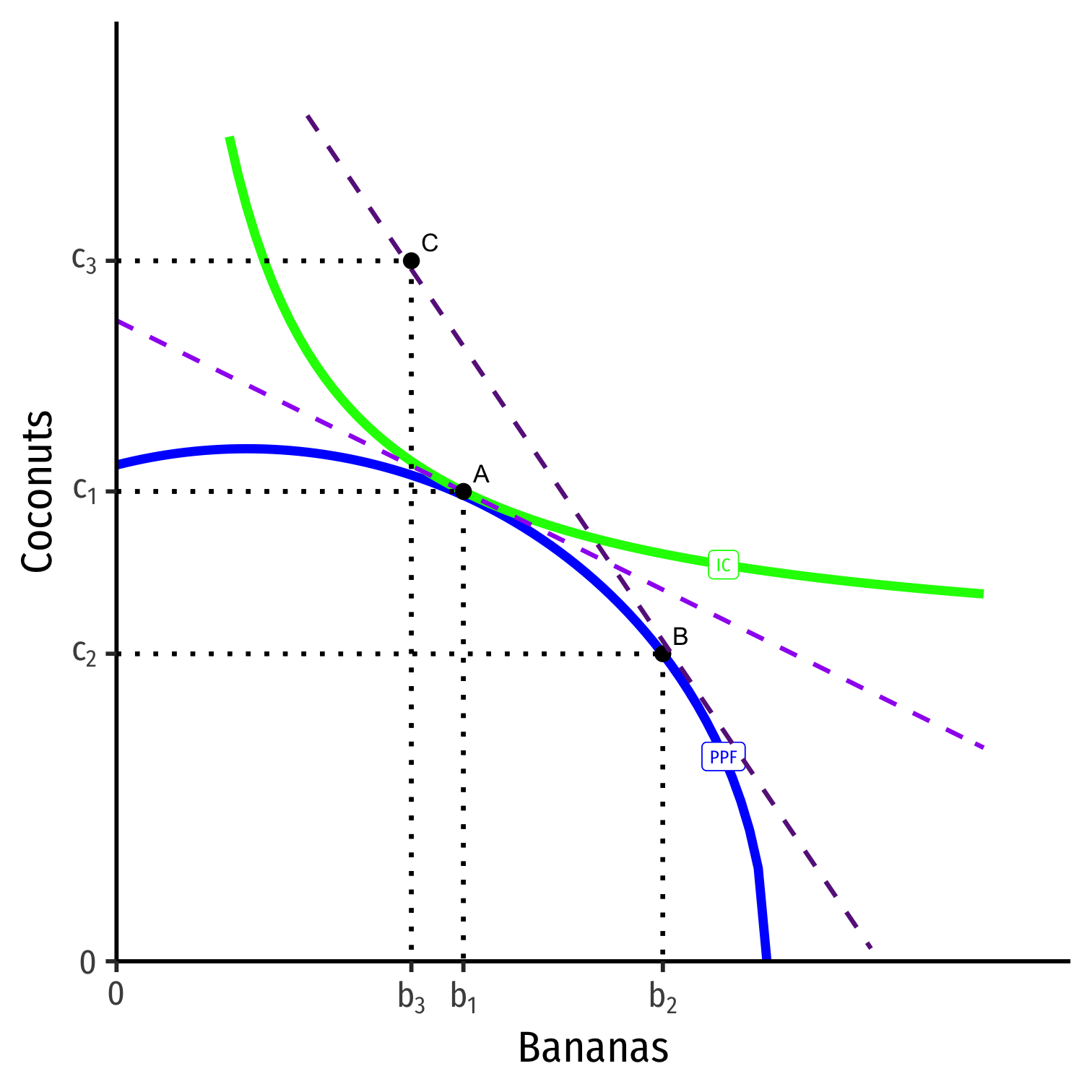

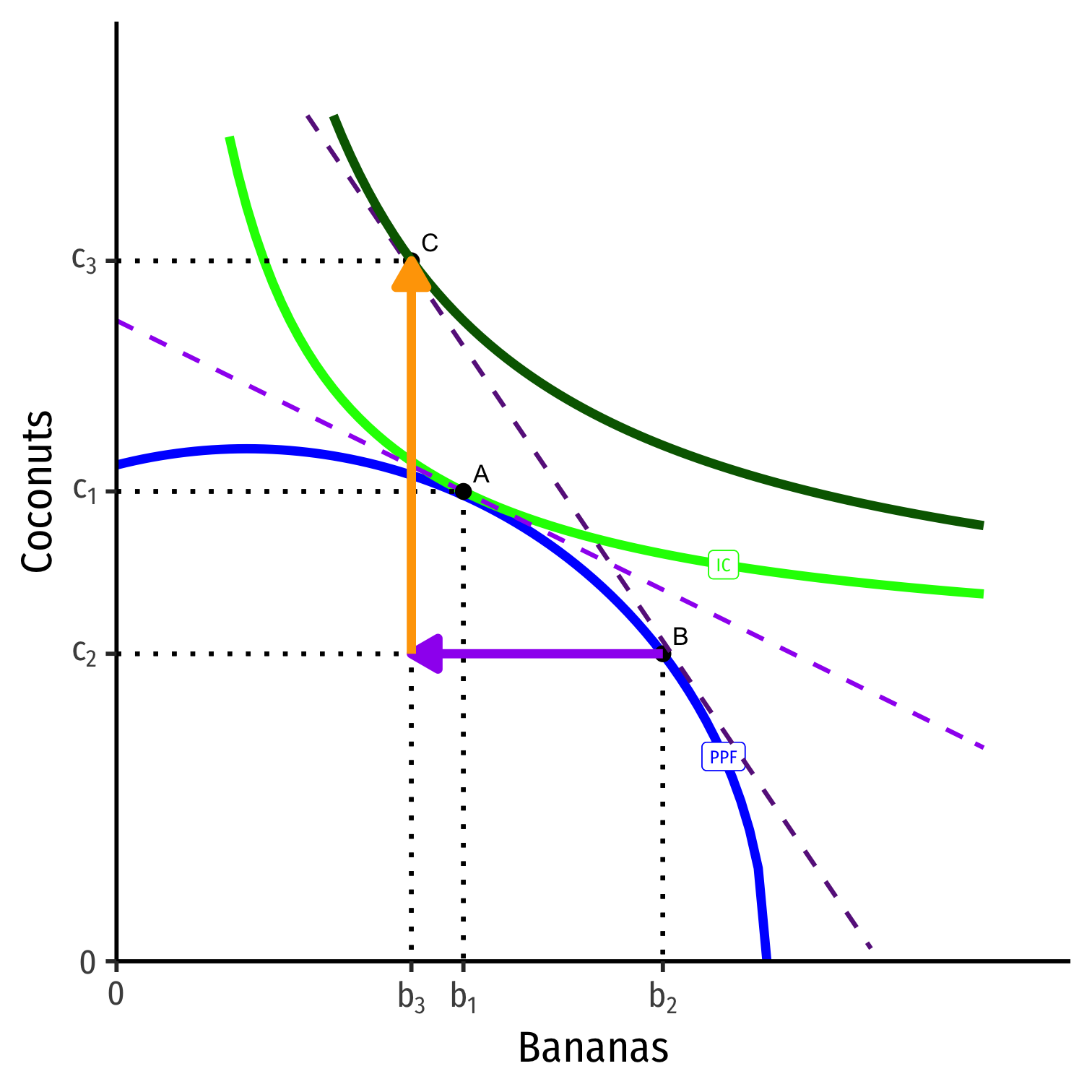

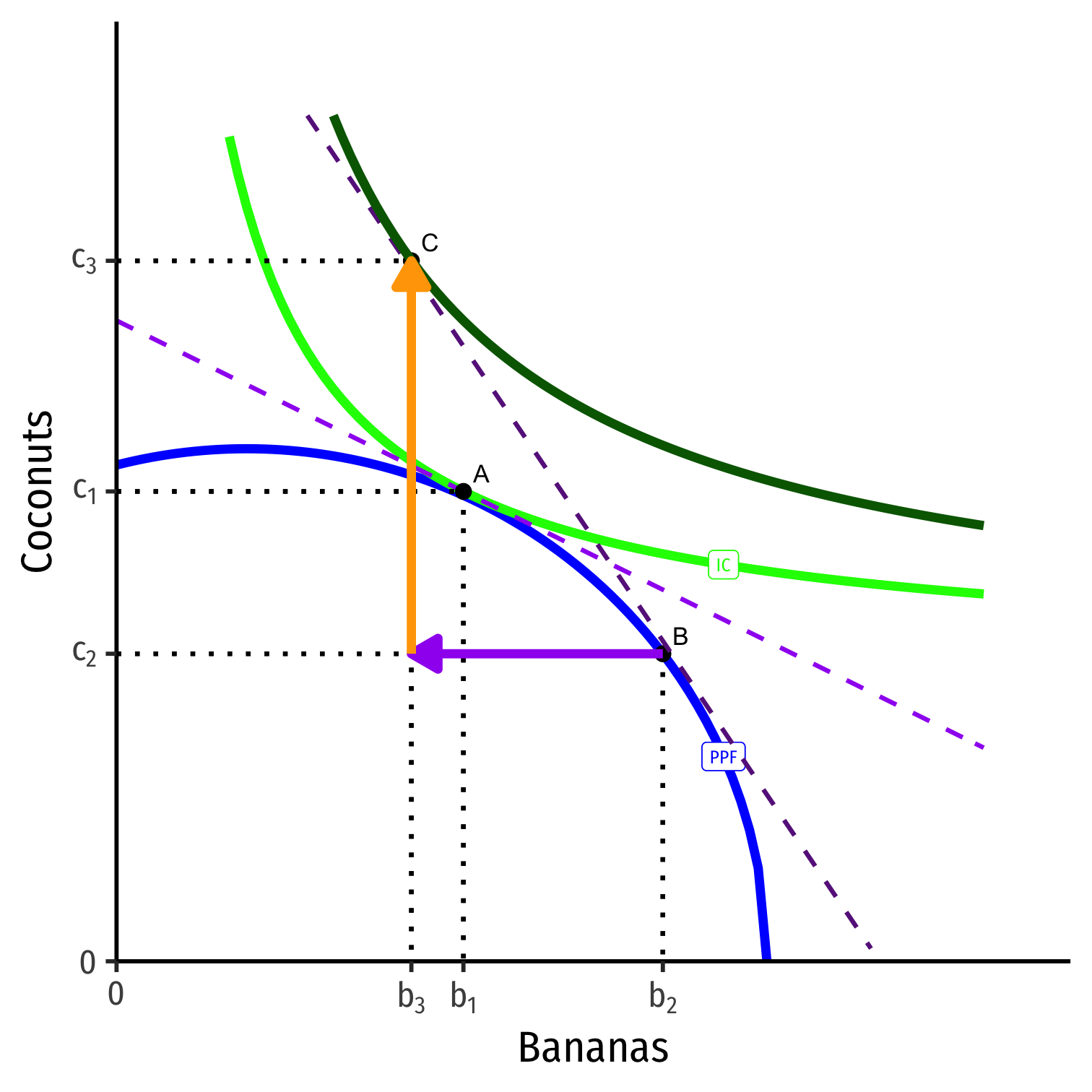

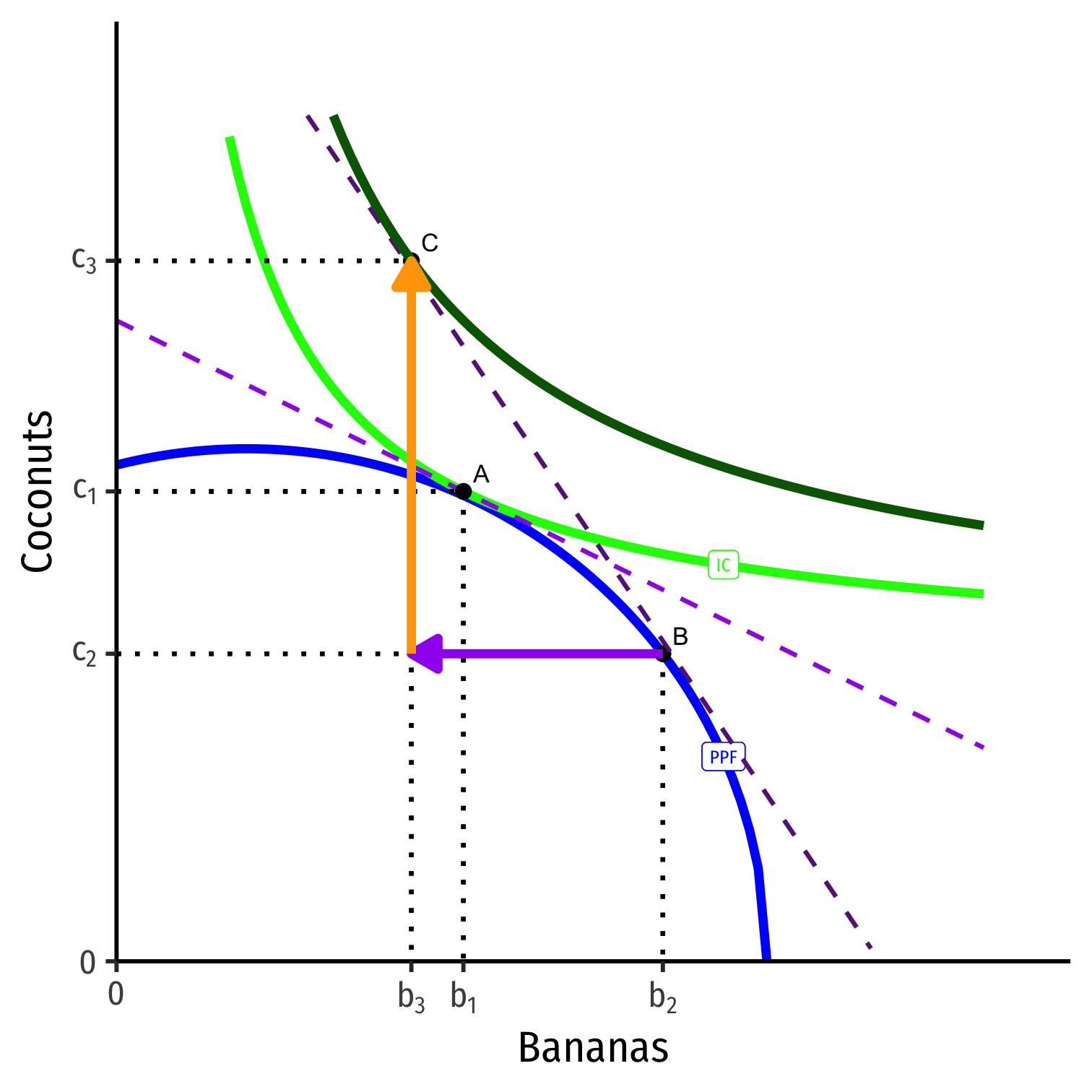

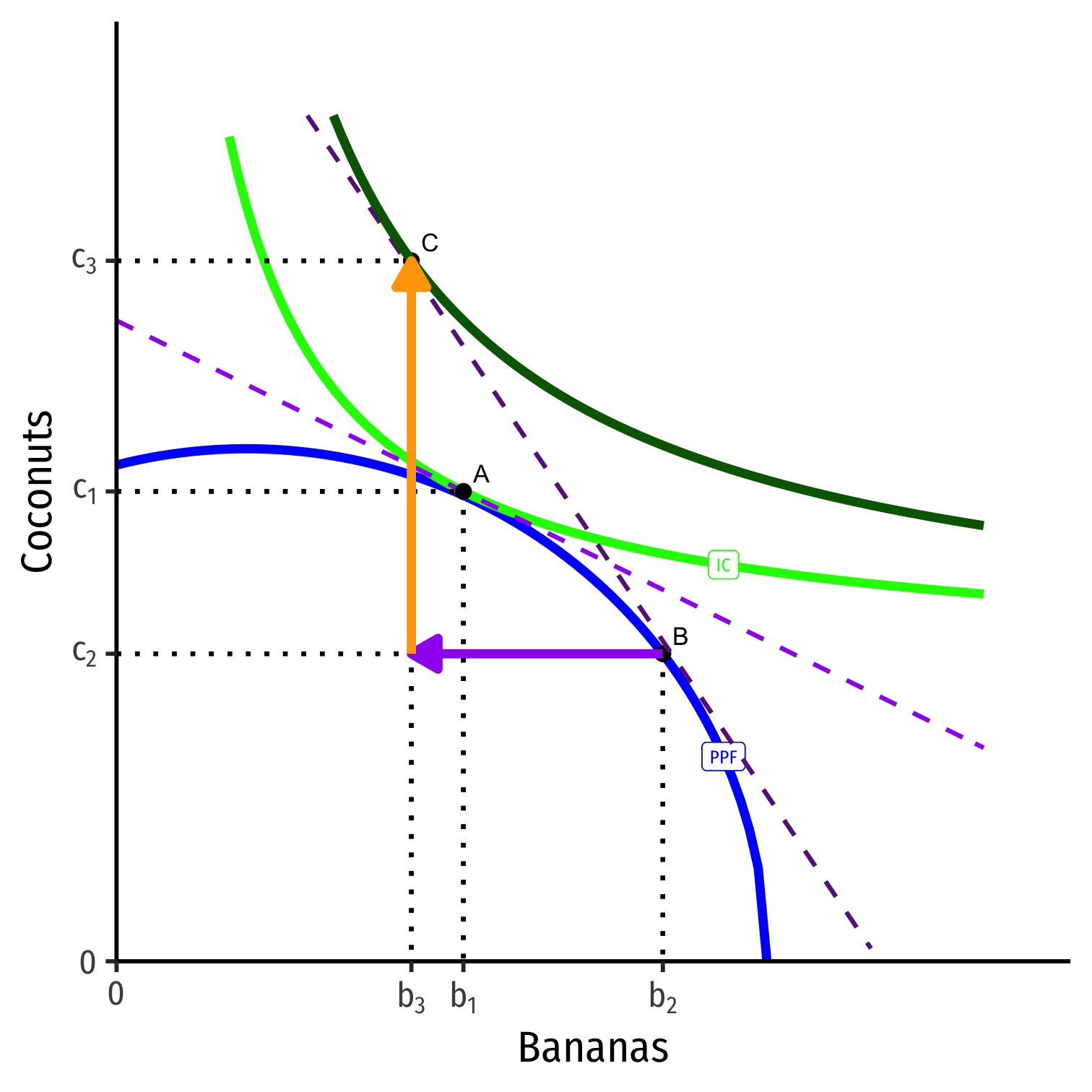

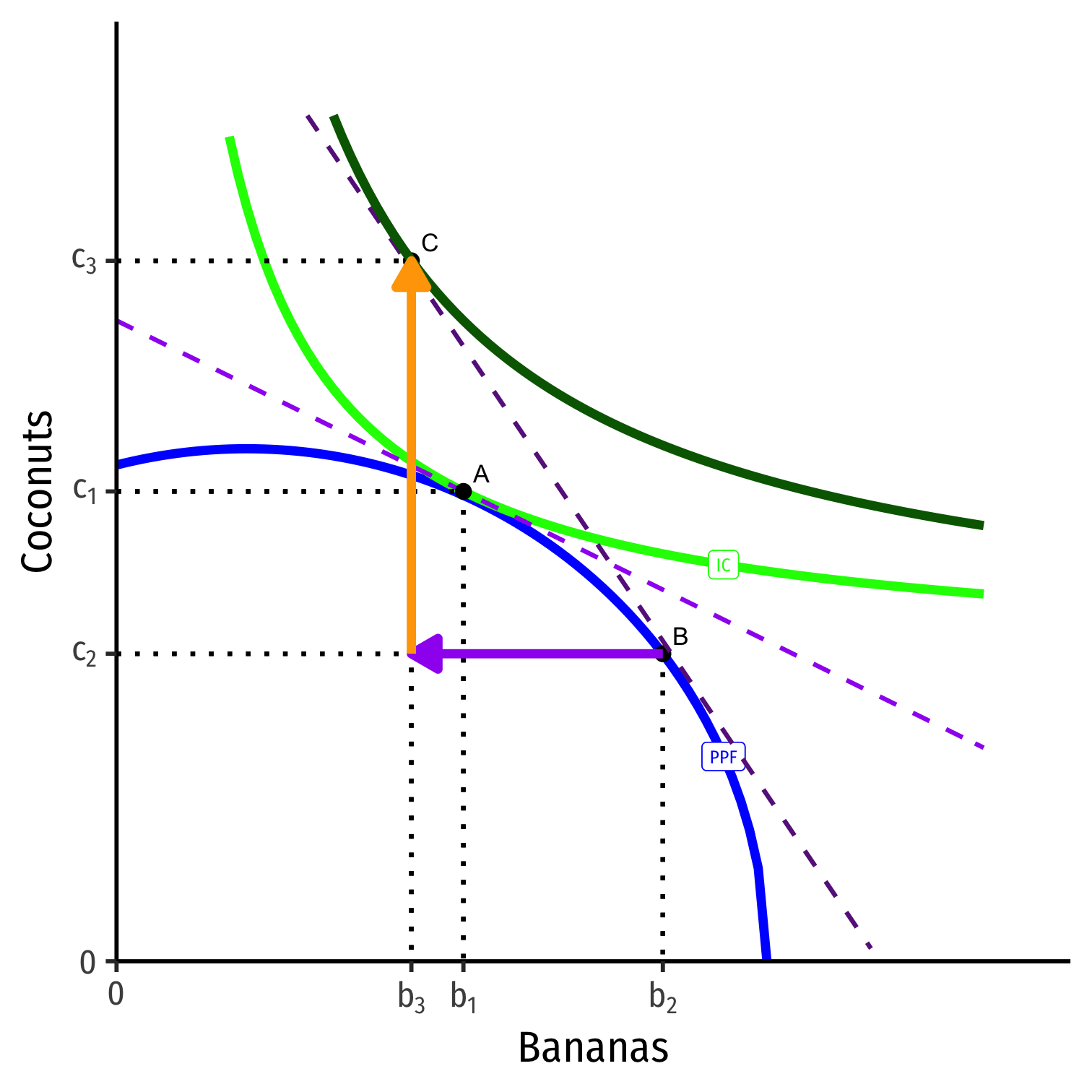

Production possibilities frontier (PPF) displaying possible combinations of outputs

Slope of PPF called “marginal rate of transformation” (MRT)

- can just call it marginal cost

Production, Specialization, & Comparative Advantage

Increasing marginal cost: to produce more of a good, (opportunity) cost rises as he cultivates more plots of land

Producing Bananas (x-axis), start with most productive plot first (Plot B), then start cultivation on (Plot A)

- “Intensive margin”: producing more on existing (most productive) plot (Plot B)

- “Extensive margin”: bringing new (worse) plots into cultivation for production (moving to Plot A)

Production, Specialization, & Comparative Advantage

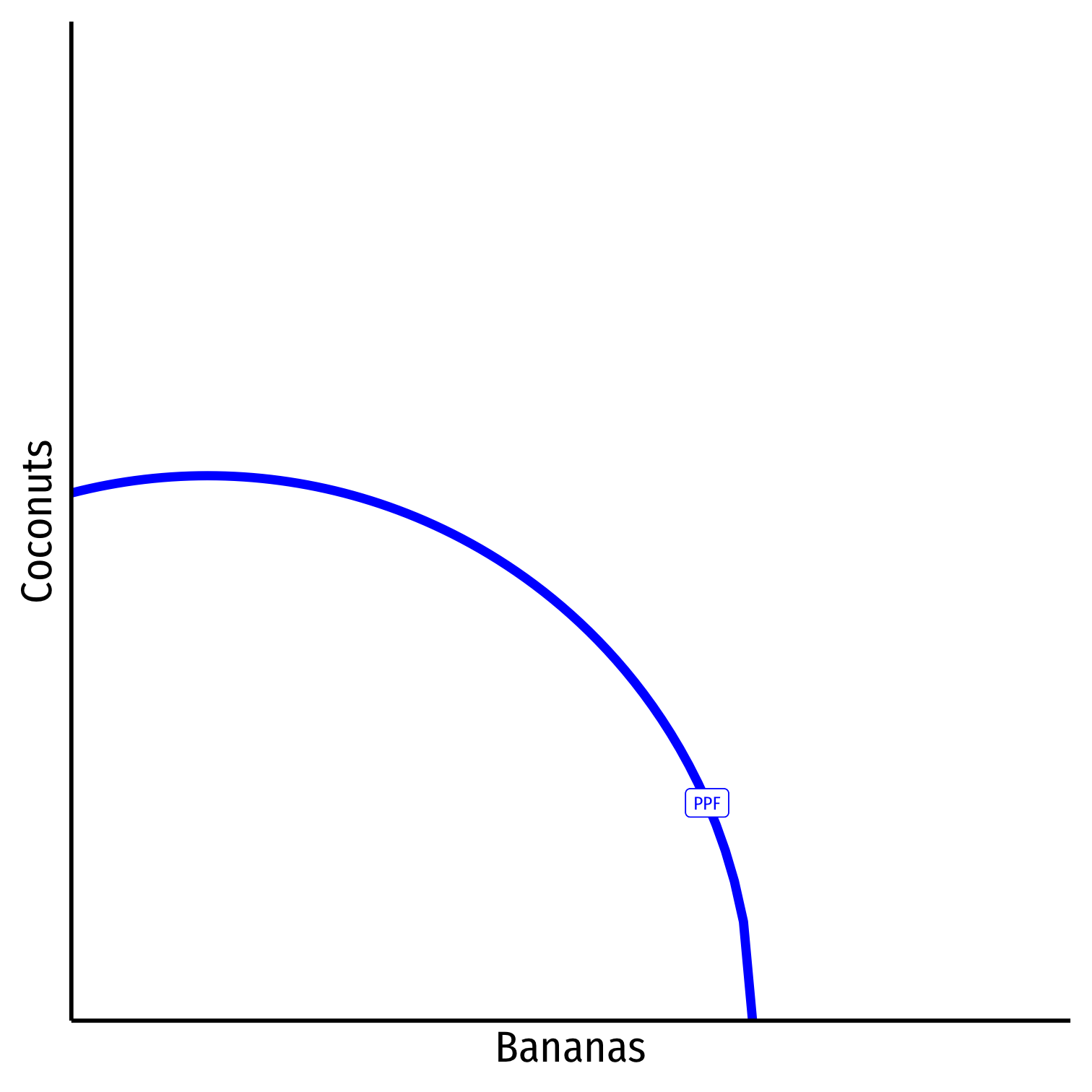

Imagine now there are many various plots of land, differing in quality

So a more-fully curved PPF

Production, Specialization, & Comparative Advantage

Imagine now there are many various plots of land, differing in quality

So a more-fully curved PPF

Again, increasing marginal cost with more production (moving to worse land)

- Producing more Bananas, (A→B), slope gets steeper

- Producing more Coconuts, (A←B), slope gets flatter

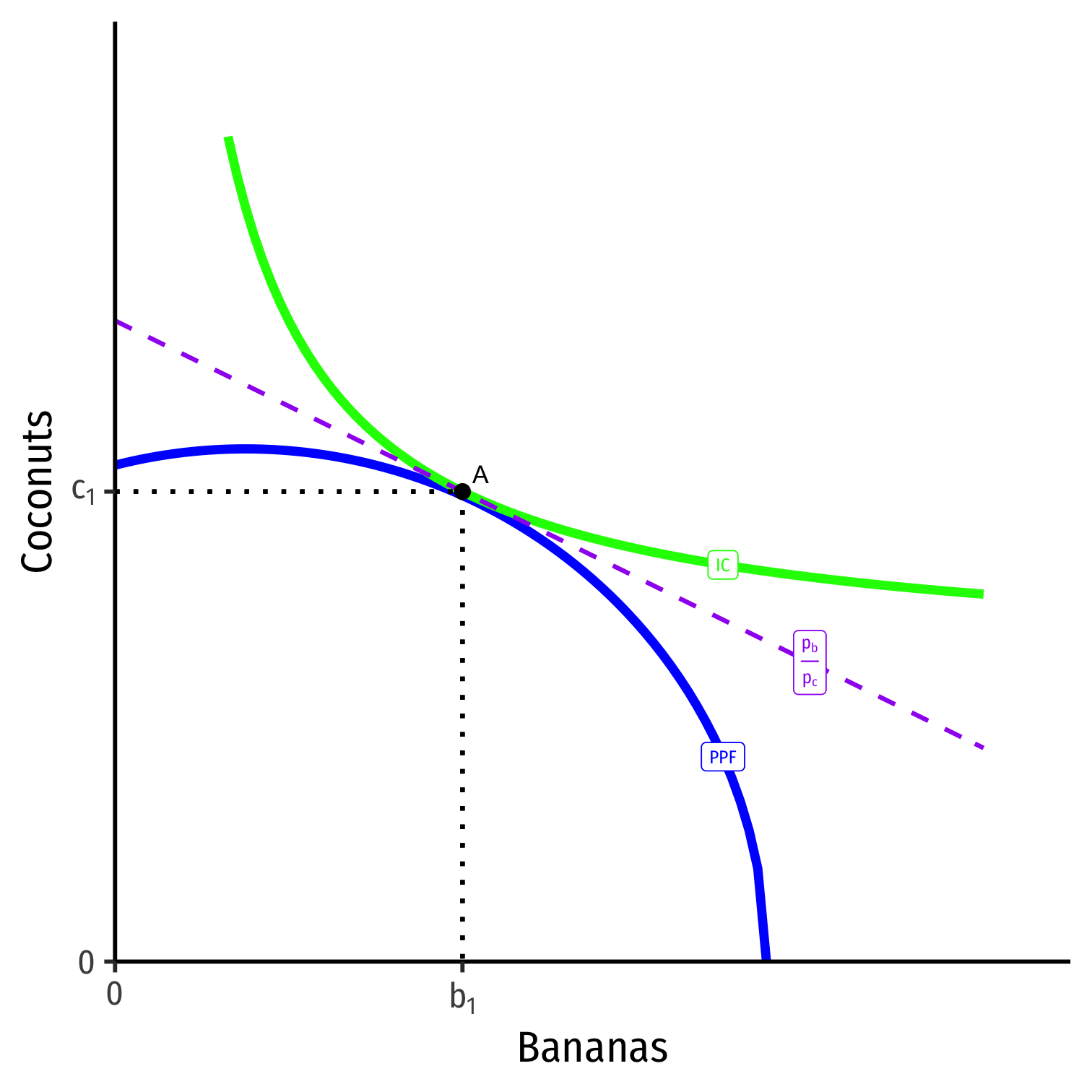

Production, Specialization, & Comparative Advantage

Based on his preferences, his productive & consumption optimum in autarky is point A (highest Indifference curve tangent to PPF)

At this point: MRTPPF slope=MRSI.C. slope=pbpcprice line

- MC = MB = price

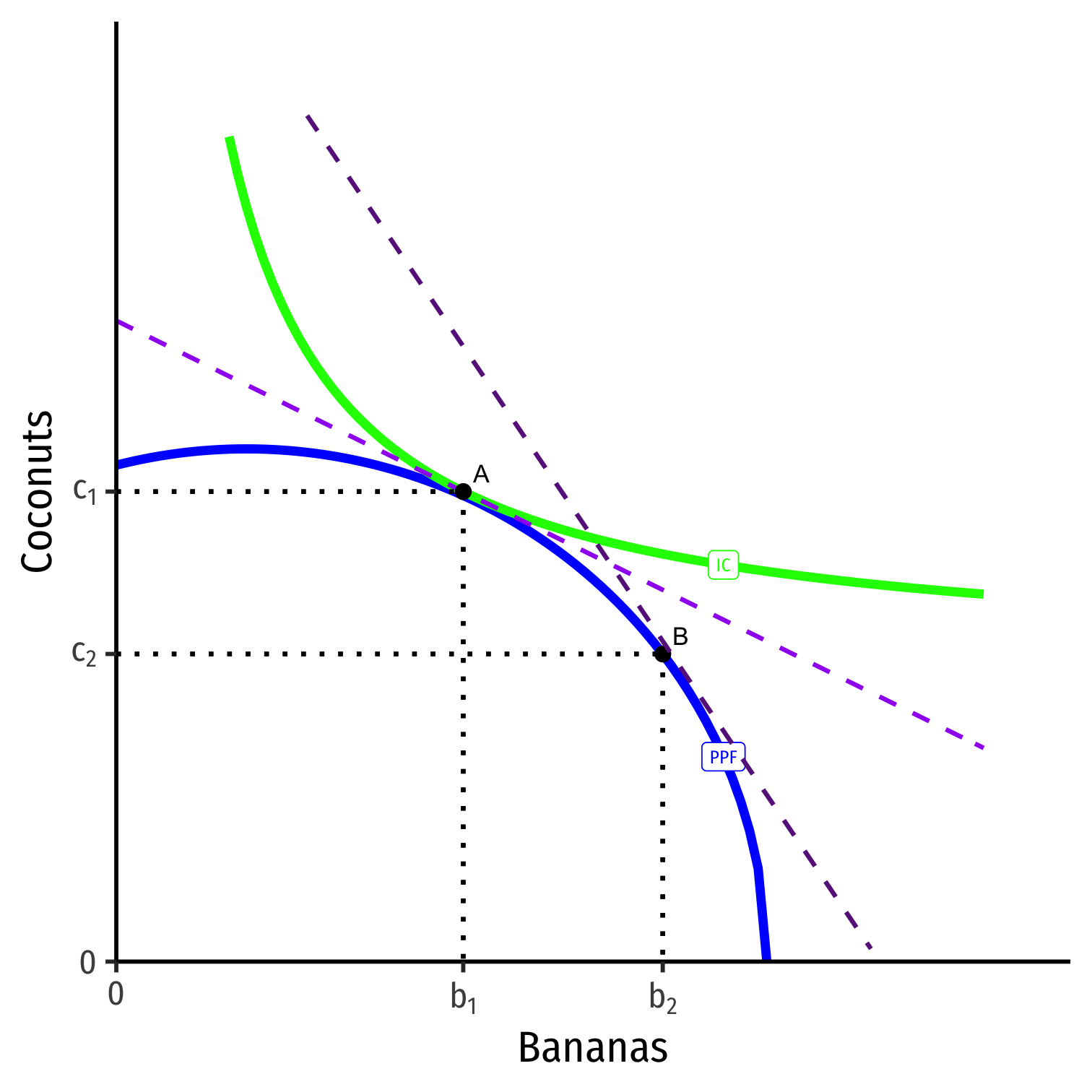

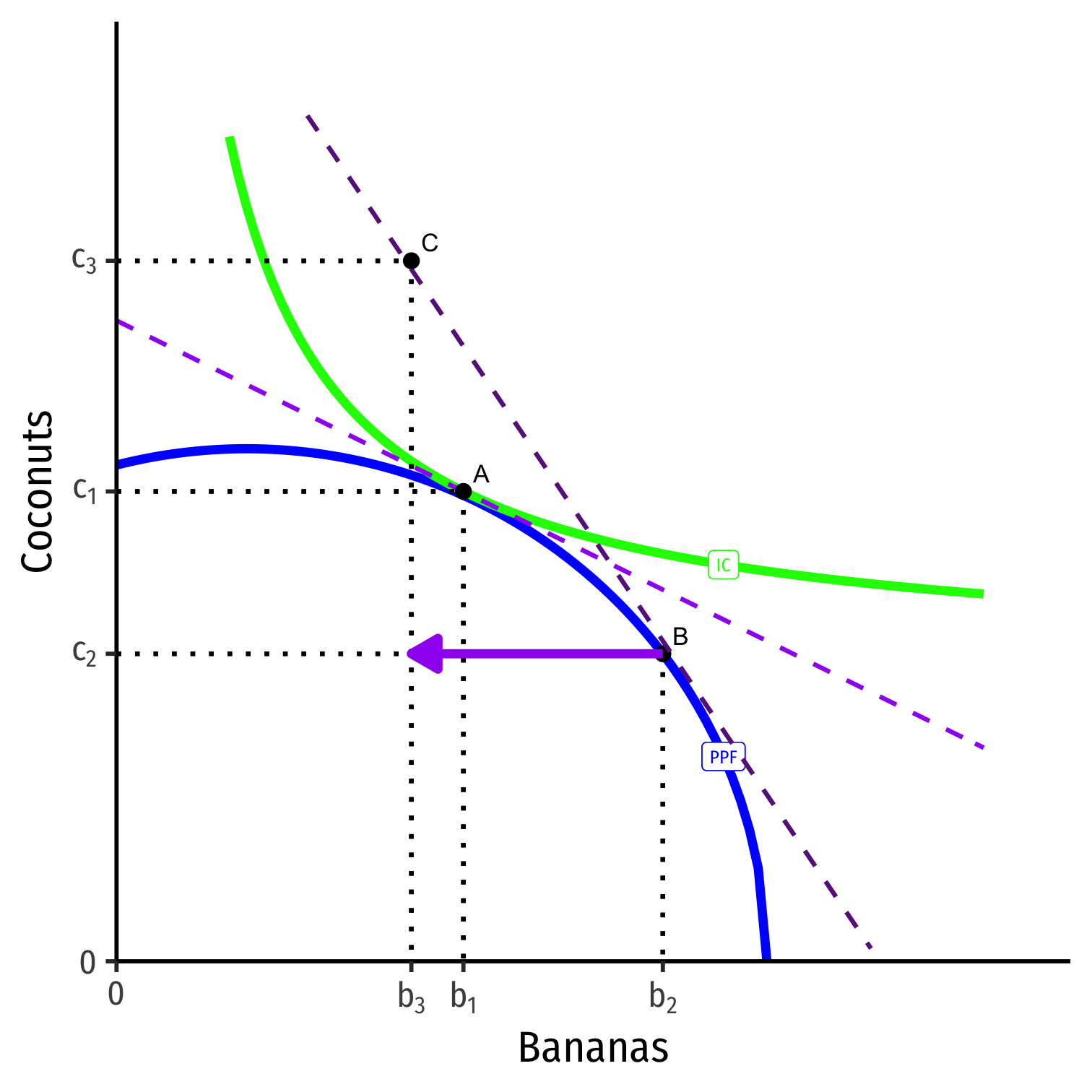

Trade

Now suppose he has the opportunity to trade with others

Current market exchange rate is the slope of darker purple dashed line

Trade

Now suppose he has the opportunity to trade with others

Current market exchange rate is the slope of darker purple dashed line

He will specialize in production of Bananas, produce more of them (A→B) to trade to get coconuts

- B is his productive optimum

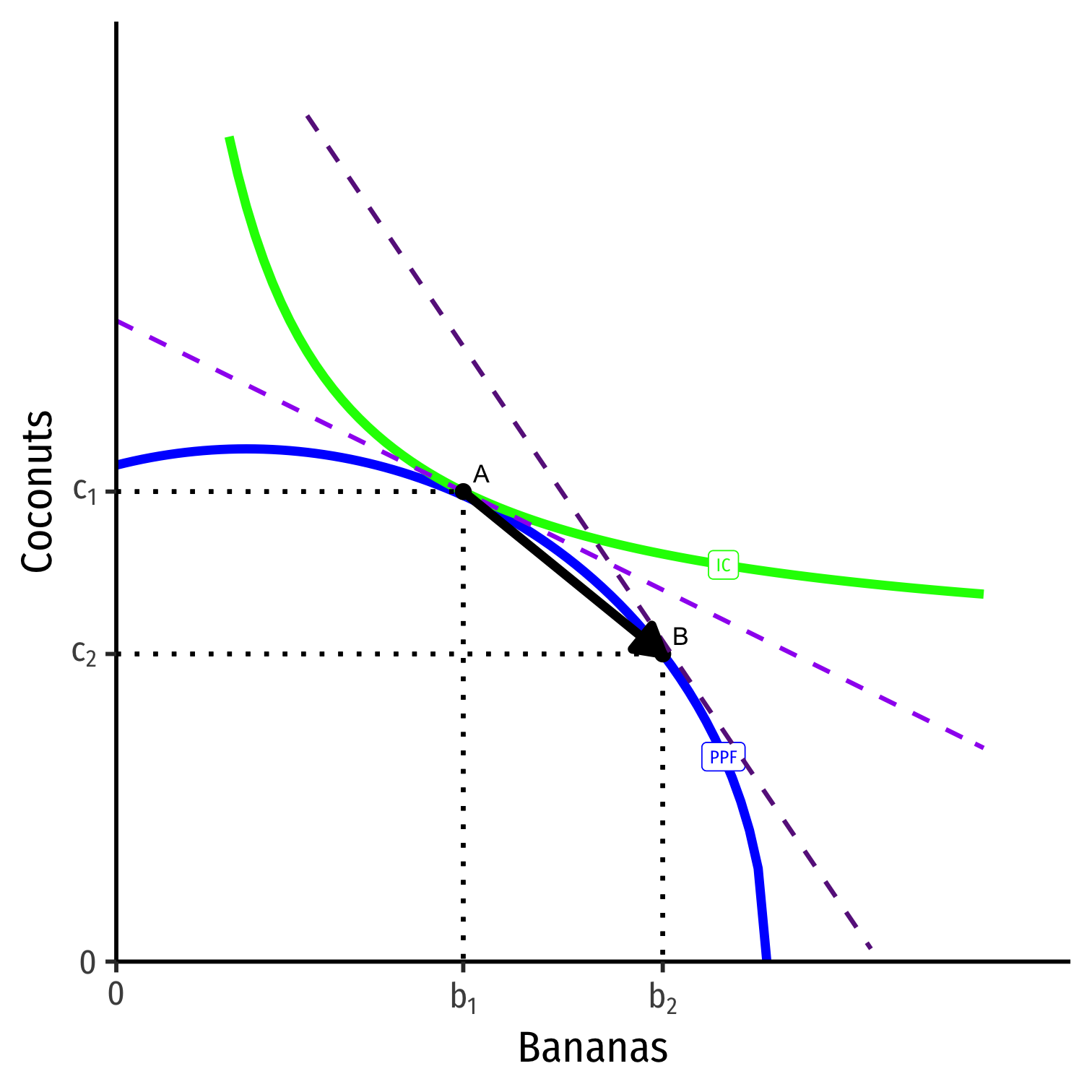

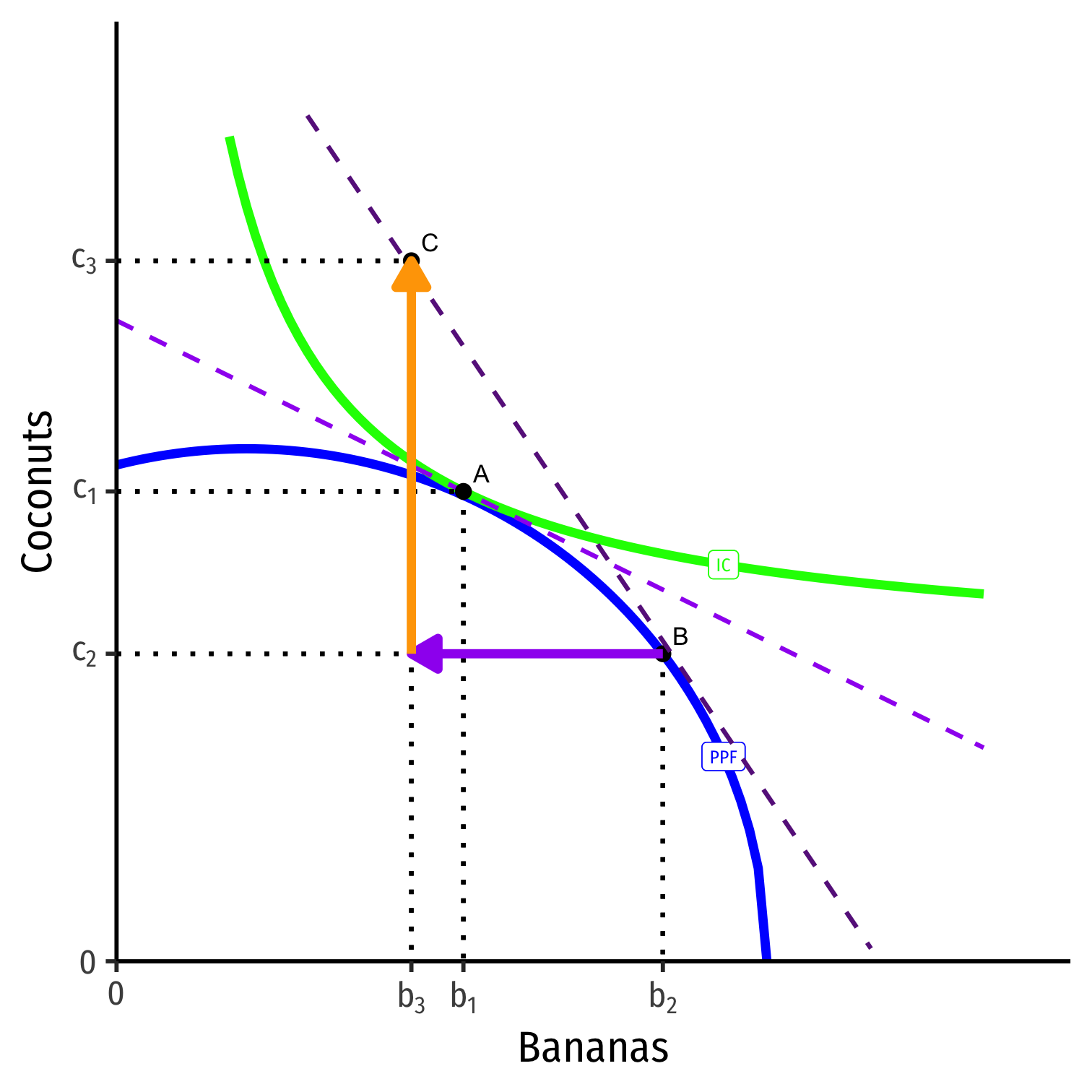

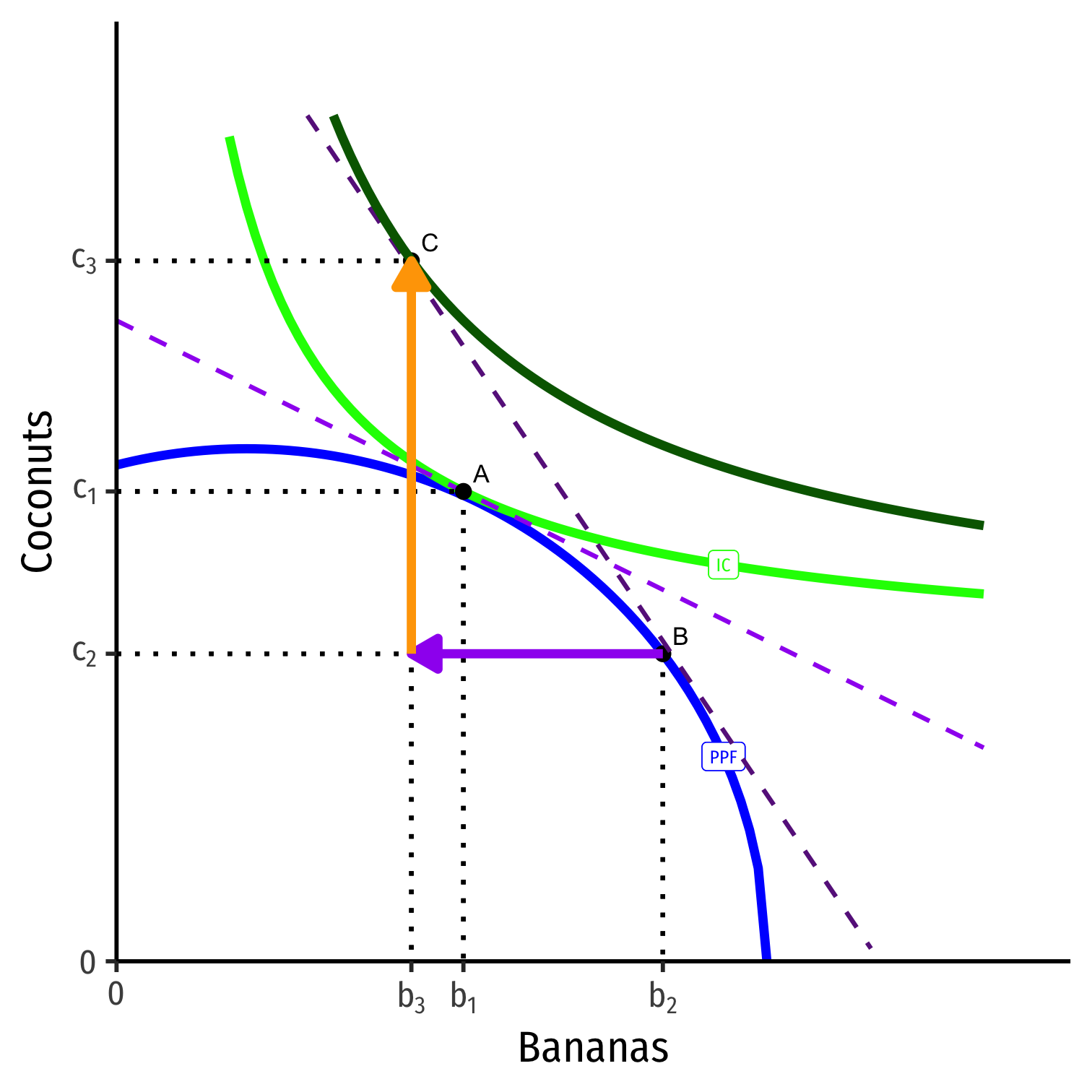

Post-Trade Consumption

- He will trade at the market prices (slope of dark purple dashed line)

Post-Trade Consumption

- He will trade at the market prices (slope of dark purple dashed line)

- Sell (export) his specialized good, Bananas

Post-Trade Consumption

- He will trade at the market prices (slope of dark purple dashed line)

- Sell (export) his specialized good, Bananas

- Buy (import) from others, Coconuts

Post-Trade Consumption

He will trade at the market prices (slope of dark purple dashed line)

- Sell (export) his specialized good, Bananas

- Buy (import) from others, Coconuts

Allows him to reach higher indifference curve at point C, new consumption optimum

- Again, at this point (but at new market prices, instead of autarky prices!): MRTPPF slope=MRSI.C. slope=pbpcprice line

- MC = MB = price

Takeaways

- Trade is good

- Reaches higher indifference curve, beyond PPF!

Takeaways: Specialization & Exchange

Trade is good

Specialization and exchange

- specialize in producing whatever good you have the comparative advantage (lower opportunity cost) in

- buy (import) everything else!

- can be comparatively good at something, or comparatively bad at everything else!

Takeaways: Comparative Advantage

Takeaways: Comparative Advantage

The Division of Labor

Adam Smith

1723-1790

"The greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgment with which it is any where directed, or applied, seem to have been the effects of the division of labour," (Book I, Chapter 1).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

Takeaways: Specialization & Exchange

Trade is good

Specialization and exchange

- specialize in producing whatever good you have the comparative advantage (lower opportunity cost) in

- buy (import) everything else!

- can be comparatively good at something, or comparatively bad at everything else!

- Learn much more in my international trade course

Takeaways

- Trade is good

- Specialization and comparative advantage

- Price differences imply gains from trade

- different price lines in “autarky” vs. with trade

- the more different his price is vs. market, the better off he will be!

Takeaways

- Trade is good

- Specialization and comparative advantage

- Price differences imply gains from trade

- A theory of the firm

- Productive optimum (B) is independent of preferences!

- Any rational producer would make the same decision, regardless of preferences (or ownership structure)

- sole-proprietor, partnership, corporation, non-profit, workers co-op, etc.

Takeaways

- Trade is good

- Specialization and comparative advantage

- Price differences imply gains from trade

- A theory of the firm

- Competitive firms produce where p = MC

- Point B:

MRTPPF slope=pbpcprice line

- MC = price

What Do Firms Do?

The Firm

In modern market economies, most production takes place in an organization known as a firm

- A legal fiction for particular purposes

It does not have to be this way, and for most of history it was not this way!

- Craft guilds

- Independent artisans

- Independent contractors

If Markets Are So Great, Why Do Firms Exist?

Firms exist in the forms they do because they are an efficient response to particular problems of economic organization

Lots of interesting & Nobel-prize winning analysis

For now, we'll sidestep these and just assume firms exist. Learn more in my Industrial Organization course:

What Do Firms Do? I

We'll assume “the firm” is the agent to model:

So what do firms do?

How would we set up an optimization model:

Choose: < some alternative >

In order to maximize: < some objective >

Subject to: < some constraints >

What Do Firms Do? II

- Firms convert some goods to other goods:

What Do Firms Do? II

Firms convert some goods to other goods:

Inputs: x1,x2,⋯,xn

- Examples: worker efforts, warehouse space, electricity, loans, oil, cardboard, fertilizer, computers, software programs, etc

What Do Firms Do? II

Firms convert some goods to other goods:

Inputs: x1,x2,⋯,xn

- Examples: worker efforts, warehouse space, electricity, loans, oil, cardboard, fertilizer, computers, software programs, etc

Output: q

- Examples: gas, cars, legal services, mobile apps, vegetables, consulting advice, financial reports, etc

What Do Firms Do? III

- Technology or a production function: rate at which firm can convert specified inputs (x1,x2,⋯,xn) into output (q) q=f(x1,x2,⋯,xn)

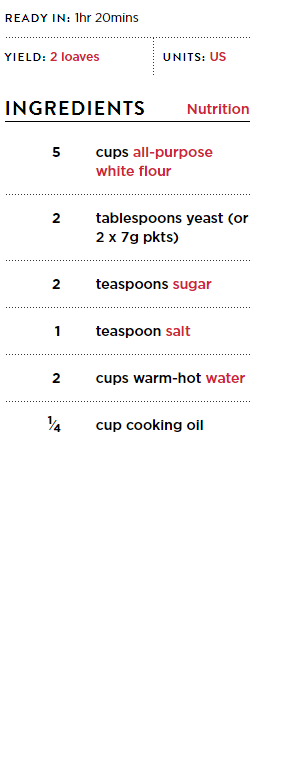

Production Function as Recipe

The production function

The production algorithm

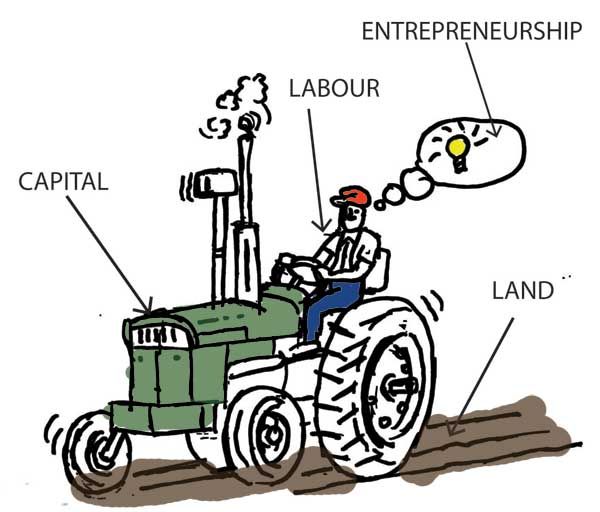

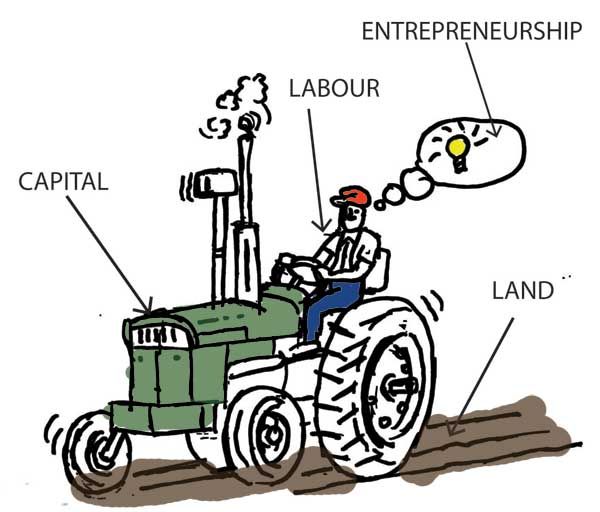

Factors of Production I

q=Af(t,l,k)

- Economists typically classify inputs, called the “factors of production” (FOP):

| Factor | Owned By | Earns |

|---|---|---|

| Land (t) | Landowners | Rent |

| Labor (l) | Laborers | Wages |

| Capital (k) | Capitalists | Interest |

- A: "total factor productivity" (ideas/knowledge/institutions)

- and Entrepreneurs/Owners who earn Profit

Factors of Production II

q=f(l,k)

- We will assume just two inputs: labor l and capital k

| Factor | Owned By | Earns |

|---|---|---|

| Labor (l) | Laborers | Wages |

| Capital (k) | Capitalists | Interest |

What Does a Firm Maximize?

We will assume firms maximize profit (π)

Not true for all firms

- Examples: non-profits, charities, civic associations, government agencies, criminal organizations, etc

Even profit-seeking firms may also want to maximize additional things

- Examples: goodwill, sustainability, social responsibility, etc

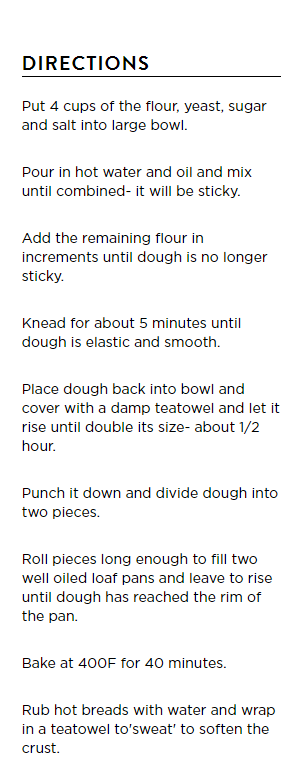

Profits Have a Bad Rap These Days

What is Profit?

- In economics, profit is simply benefits minus (opportunity) costs

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose firm sells output q at price p

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose firm sells output q at price p

It can buy each input xi at an associated price pi

- labor l at wage rate w

- capital k at rental rate r

What is Profit?

In economics, profit is simply benefits minus (opportunity) costs

Suppose firm sells output q at price p

It can buy each input xi at an associated price pi

- labor l at wage rate w

- capital k at rental rate r

The profit of selling q units and using inputs l,k is:

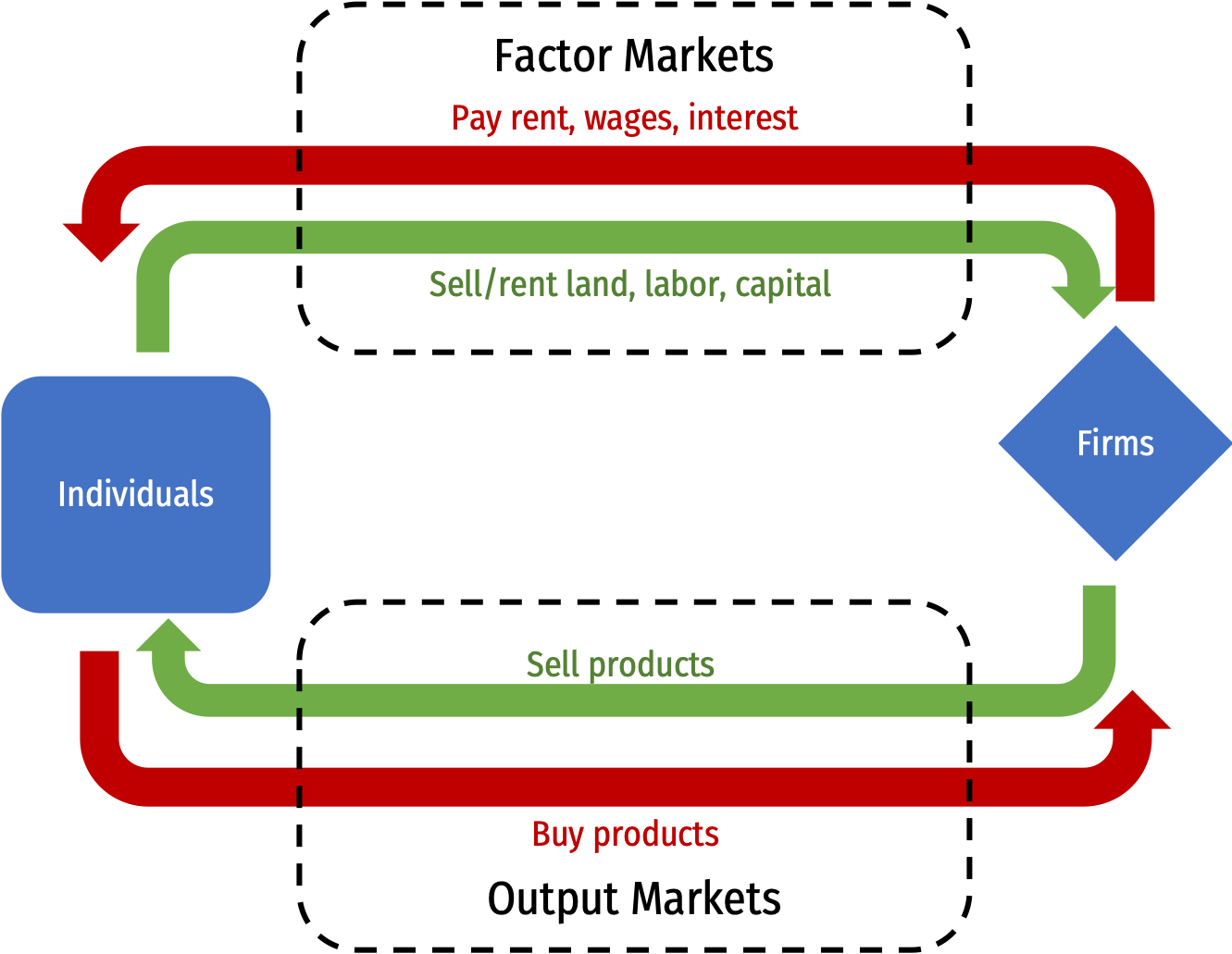

Who Gets the Profits? I

π=pqrevenues−(wl+rk)costs

Reminder from Macroeconomics: “The Circular Flow”

Who Gets the Profits? I

π=pqrevenues−(wl+rk)costs

- The firm's costs are all of the factor-owner's incomes!

- Landowners, laborers, creditors are all paid rent, wages, and interest, respectively

Who Gets the Profits? I

π=pqrevenues−(wl+rk)costs

Profits are the residual value leftover after paying all factors

Profits are income for the residual claimant(s) of the production process (i.e. owner(s) of a firm):

- Entrepreneurs

- Shareholders

Who Gets the Profits? II

π=pqrevenues−(wl+rk)costs

Residual claimants have incentives to maximize firm's profits, as this maximizes their own income

Entrepreneurs and shareholders are the only participants in production that are not guaranteed an income!

- Starting and owning a firm is inherently risky!

Profits and Entrepreneurship: A Preview

In markets, production must face the profit test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival in markets requires firms continually create value & earn profits

The Firm's Optimization Problem I

- So what do firms do?

Choose: < some alternative >

In order to maximize: < profits >

Subject to: < technology >

- We've so far assumed they maximize profits and they are limited by their technology

The Firm's Optimization Problem II

What do firms choose? (Not an easy answer)

Prices?

- Depends on the market the firm is operating in!

- Study of industrial organization

Essential question: how competitive is a market? This will influence what firms (can) do

Industrial Organization: A Roadmap I

Begin with one extreme case: “perfect competition”

- Firms can choose to sell as much q∗ as they want

- Firms are constrained to sell at the (exogenous) market price ¯p

Appropriate for settings with many firms, each small relative to market

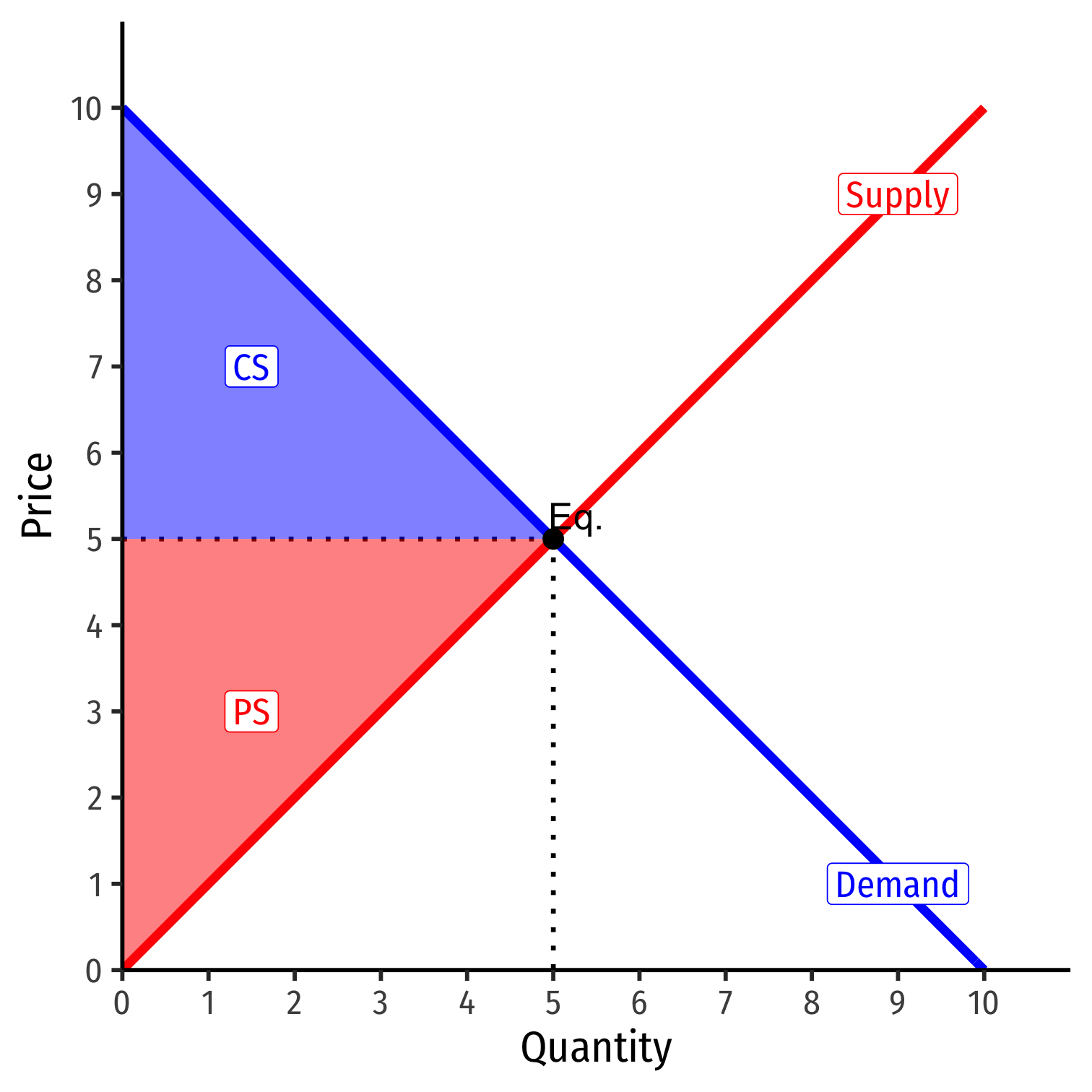

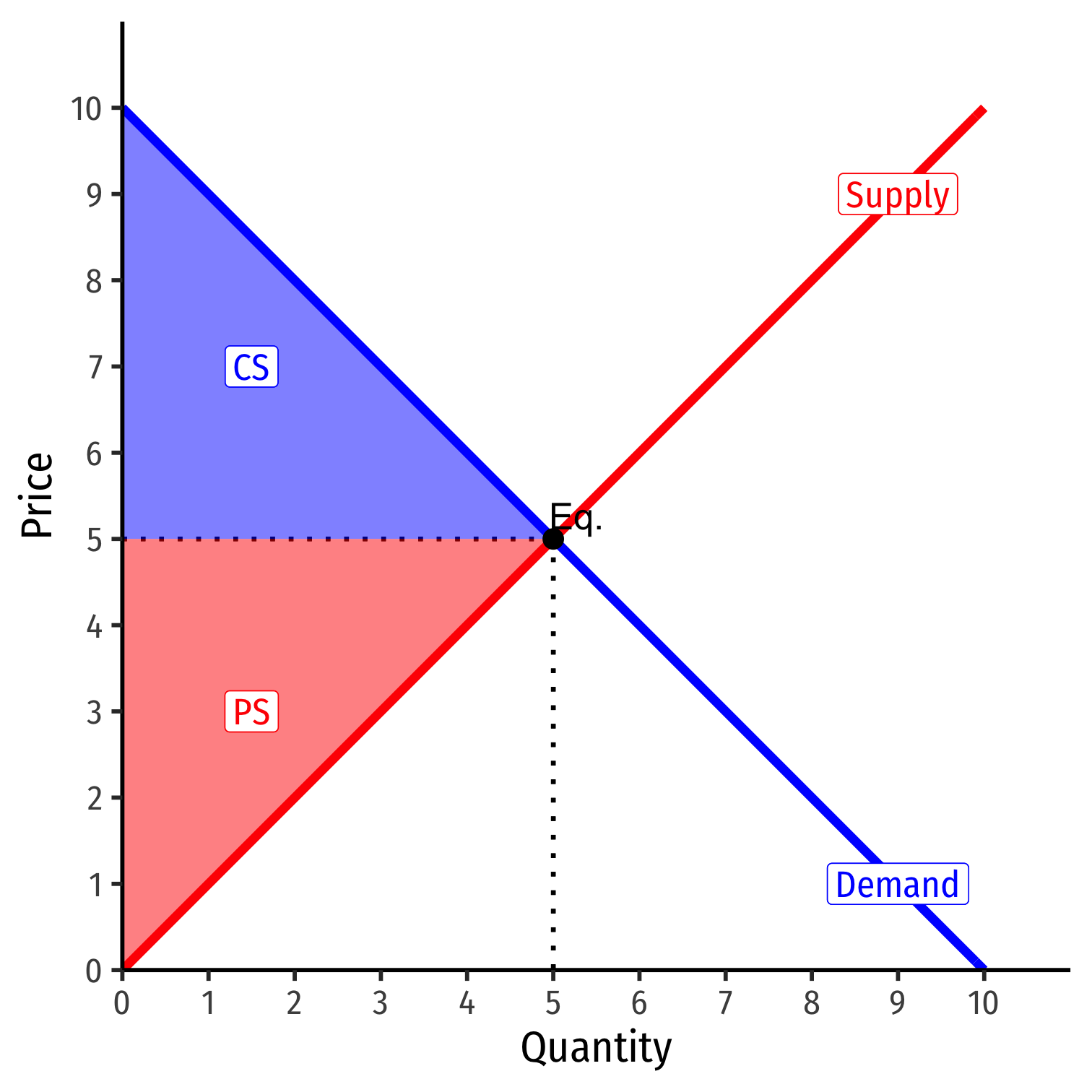

Interlude

After we find firm's optimal decisions in this market (and have Exam 2), we will then finally look at Unit III: Market Equilibrium

Put Supply and Demand together

Interlude

We've seen how consumers cause and respond to market changes

- e.g. (Δpx, Δpy, Δm)

We're about to explore how producers cause and respond to market changes

Finally we can explain all of these market changes with Supply and Demand equilibrium models

Discuss how markets work, why they are good & efficient, and when they fail

Industrial Organization: A Roadmap II

Examine another extreme case: monopoly of a single seller

- Appropriate for some markets

“Imperfect competition”: models of monopolistic competition & oligopoly

- In latter case, firms act strategically, so we will need game theory

Firms can choose both q∗ & p∗ to maximize π