1.4 — Utility Maximization

ECON 306 • Microeconomic Analysis • Spring 2022

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS22

microS22.classes.ryansafner.com

Constrained Optimization

Constrained Optimization I

We model most situations as a constrained optimization problem:

People optimize: make tradeoffs to achieve their objective as best as they can

Subject to constraints: limited resources (income, time, attention, etc)

Constrained Optimization II

One of the most generally useful mathematical models

Endless applications: how we model nearly every decision-maker

consumer, business firm, politician, judge, bureaucrat, voter, dictator, pirate, drug cartel, drug addict, parent, child, etc

- Key economic skill: recognizing how to apply the model to a situation

Remember!

Constrained Optimization III

- All constrained optimization models have three moving parts:

Constrained Optimization III

- All constrained optimization models have three moving parts:

- Choose: < some alternative >

Constrained Optimization III

- All constrained optimization models have three moving parts:

Choose: < some alternative >

In order to maximize: < some objective >

Constrained Optimization III

- All constrained optimization models have three moving parts:

Choose: < some alternative >

In order to maximize: < some objective >

Subject to: < some constraints >

Constrained Optimization: Example I

Example: A Hood student picking courses hoping to achieve the highest GPA while getting an Econ major.

Choose:

In order to maximize:

Subject to:

Constrained Optimization: Example II

Example: How should FedEx plan its delivery route?

Choose:

In order to maximize:

Subject to:

Constrained Optimization: Example III

Example: The U.S. government wants to remain economically competitive but reduce emissions by 25%.

Choose:

In order to maximize:

Subject to:

Constrained Optimization: Example IV

Example: How do elected officials make decisions in politics?

Choose:

In order to maximize:

Subject to:

The Utility Maximization Problem

- The individual's utility maximization problem we've been modeling, finally, is:

Choose: < a consumption bundle >

In order to maximize: < utility >

Subject to: < income and market prices >

The Utility Maximization Problem: Tools

We now have the tools to understand individual choices:

Budget constraint: individual’s constraints of income and market prices

- How market trades off between goods

- Marginal cost (of good x, in terms of y)

Utility function: individual’s objective to maximize, based on their preferences

- How individual trades off between goods

- Marginal benefit (of good x, in terms of y)

The Utility Maximization Problem: Verbally

- The individual's constrained optimization problem:

choose a bundle of goods to maximize utility, subject to income and market prices

The Utility Maximization Problem: Mathematically

maxx,y≥0u(x,y) s.t.pxx+pyy=m

- This requires calculus to solve.† We will look at graphs instead!

† See the mathematical appendix in today's class notes on how to solve it with calculus, and an example.

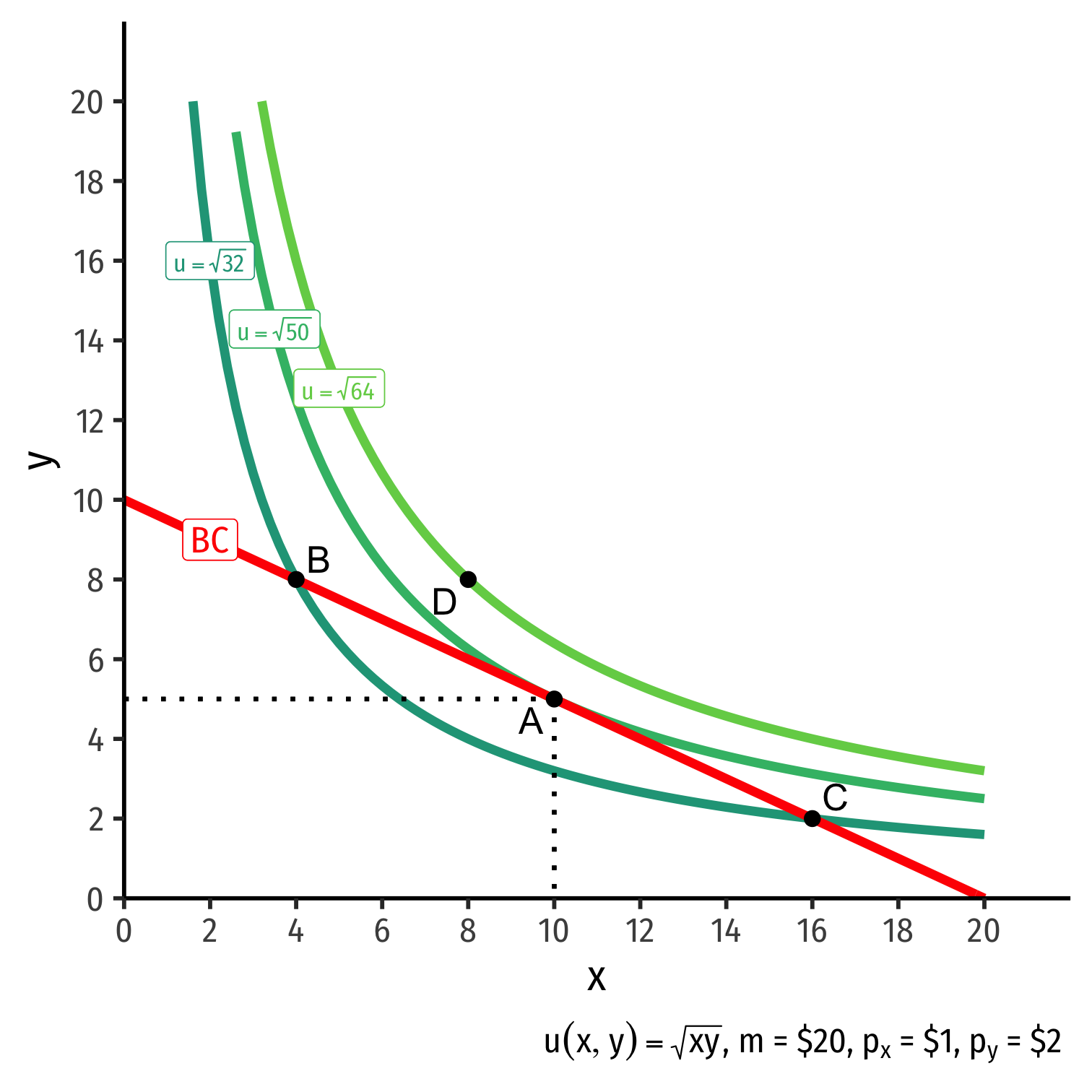

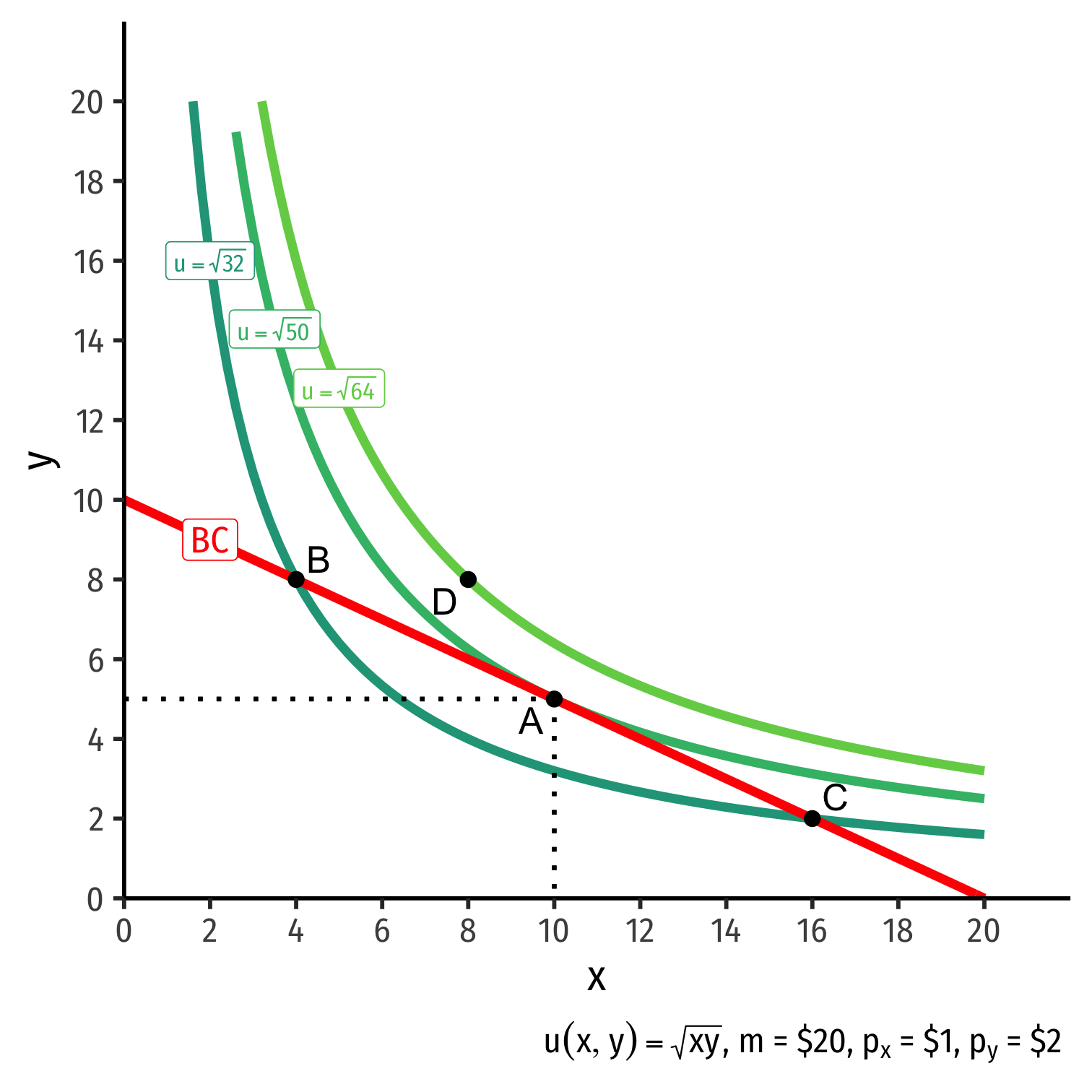

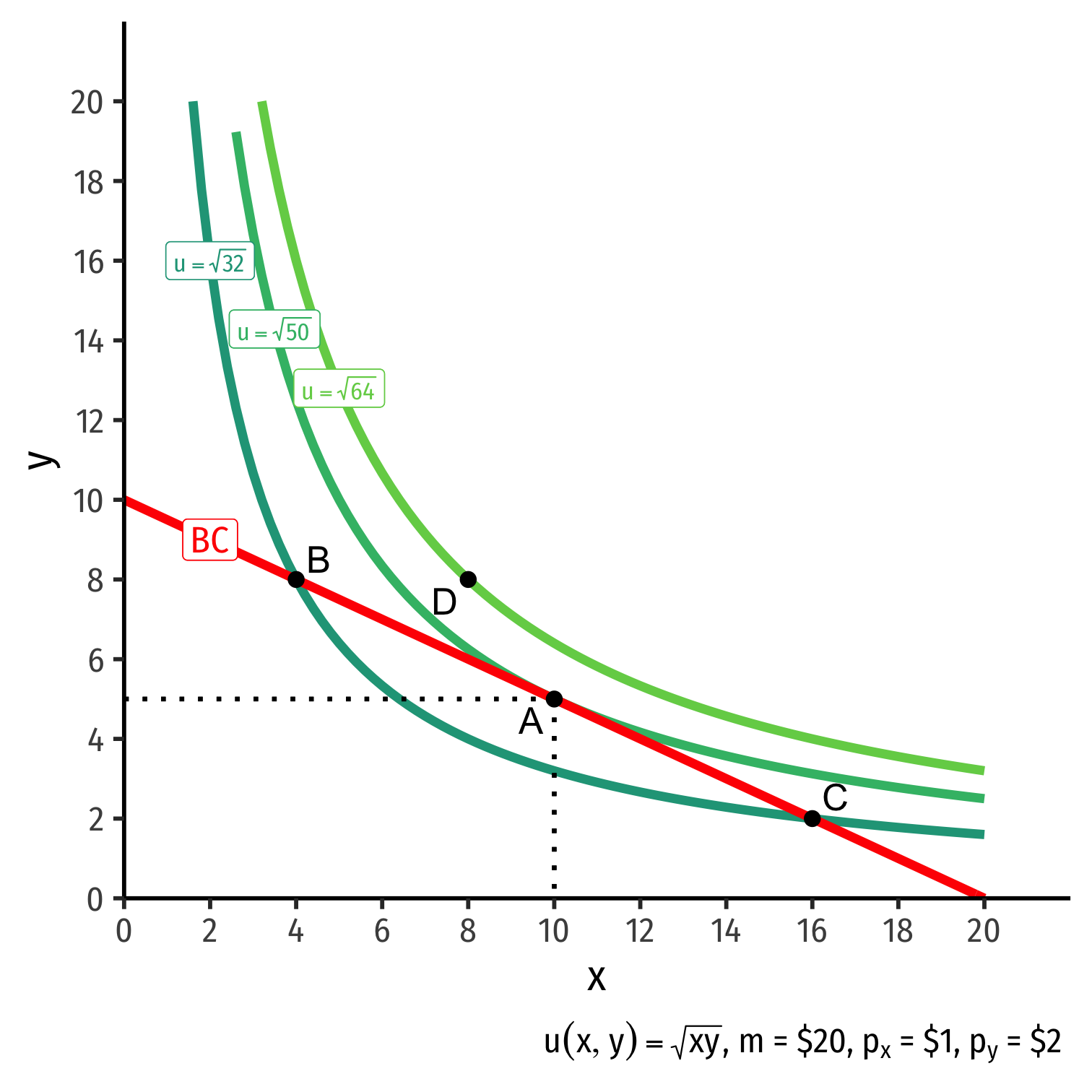

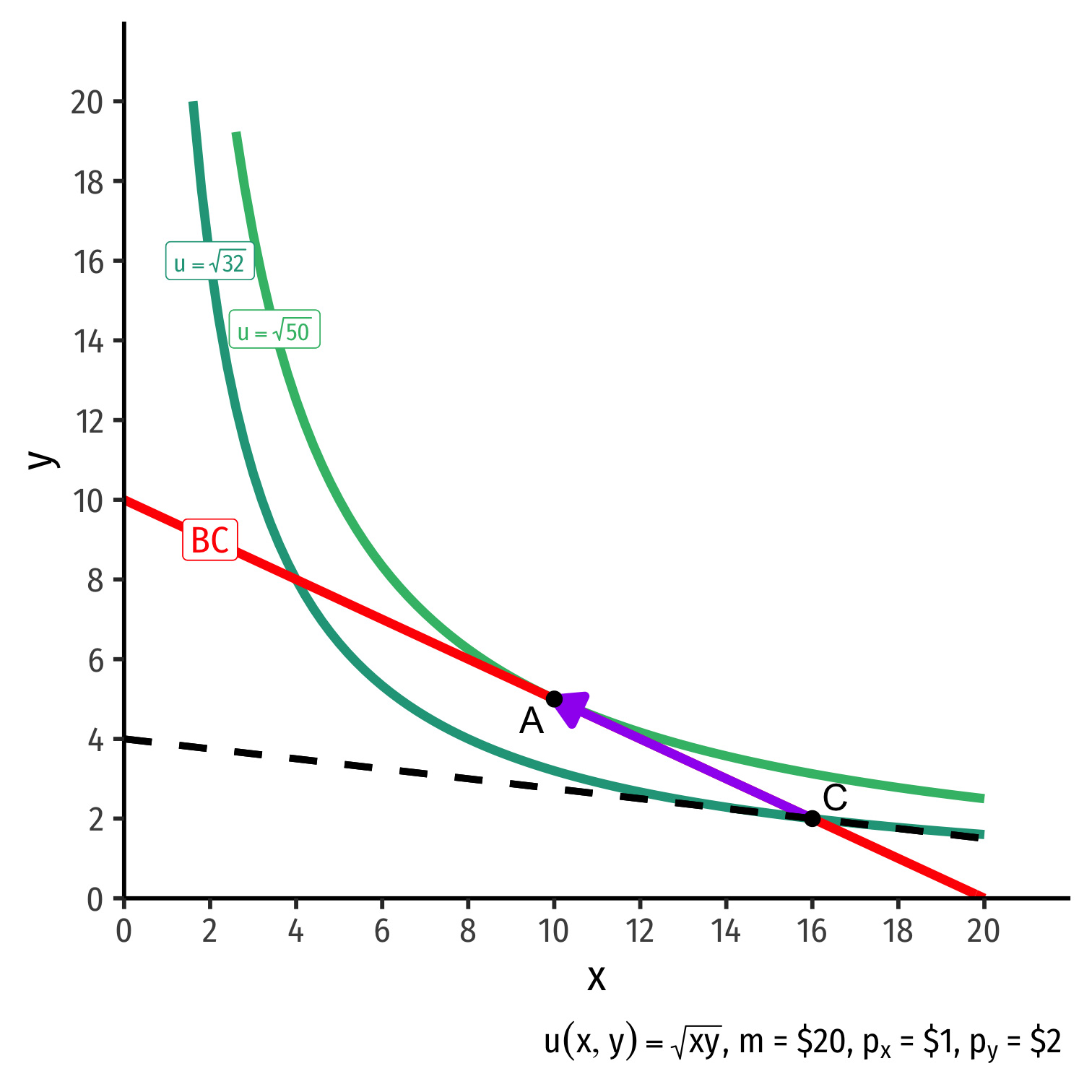

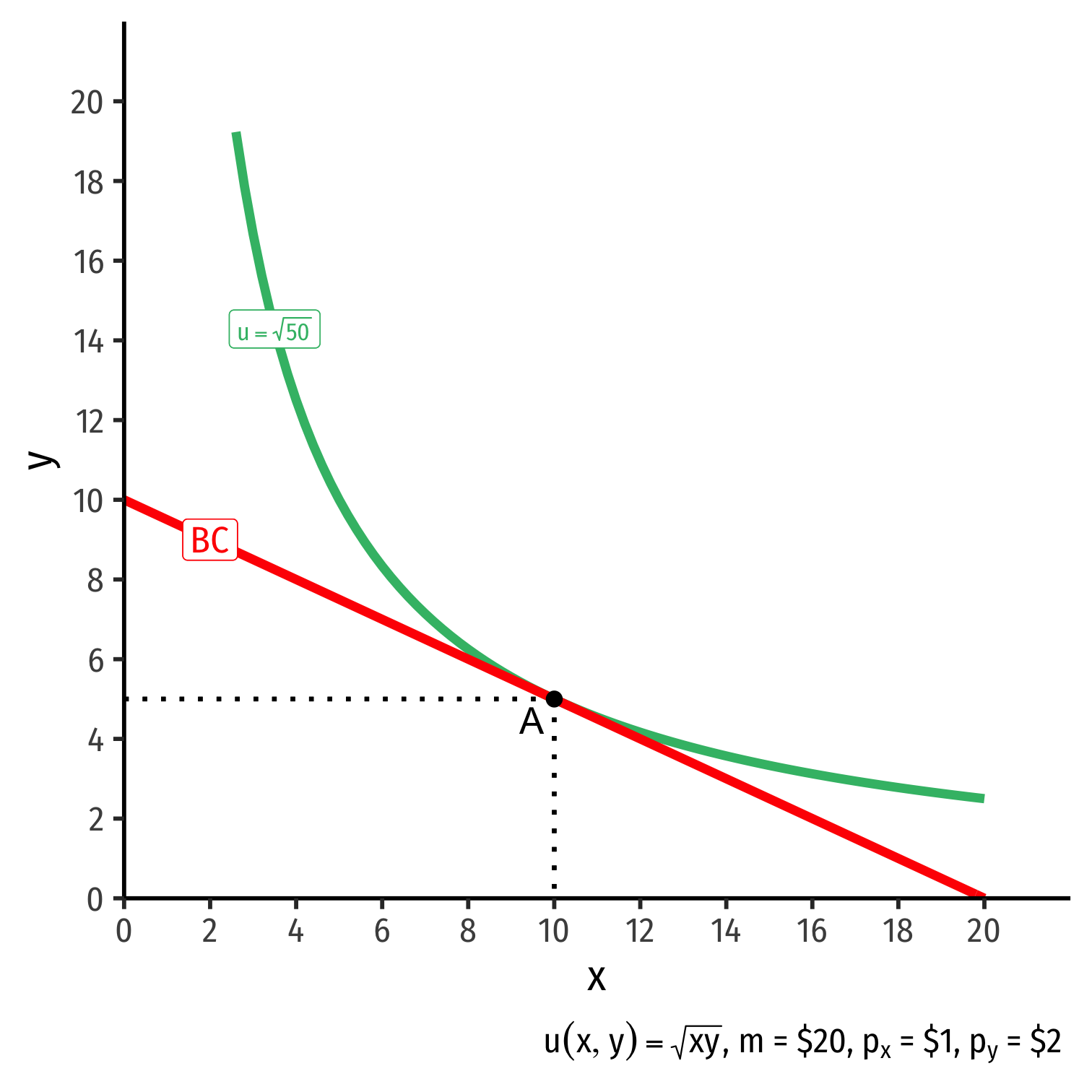

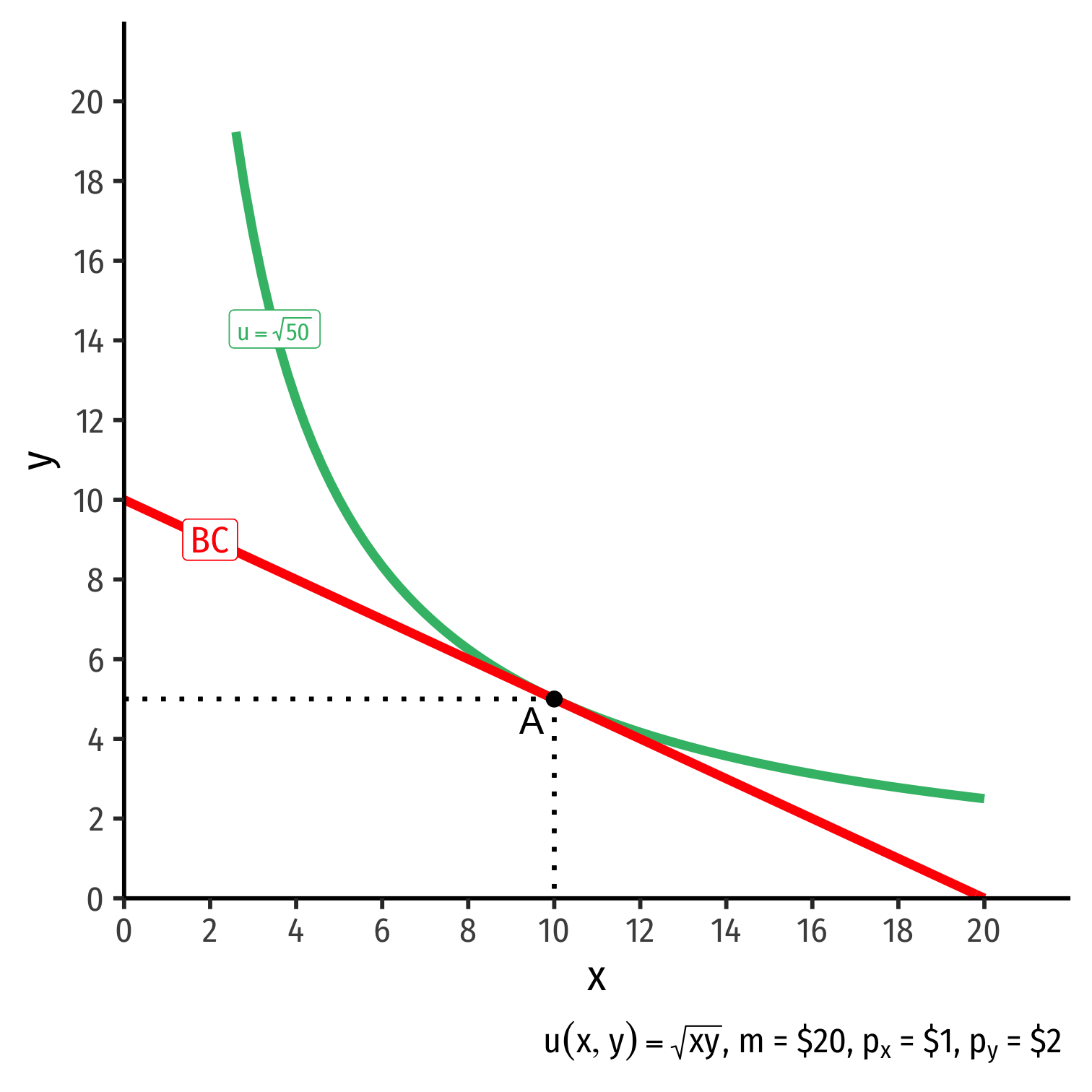

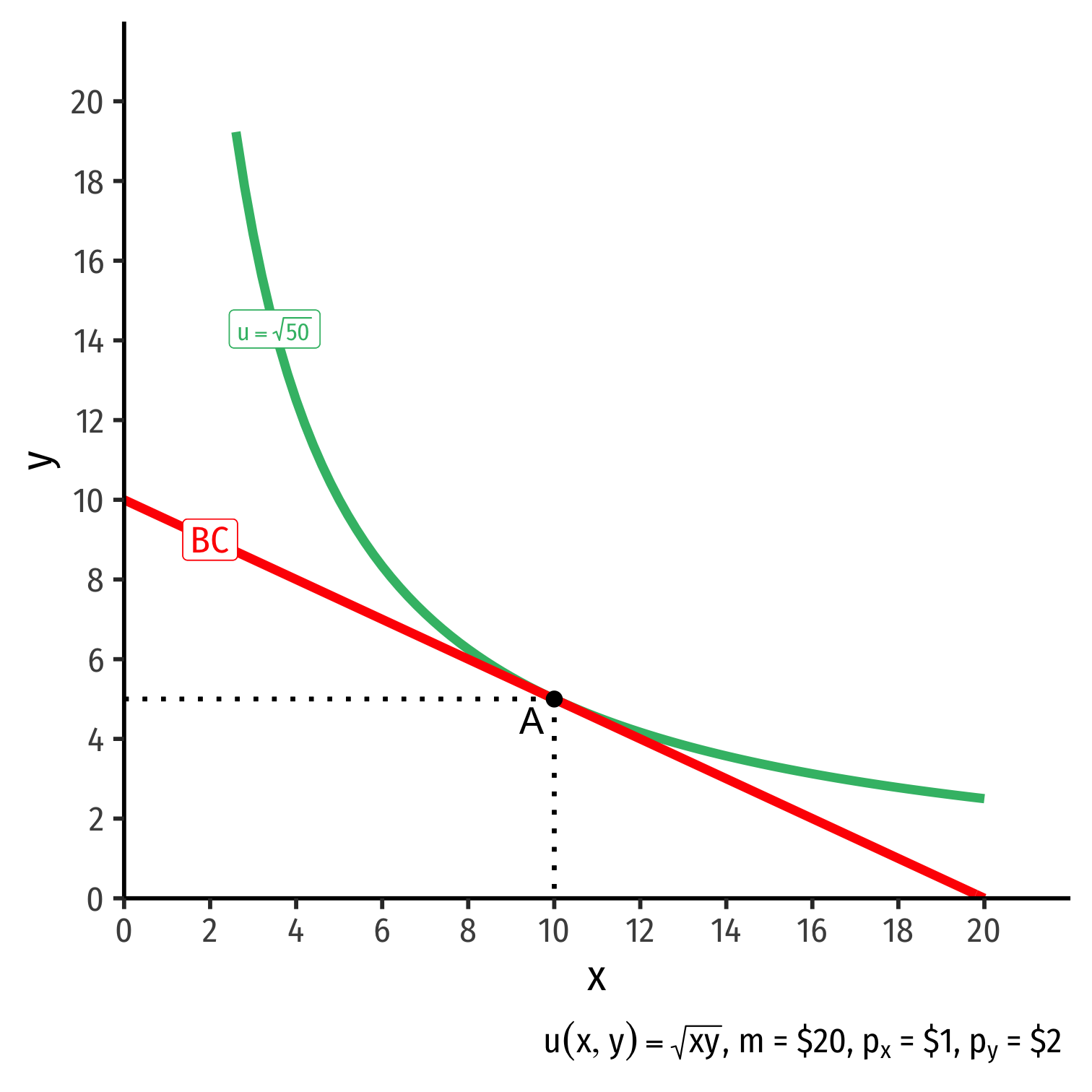

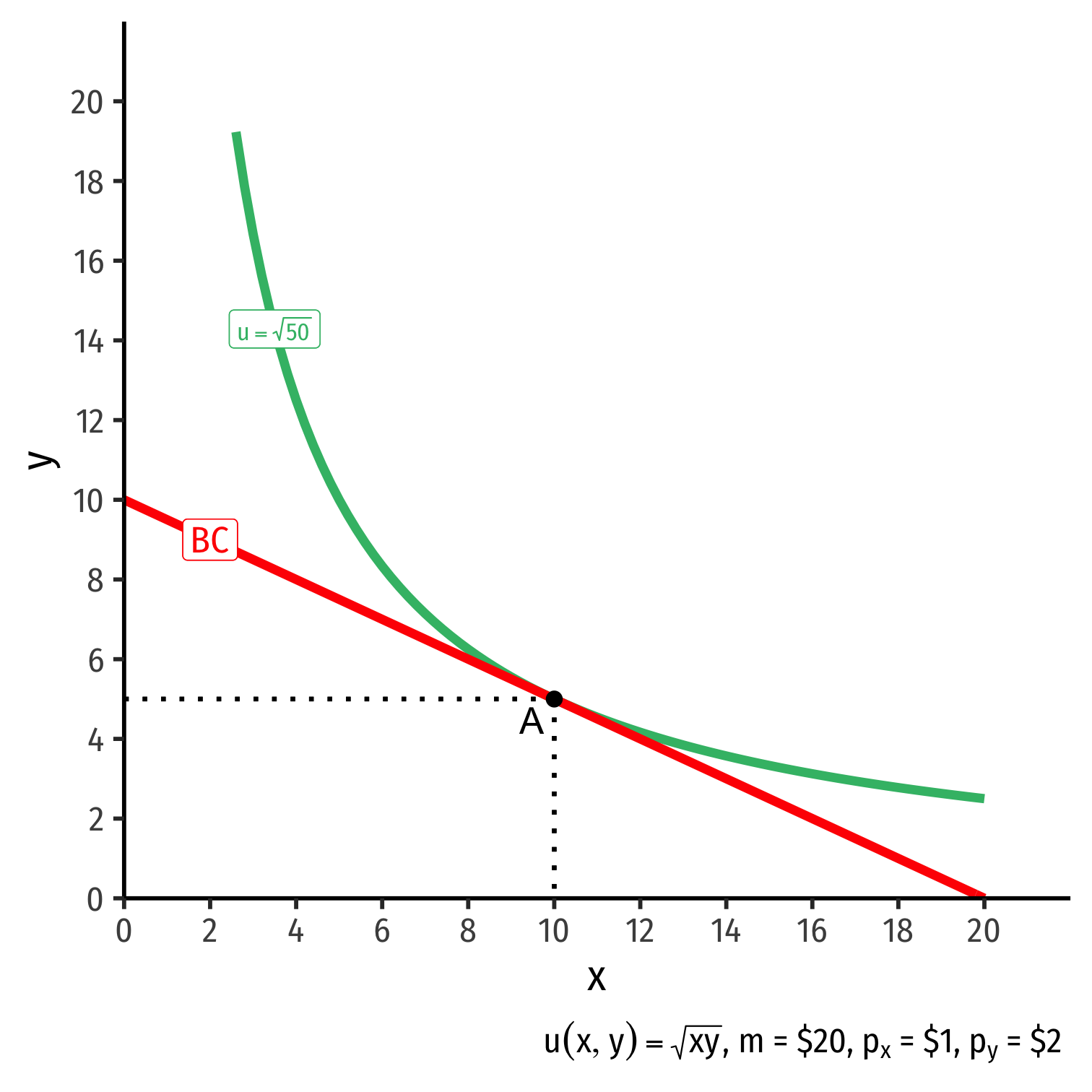

The Individual's Optimum: Graphically

- Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

The Individual's Optimum: Graphically

Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

B or C spend all income, but a better combination exists

The Individual's Optimum: Graphically

Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

B or C spend all income, but a better combination exists

D is higher utility, but not affordable at current income & prices

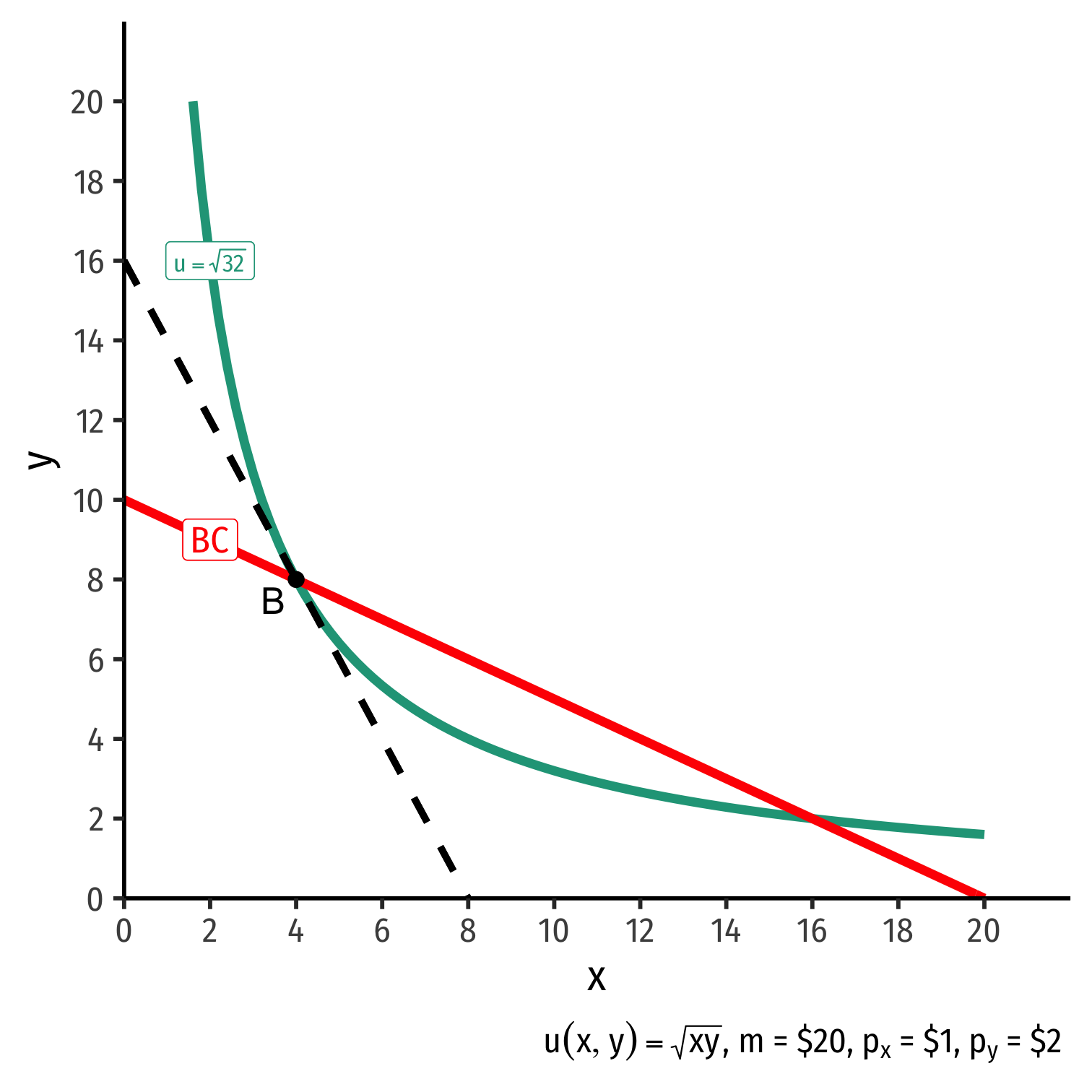

The Individual's Optimum: Why Not B?

indiff. curve slope>budget constr. slope

The Individual's Optimum: Why Not B?

indiff. curve slope>budget constr. slopeMUxMUy>pxpy2>0.5

Consumer views MB of x is 2 units of y

- Consumer’s “exchange rate:” 2Y:1X

Market-determined MC of x is 0.5 units of y

- Market exchange rate is 0.5Y:1X

The Individual's Optimum: Why Not B?

indiff. curve slope>budget constr. slopeMUxMUy>pxpy2>0.5

Consumer views MB of x is 2 units of y

- Consumer’s “exchange rate:” 2Y:1X

Market-determined MC of x is 0.5 units of y

- Market exchange rate is 0.5Y:1X

Can spend less on y, more on x for more utility!

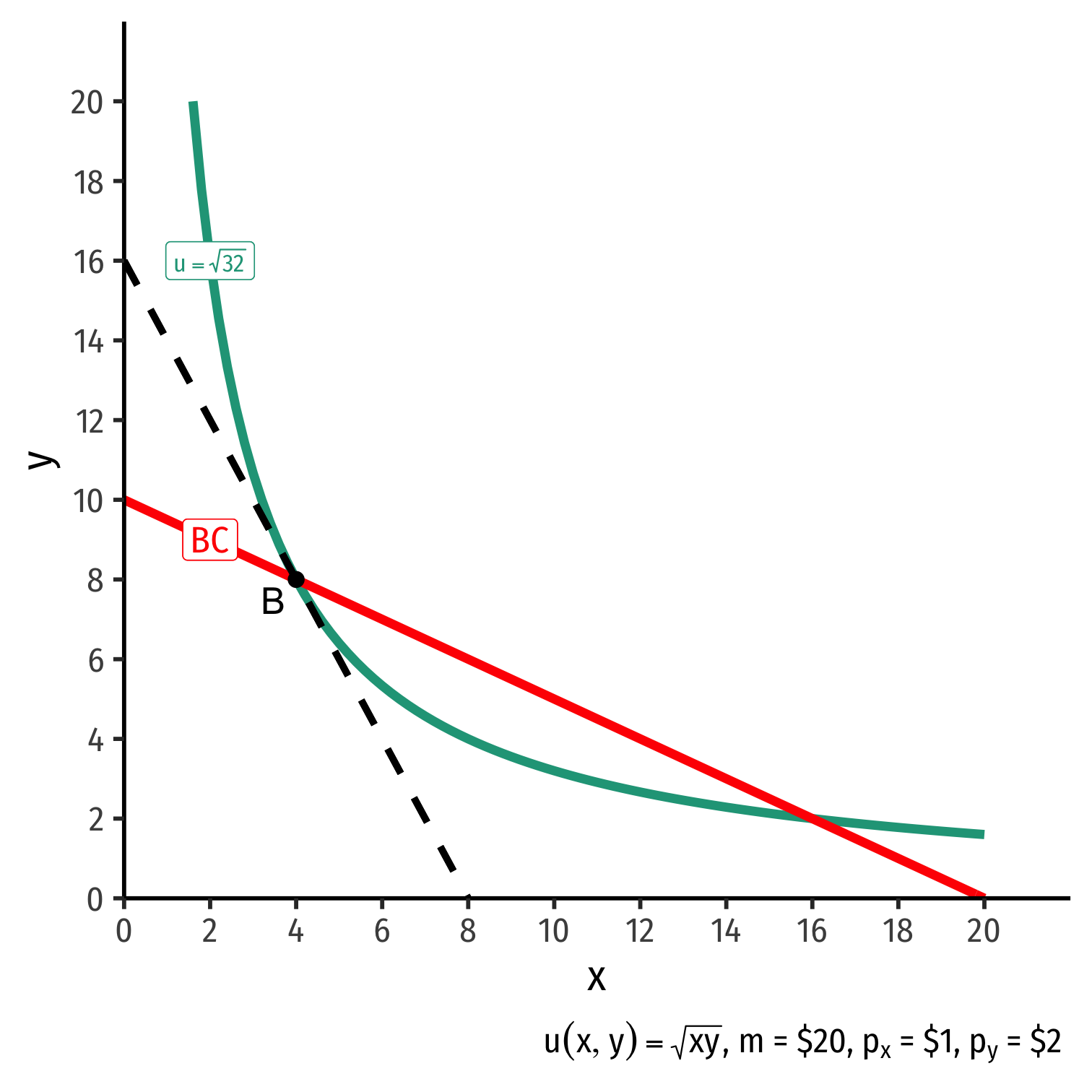

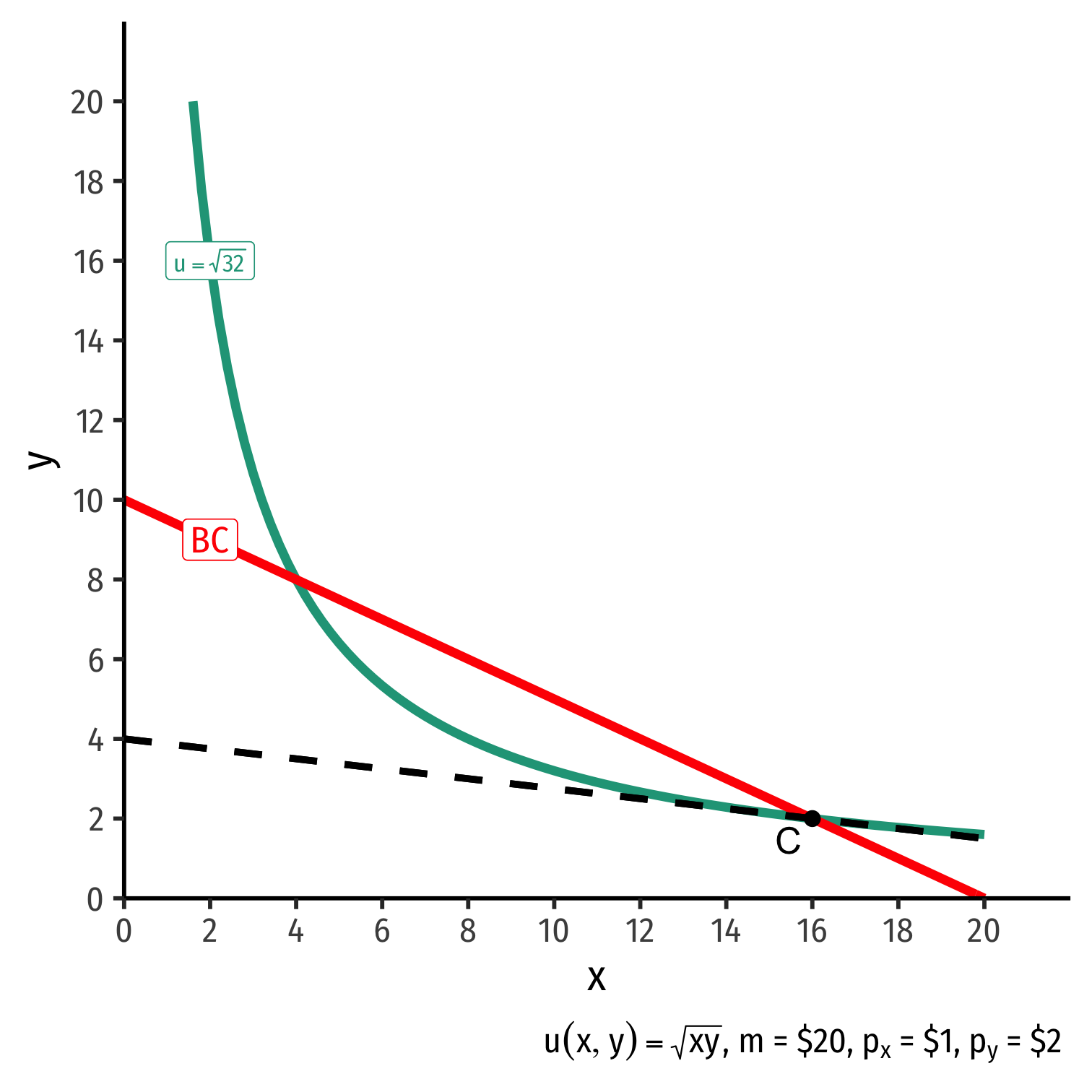

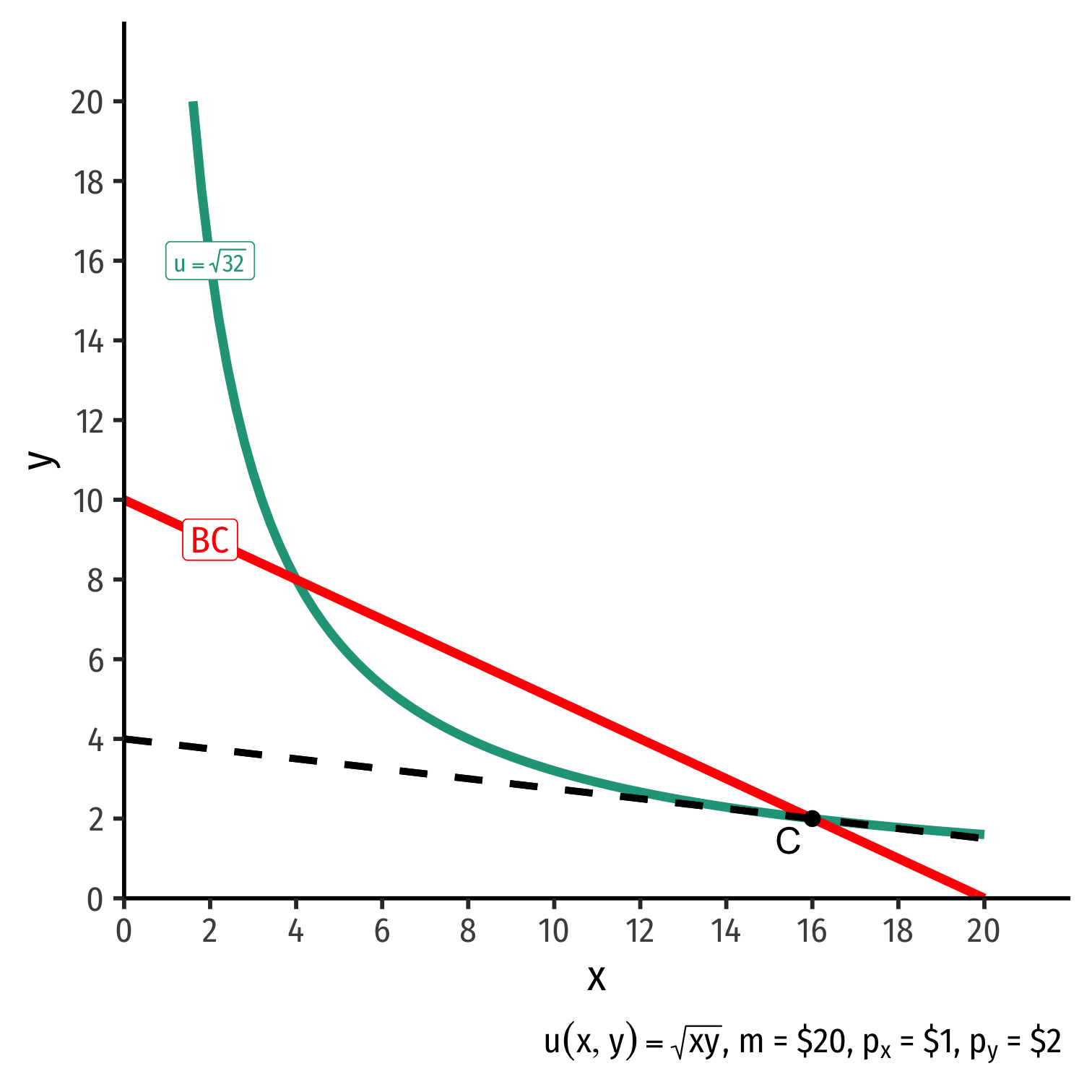

The Individual's Optimum: Why Not C?

indiff. curve slope<budget constr. slope

The Individual's Optimum: Why Not C?

indiff. curve slope<budget constr. slopeMUxMUy<pxpy0.125<0.5

Consumer views MB of x is 0.125 units of y

- Consumer’s “exchange rate:” 0.125Y:1X

Market-determined MC of x is 0.5 units of y

- Market exchange rate is 0.5Y:1X

The Individual's Optimum: Why Not C?

indiff. curve slope<budget constr. slopeMUxMUy<pxpy0.125<0.5

Consumer views MB of x is 0.125 units of y

- Consumer’s “exchange rate:” 0.125Y:1X

Market-determined MC of x is 0.5 units of y

- Market exchange rate is 0.5Y:1X

Can spend less on y, more on x for more utility!

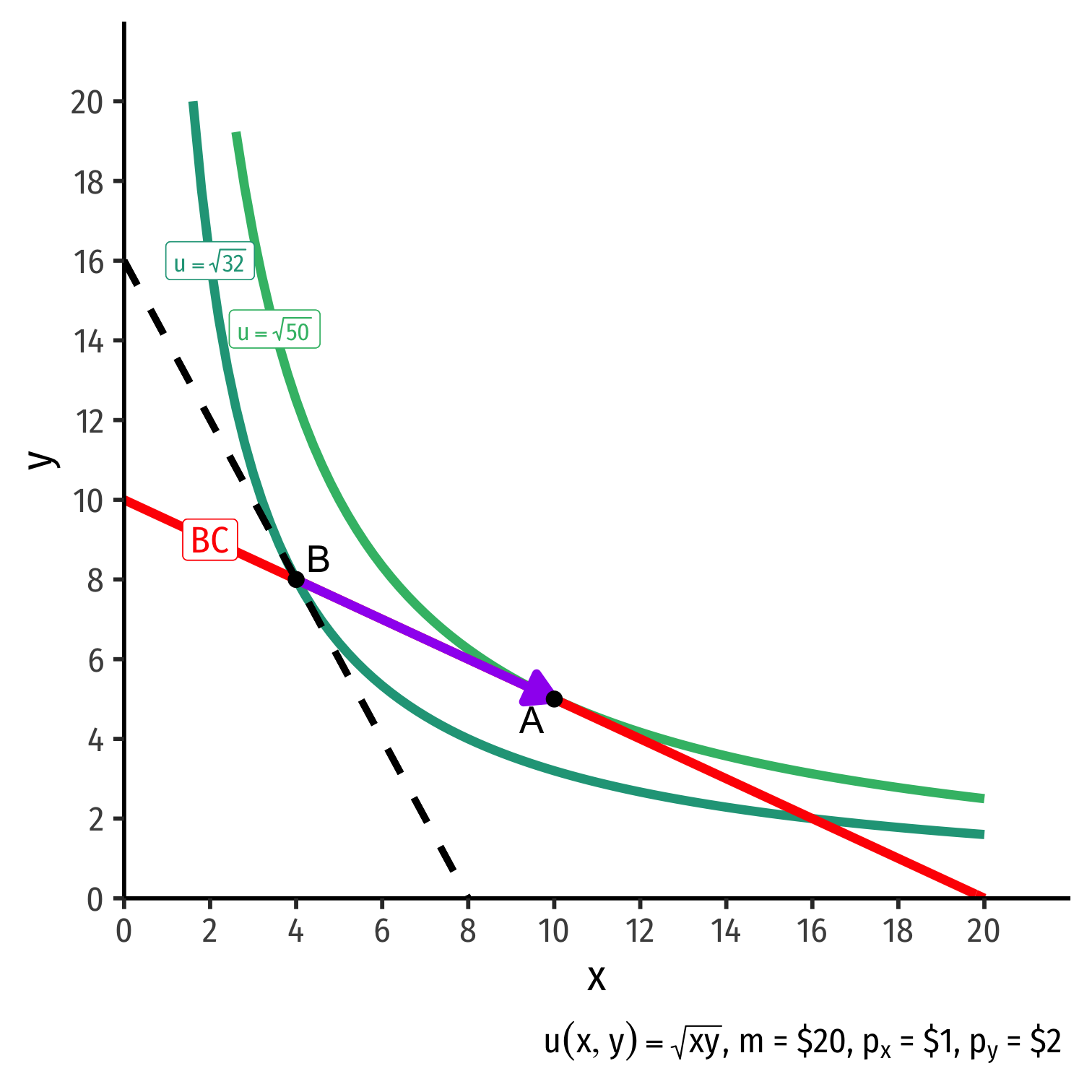

The Individual's Optimum: Why A?

indiff. curve slope=budget constr. slope

The Individual's Optimum: Why A?

indiff. curve slope=budget constr. slopeMUxMUy=pxpy0.5=0.5

Marginal benefit = Marginal cost

- Consumer exchanges at same rate as market

No other combination of (x,y) exists that could increase utility!†

† At current income and market prices!

The Individual's Optimum: Two Equivalent Rules

Rule 1

MUxMUy=pxpy

- Easier for calculation (slopes)

The Individual's Optimum: Two Equivalent Rules

Rule 1

MUxMUy=pxpy

- Easier for calculation (slopes)

Rule 2

MUxpx=MUypy

- Easier for intuition (next slide)

The Individual's Optimum: The Equimarginal Rule

MUxpx=MUypy=⋯=MUnpn

Equimarginal Rule: consumption is optimized where the marginal utility per dollar spent is equalized across all n possible goods/decisions

Always choose an option that gives higher marginal utility (e.g. if MUx<MUy), consume more y!

- But each option has a different price, so weight each option by its price, hence MUxpx

An Optimum, By Definition

Any optimum in economics: no better alternatives exist under current constraints

No possible change in your consumption that would increase your utility

Practice I

Example: You can get utility from consuming bags of Almonds (a) and bunches of Bananas (b), according to the utility function:

u(a,b)=abMUa=bMUb=a

You have an income of $50, the price of Almonds is $10, and the price of Bananas is $2. Put Almonds on the horizontal axis and Bananas on the vertical axis.

- What is your utility-maximizing bundle of Almonds and Bananas?

- How much utility does this provide? [Does the answer to this matter?]

Practice II, Cobb-Douglas!

Example: You can get utility from consuming Burgers (b) and Fries (f), according to the utility function:

u(b,f)=√bfMUb=0.5b−0.5f0.5MUf=0.5b0.5f−0.5

You have an income of $20, the price of Burgers is $5, and the price of Fries is $2. Put Burgers on the horizontal axis and Fries on the vertical axis.

- What is your utility-maximizing bundle of Burgers and Fries?

- How much utility does this provide?